The GBP/USD currency pair traded higher on Wednesday. In fact, we had warned that the pound sterling would not fall for long, and that its entire drop looked very much like market-maker manipulation. Consider this: UK bond yields have risen to their highest level since 1998. This is indeed bad, as demand for bonds is falling, inflation in the UK is rising, there are serious "holes" in the budget that need to be covered, and now bond yields are rising, which only increases budget expenditures. Of course, the pound sterling had every reason to fall.

But there's a "small" inconsistency: in America, bond yields are rising too, and the US Appeals Court's cancellation of nearly all of Donald Trump's tariffs creates a risk that the US budget will miss out on tens or hundreds of billions of dollars. Trump has reconfigured the American economy, and now it is somewhat dependent on tariff revenues. Of course, Americans themselves pay these tariffs, but at this point, does it matter who pays? The fact remains that the US budget needs tariff revenues, as it has suffered significant losses from reduced imports into the US due to Trump's trade war.

If US Treasury yields are also rising, then what reasons did the market have to sell the pound and buy the dollar at all? If the situation in both countries is basically the same? So, as we said yesterday, this move looks very much like a manipulation. Now we just have to wait a little while to understand whether that's really the case.

Most interesting is that the dollar could well continue rising this week, with only two days left. If Thursday features only the US ISM Services PMI as a major event, then Friday will bring reports that the market has probably been waiting for three weeks. Recall that traders consider the labor market and inflation reports as crucial for upcoming changes to the Federal Reserve's monetary policy. If the Nonfarm Payrolls report disappoints for a fourth consecutive month, it will guarantee a rate cut at the September 16–17 meeting. Right now, it wouldn't take much for the dollar to fall.

In recent weeks, it's been barely managing to avoid another collapse, but any pause is just a temporary phenomenon. The fundamental background for the dollar remains unchanged. So what should we expect in terms of a strong US rally? Not just a correction, but an actual trend? We believe there simply aren't any such reasons.

Also, remember that with inflation near 4%, the Bank of England is unlikely to ease monetary policy anytime soon. The Fed, facing constant attacks from Trump, may not only cut rates twice this year but could end up reducing them by a total of 1.5–2% next year. If the dollar was falling into the abyss back when the BoE was cutting rates but the Fed was not, then what happens when the Fed is actively cutting and the BoE is not?

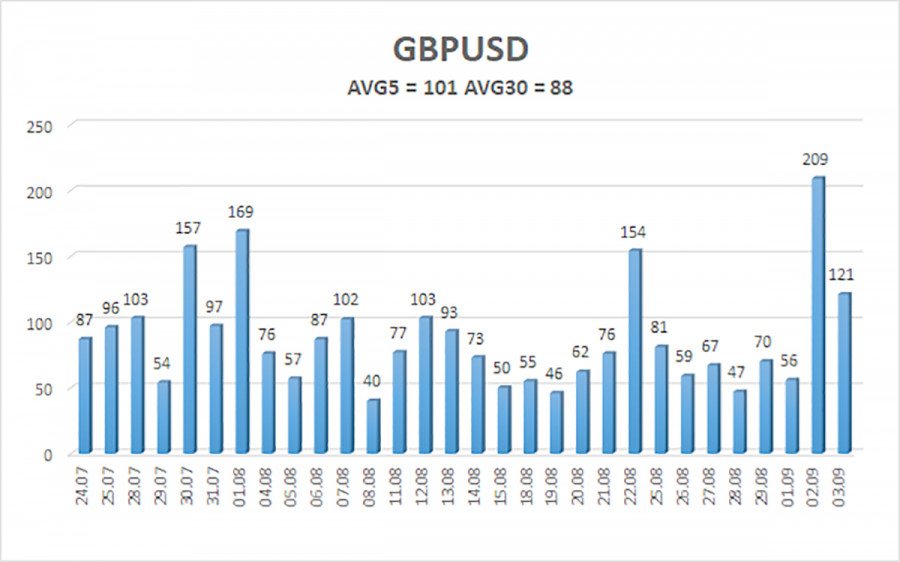

The average volatility for GBP/USD over the last five trading days is 101 pips. For the pound/dollar pair, this is considered "average." Thus, on Thursday, September 4, we expect movement within the range bounded by 1.3344 and 1.3546. The upper channel of linear regression is upward, which indicates an unequivocal upward trend. The CCI indicator has once again entered the oversold zone, warning once again of a resumption of the uptrend.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest Resistance Levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading Recommendations:

The GBP/USD pair has started a new round of downward correction. In the medium term, Donald Trump's policy will likely continue to put pressure on the dollar. Thus, long positions targeting 1.3611 and 1.3672 remain much more relevant if the price is above the moving average. If the price is below the moving average, small shorts can be considered on purely technical grounds. From time to time, the US currency will correct, but for a proper trend-based strengthening, it needs real signs of the end of the global trade war or other significant positive factors.

Chart Elements Explained:

- Linear regression channels help determine the current trend. If both channels point in the same direction, the trend is strong.

- The moving average line (settings 20,0, smoothed) indicates the short-term trend and trade direction.

- Murray levels serve as target levels for moves and corrections.

- Volatility levels (red lines) are the likely price channel for the next day, based on current volatility readings.

- The CCI indicator: dips below -250 (oversold) or rises above +250 (overbought) mean a trend reversal may be near.