On Tuesday, the EUR/USD currency pair continued trading lower. But why? Why is the U.S. dollar continuing to strengthen when all key factors seem to indicate it should be falling? The macroeconomic and fundamental background is virtually nonexistent, yet for once, the dollar is clearly in demand among traders.

To understand what's going on, we need to look back at last week when the U.S. government shutdown began. The ADP employment report missed expectations by a wide margin, and the ISM business activity indices came in weak, showing figures nobody wanted to see. Yet even amid all this, the dollar remained resilient and even advanced on some days. This week, with no major reports or events released so far, the dollar continues to rise.

As we've said in previous articles, if a market move is illogical, it's best to simply acknowledge that fact rather than try to explain it with generic phrases like "growth in risk-off sentiment" or "hawkish/dovish expectations." Market sentiment can change — but only specific triggers can explain such shifts. And last week, nothing really changed for the dollar.

On Monday, news emerged about the resignation of yet another French Prime Minister — this time after only 27 days in office. On Tuesday, a car exploded near the residence of the now former PM Sebastien Lecornu. Along with Lecornu, Defense Minister Bruno Le Maire also resigned. In our view, there's nothing overly extraordinary about any of that. Consider how many times a political crisis has threatened to erupt in Germany. And in France, five prime ministers have come and gone over the last two years. As for Britain, no prime minister in the past decade has served a full term. So, an early resignation of a government official is not a political crisis. It's simply a reshuffling of leadership.

Still, the market may price in the worst-case scenario, reacting to events of this nature even when logic says otherwise. No one can honestly say what the market is currently responding to, because the market is not a single entity but an aggregation of countless traders. We can only speculate.

And based on that, we believe the so-called crisis in France has little to do with what's happening in EUR/USD. More likely, it's just a convenient excuse used to justify a move that doesn't need justification.

Looking at the daily timeframe, note the price action from July 1 to the present. The EUR/USD may be in a range or consolidating. For comparison, the British pound has been stuck in a flat range for several months — something you can see on the daily chart as well.

If this is indeed a flat phase, then there may be no need for news or data to justify declines in the euro. A flat is a period of accumulation or distribution, and price movement within it is 80–90% technical. We observed last week that the market largely ignored major events and economic releases. In other words, the market is not yet ready to resume selling the dollar, even if the fundamentals permit it.

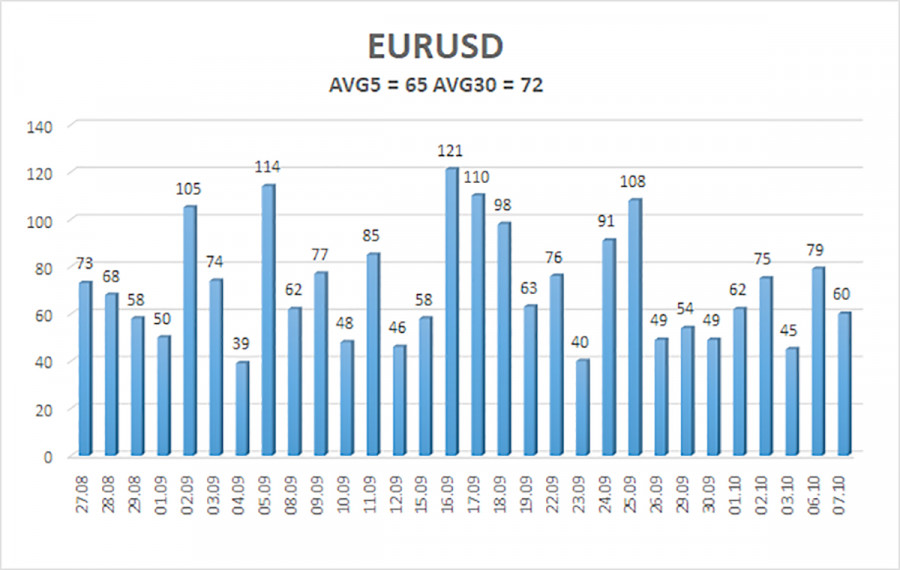

As of October 8, the average volatility in EUR/USD over the last five trading days stands at 65 pips, which is considered "moderate." On Wednesday, we expect the pair to fluctuate between the levels of 1.1610 and 1.1740. The higher linear regression channel remains pointed upward, indicating that the long-term uptrend is still intact. The CCI indicator has entered oversold territory, which may trigger the next wave of upward movement.

Nearest Support Levels:

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

Nearest Resistance Levels:

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair continues to consolidate within a downward correction, but the broader uptrend remains intact across all higher timeframes. The U.S. dollar continues to be heavily impacted by Donald Trump's policies, particularly his refusal to "stop at what has already been achieved." The dollar has risen as much as it could over the past month, but now it appears to be time for a more prolonged drop.

If price trades below the 20-period moving average, short-term sell positions are suitable as a purely technical play, with targets at 1.1658 and 1.1610. Long positions remain valid above the moving average, with upside targets at 1.1841 and 1.1902, continuing the trend.

Chart Annotations:

- Linear regression channels help determine the current market trend. If both channels are aligned in the same direction, the trend is considered strong.

- The 20-period smoothed moving average defines the short-term trend direction and determines the preferred trade action.

- Murrey levels are used to set price targets for both trending and corrective phases.

- Volatility levels (marked with red lines) outline the likely price range for the next 24 hours based on recent volatility metrics.

- CCI (Commodity Channel Index): Readings below -250 or above +250 signal potential trend reversals.