Wall Street Surges as US Stocks See Strongest One-Day Gains Since May

US markets kicked off the week on a high note, with all three major indexes posting their biggest daily percentage gains since May 27. The rally followed a broad selloff in the previous session and was fueled by growing expectations of an interest rate cut in September, after weaker-than-expected job data was released on Friday.

Bargain Hunters Step In

Investors moved swiftly to snap up undervalued assets after last week's dip. The disappointing employment figures sparked renewed hope that the Federal Reserve might ease monetary policy sooner rather than later.

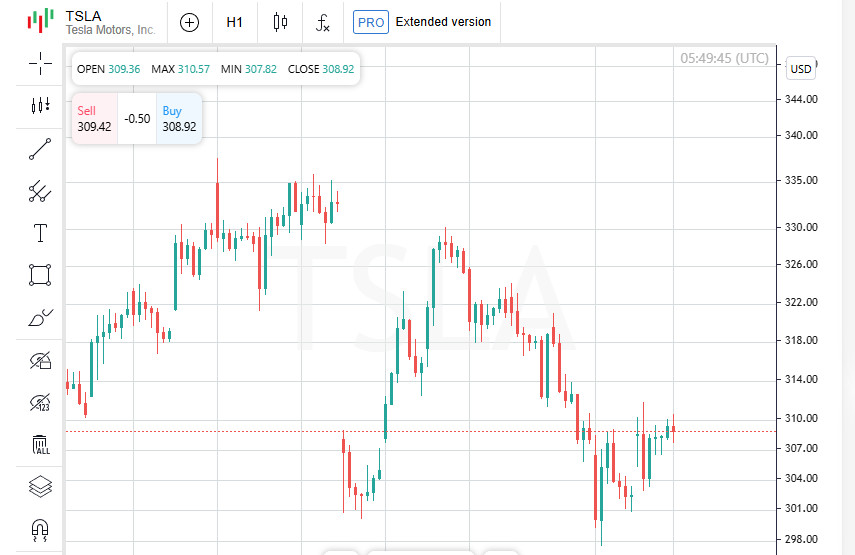

Tesla Jumps as Musk Receives Massive Share Award

Tesla shares rose by 2.2 percent after news broke that CEO Elon Musk was granted 96 million shares, a package valued at roughly 29 billion dollars.

Rate Cut Bets Strengthen

According to CME FedWatch data, the probability of a rate cut in September now stands at approximately 84 percent. Market participants are forecasting at least two quarter-point reductions before the end of the year.

Indexes Hit New Highs

The rally helped push all major US indexes closer to or beyond record levels. The Dow Jones Industrial Average climbed 585 points, or 1.34 percent, reaching 44,173. The S&P 500 advanced by 91 points, or 1.47 percent, ending the day at 6,330. The Nasdaq soared by 403 points, a 1.95 percent gain, to close at 21,054.

Shake-ups in Washington

The political arena added another layer of volatility. President Donald Trump dismissed Bureau of Labor Statistics Commissioner Erika MacEntarfer, accusing her of deliberately distorting employment figures.

The same day, Federal Reserve Board member Adriana Kugler unexpectedly resigned, a move that could pave the way for Trump to push for more dovish Fed leadership. Trump has repeatedly called for lower rates and has criticized the Fed for being too slow to act.

Trade Tensions with India Escalate

On the trade front, Trump announced a significant hike in tariffs on Indian goods, citing the country's continued purchases of Russian oil. India responded by calling the move "unjustified" and pledged to defend its national interests.

Investors Eye Final Earnings: Key Updates Stir Market Activity

Although the second-quarter earnings season in the United States is drawing to a close, market participants remain focused on upcoming reports, with particular attention on Walt Disney's financial results expected this week.

Spotify Hikes Subscription Price, Shares Jump

Spotify shares surged by 5 percent on Monday following the company's announcement that it will raise the monthly fee for individual Premium subscriptions in select markets starting in September. Investors welcomed the move as a potential boost to the platform's revenue stream.

Joby Aviation Soars After Acquiring Blade's Passenger Business

Joby Aviation became one of the day's top movers, with its stock climbing nearly 19 percent. The surge followed news that the company will acquire the passenger transportation division of Blade Air Mobility in a deal valued at up to 125 million dollars. Blade Air's own shares also rallied, gaining over 17 percent in response.

Berkshire Hathaway Slides After Disappointing Quarter

Meanwhile, Class A shares of Warren Buffett's conglomerate Berkshire Hathaway fell by 2.7 percent. The decline came after the firm reported weaker-than-expected operating earnings and disclosed asset write-downs totaling 3.8 billion dollars.

Asian Markets Extend Rally as Fed Easing Hopes Gain Ground

Asian stocks climbed for a second consecutive session on Tuesday, buoyed by growing speculation that the US Federal Reserve may shift toward a more accommodative stance to support the world's largest economy. Meanwhile, the US dollar held on to most of its recent losses.

Japan's Services Sector Shows Strong Momentum

Japan's Nikkei index rose by half a percent, bouncing back from its sharpest drop in two months the previous day. The rebound came on the heels of strong economic data, with the S&P Global Services Purchasing Managers' Index climbing to 53.6 in July, up from 51.7 in June. This marked the fastest growth pace since February.

Regional Gains Continue

The MSCI index tracking Asia-Pacific equities excluding Japan gained 0.6 percent in early trading, reflecting a broad-based optimism across the region. Investor sentiment was supported by improving economic indicators and continued demand for major tech stocks.

Currency Moves: Dollar Slips Slightly Against Yen

The dollar eased 0.1 percent against the yen, trading at 146.96. The euro remained unchanged at 1.1572 dollars. The US dollar index, which measures the greenback against a basket of major currencies, ticked up 0.1 percent after two straight days of declines.

Trump's Fed Ambitions Raise Eyebrows

Markets were also stirred by reports that Donald Trump may assume the position of Federal Reserve governor ahead of schedule. The possibility of increased political influence over monetary policy has sparked fresh concerns among investors.

Tech Stocks Surge: AI Demand Lifts Outlooks

In the US, tech giants continued to lead gains. Nvidia and Alphabet both posted strong performances, while Palantir Technologies raised its revenue forecast for the second time this year, citing robust and growing demand for its artificial intelligence solutions.

Oil Prices Stay Under Pressure Amid Supply Growth and Trade Tensions

Oil markets remained subdued as investor sentiment continued to be weighed down by rising output from OPEC plus and renewed geopolitical friction. US President Donald Trump's threat to raise tariffs on India over its purchases of Russian crude added to the uncertainty.

Brent Holds Steady, US Crude Dips Slightly

Brent crude futures were unchanged at 68 dollars and 76 cents per barrel. US West Texas Intermediate futures edged down by 0.02 percent to 66 dollars and 28 cents per barrel. The combination of increased supply and political risk is keeping upward momentum in check.

Gold Inches Higher

Gold prices saw a modest uptick, with spot rates rising to 3381 dollars and 40 cents per ounce. The precious metal found some support amid ongoing market volatility and international tensions.

European and US Markets Edge Up

Equity futures in Europe and the United States reflected cautious optimism. The Euro Stoxx 50 climbed 0.2 percent, Germany's DAX rose 0.3 percent, and the FTSE gained 0.4 percent. In the US, S&P 500 e-mini futures advanced by 0.2 percent, as traders looked for signs of stability in a turbulent environment.

Bitcoin Pauses After Rally

Bitcoin's value held steady at 114 thousand 866 dollars and 6 cents. After a two-day rally, the leading cryptocurrency is now consolidating, with no clear directional movement in early trading.