On Wednesday, the GBP/USD currency pair made only a minimal upward retracement, and for most of the day, trading was dull and calm. As we predicted on Wednesday morning, the GDP reports from Germany, the European Union, and the United States did not trigger much market excitement, and as usual, we won't cover the FOMC meeting results in this article. We remind readers that, in our view, it takes 12–24 hours after the announcement of the Federal Reserve's decision for the market to calm down. And even if there was no initial turbulence, the market still needs time to digest the information and draw conclusions fully. It often happens that right after an FOMC meeting, the price moves sharply in one direction, only to return to its original levels by the next morning. That's why we always advise against rushing to conclusions.

In this article, we will discuss the outlook for the Fed's monetary policy and U.S. inflation. Over the past few months, the Consumer Price Index has increased slightly, but much less than many expected. We have already explained why this is happening. First, for the past three months, the U.S. had "preferential" and minimal tariffs in place. For example, tariffs on European imports have now risen to 15%. Second, American manufacturers and retailers had prepared in advance for Donald Trump's trade war by stockpiling goods, which allowed them to spend several months selling inventory at old prices. Therefore, inflation hasn't fully materialized yet — it is only just beginning to respond to Trump's tariffs.

Thus, in the coming months, given the fact that tariffs remain in place even after the trade deals were signed, not only can we expect further acceleration of inflation in the U.S., but we must. If that does indeed happen, even two rounds of Fed easing before year-end will be hard to justify. But rising inflation is a double-edged sword. Alongside it, the labor market might begin to shrink. If employment and unemployment data continue to disappoint month after month, the Fed will have to recall its second mandate — ensuring maximum employment. And for that, it would have to lower the key interest rate.

In essence, the Fed could find itself caught between two fires. On the one hand, inflation is rising — cutting rates is off the table. On the other hand, the labor market is deteriorating — a rate cut is needed. What Jerome Powell and the FOMC will choose is impossible to predict. One must also remember the continued pressure on Powell and the Fed from Trump, for whom inflation is never high enough and who desperately needs economic growth.

It's also worth noting that in recent years, the lowest-income population groups in the U.S. have begun spending less money, yet overall national demand has remained nearly unchanged. This indicates that the poor are becoming poorer while the rich are getting richer — a situation that clearly suits Trump. The U.S. president cares about overall national statistics, not how vulnerable groups of the population are faring. Inflation primarily harms low-income citizens, not millionaires. That's why high inflation doesn't scare Trump — he wants GDP growth and more money, money, money.

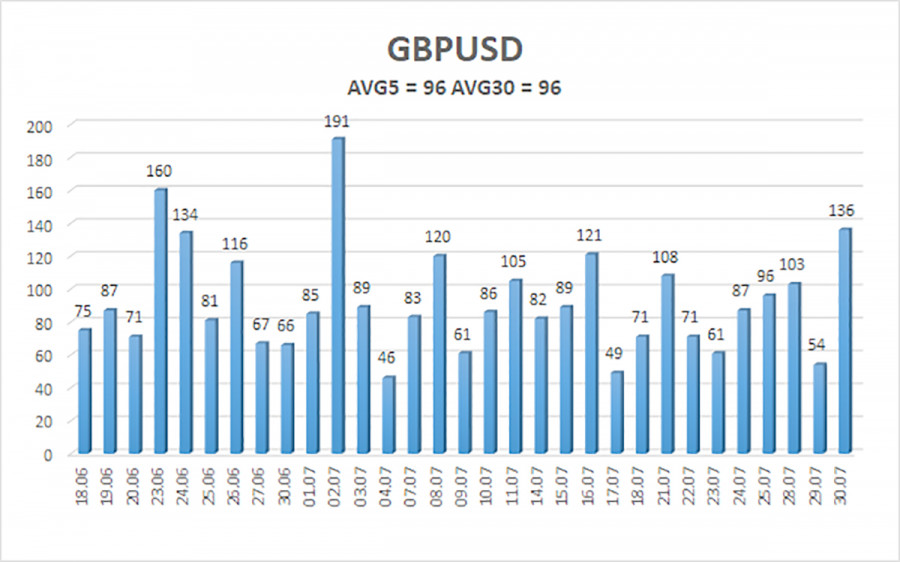

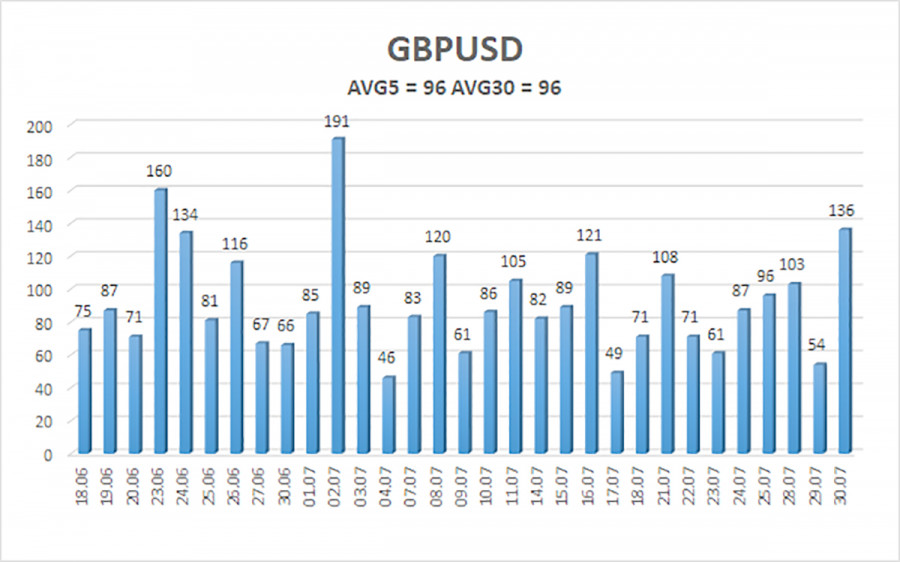

The average volatility of the GBP/USD pair over the last five trading days is 96 pips. For the pound/dollar pair, this figure is considered "moderate." Therefore, on Thursday, July 31, we expect movement within the range limited by 1.3185 and 1.3377. The long-term linear regression channel points upward, indicating a clear uptrend. The CCI indicator has twice entered the oversold zone, signaling a potential resumption of the bullish trend. A new wave of corrective movement has now begun.

Nearest Support Levels:

S1 – 1.3245

S2 – 1.3184

S3 – 1.3123

Nearest Resistance Levels:

R1 – 1.3306

R2 – 1.3367

R3 – 1.3428

Trading Recommendations:

The GBP/USD currency pair has resumed a technical downward correction. However, in the medium term, Trump's policies will likely continue to put pressure on the dollar. Thus, long positions targeting 1.3550 and 1.3611 remain relevant if the price is above the moving average. If the price is below the moving average, short positions may be considered with targets at 1.3245 and 1.3184, based purely on technical grounds. From time to time, the U.S. dollar shows corrections, but for a trend-driven strengthening to occur, we would need genuine signs of the end of the global trade war — something that now appears unlikely.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.