Trade Review and Advice on Trading the Euro

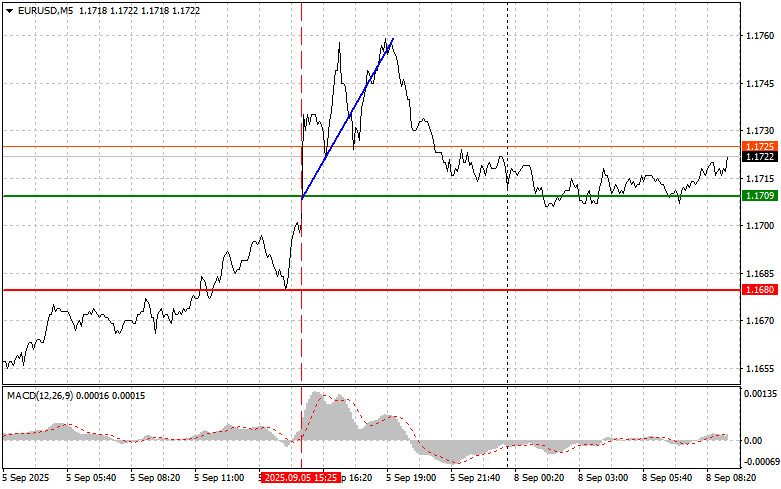

The test of the 1.1709 price level occurred when the MACD indicator began to move upwards from the zero line, confirming a correct entry point for buying the euro. As a result, the pair grew by more than 50 pips.

August US data showing only a slight increase in nonfarm payrolls led to a decline in the dollar and a rise in the euro. According to the US Department of Labor, only 22,000 new jobs were created in August, far less than the 75,000 expected. This information had an immediate impact on the currency markets, causing the dollar to fall and several risk assets, including the euro, to rally. Market participants interpreted the weak employment data as a sign of a US economic slowdown that may force the Federal Reserve to cut rates soon. The euro, in turn, gained upward momentum. The strength of the single European currency is tied to a weaker dollar and expectations that the European Central Bank will continue to hold rates steady at current levels.

Today, data on changes in German industrial production and the trade balance are due. A decline in industrial production may point to a slowdown in economic growth, supply chain difficulties, or decreased demand for German goods, which could potentially have a negative effect on the euro. At the same time, a positive trade balance—especially if it exceeds forecasts—could support the euro by showcasing the competitiveness of German products on the world stage. Later, the Sentix investor confidence report for the eurozone will be released. An increase in this indicator reflects investor optimism about eurozone economic prospects, usually leading to a rise in investment and the euro strengthening. On the contrary, if the indicator falls, it may reflect doubts and concerns, negatively impacting financial markets and the currency. Significant deviations from expected values can lead to market volatility and force traders to quickly adapt their strategies.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

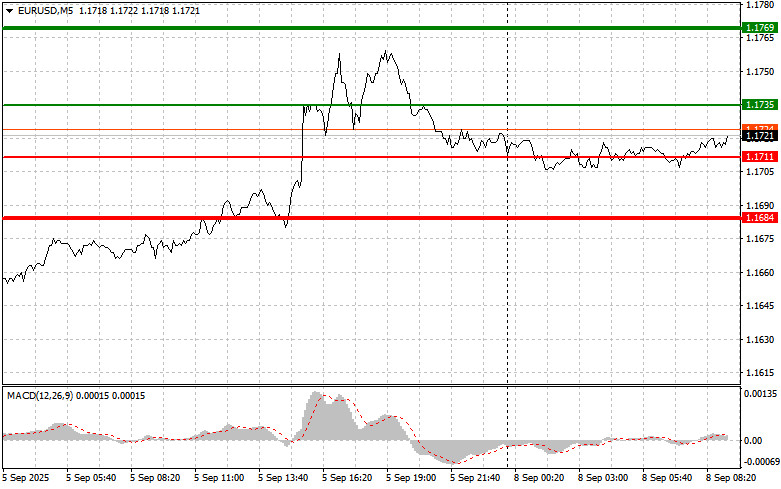

Scenario 1: Today, I plan to buy the euro if the price reaches the 1.1735 area (green line on the chart) with a target to rise to 1.1769. At the 1.1769 level, I plan to exit the market and sell the euro in the opposite direction, aiming for a move of 30–35 pips from the entry point. Euro growth should only be expected after strong data. Important! Before buying, make sure the MACD indicator is above zero and just beginning to rise.

Scenario 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1711 price when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal to the upside. Growth toward the targets of 1.1735 and 1.1769 can be expected.

Sell Scenario

Scenario 1: I plan to sell the euro after reaching the 1.1711 level (red line on the chart). The target is 1.1684, where I plan to exit the market and immediately buy in the opposite direction (expecting a move of 20–25 pips from the level). Pressure on the pair may return today with weak data. Important! Before selling, ensure the MACD is below zero and starting to decline.

Scenario 2: I also plan to sell the euro today if there are two consecutive tests of the 1.1735 price while MACD is in the overbought zone. This will limit the pair's upside potential and result in a reversal down. A decline to the opposite targets of 1.1711 and 1.1684 can be expected.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.