Trade Analysis and Recommendations for the Euro

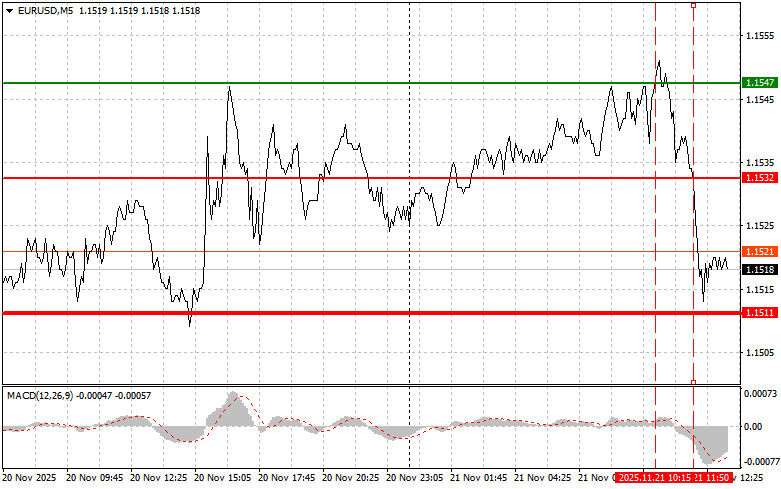

The test of the 1.1547 price occurred when the MACD indicator had already risen significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the euro.

The negative dynamics of the Eurozone manufacturing PMI triggered a wave of concerns about a slowdown in economic growth in the region. Investors fear that the European Central Bank may face the need to revise its monetary policy, which had previously been aimed at keeping interest rates unchanged. Now, against the backdrop of worsening economic indicators, pressure on the ECB will shift toward a more accommodative policy aimed at supporting economic growth. The composite PMI index, which reflects the overall state of the Eurozone economy, also declined, though it remained above the critical 50-point threshold. This signals that the economy is still showing moderate growth overall, but the pace has slowed significantly compared to previous months.

Similar U.S. figures are expected in the second half of the day. Traders always pay close attention to these data, as they provide insight into the current state of the U.S. economy and can influence Federal Reserve decisions regarding future monetary policy. The manufacturing PMI reflects activity in the manufacturing sector, while the services PMI shows the state of the services sector, which makes up a large portion of the U.S. economy. The composite PMI combines data from both sectors, providing an overall picture of economic activity. All indicators are expected to remain above 50 points, indicating expanding activity, which will support the dollar.

The University of Michigan's Consumer Sentiment Index report is an important indicator of consumer spending, since consumer spending accounts for a significant share of U.S. GDP. The inflation expectations included in the report are also important, as they may influence the Fed's decisions on interest rates.

As for the intraday strategy, I will rely more on implementing Scenarios No. 1 and No. 2.

Buy Signal

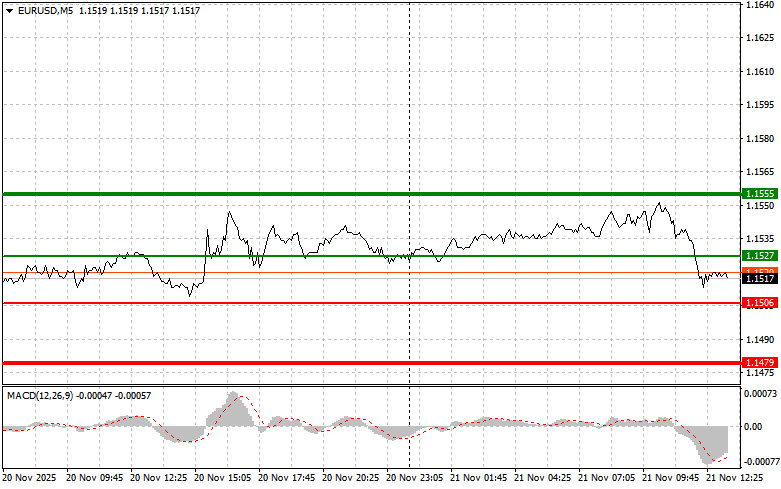

Scenario No. 1: Today, you can buy the euro if the price reaches the level of 1.1527 (green line on the chart), targeting growth to the 1.1555 level. At 1.1555, I plan to exit the market and also sell the euro in the opposite direction, expecting a 30–35 point move from the entry point. You can count on euro growth today only after weak U.S. labor market data. Important! Before buying, make sure the MACD indicator is above the zero mark and only beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1506 price at a moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. You can expect growth toward the opposite levels of 1.1527 and 1.1555.

Sell Signal

Scenario No. 1: I plan to sell the euro after reaching the 1.1506 level (red line on the chart). The target will be 1.1479, where I plan to exit the market and buy immediately in the opposite direction (expecting a 20–25 point move in the opposite direction from the level). Pressure on the pair will return today if the statistics are strong. Important! Before selling, make sure the MACD indicator is below the zero mark and only beginning to decline from it.

Scenario No. 2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1527 price when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.1506 and 1.1479 can be expected.

Chart Explanation:

- Thin green line – entry price at which you can buy the trading instrument.

- Thick green line – expected price at which you can set Take Profit or manually lock in profit, as further growth above this level is unlikely.

- Thin red line – entry price at which you can sell the trading instrument.

- Thick red line – expected price at which you can set Take Profit or manually lock in profit, as further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to be guided by overbought and oversold zones.

Important: Beginning Forex traders must be very cautious when making entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large positions.

And remember: to trade successfully, you need a clear trading plan, like the one I presented above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for an intraday trader.