Trade Analysis and Tips for Trading the Euro

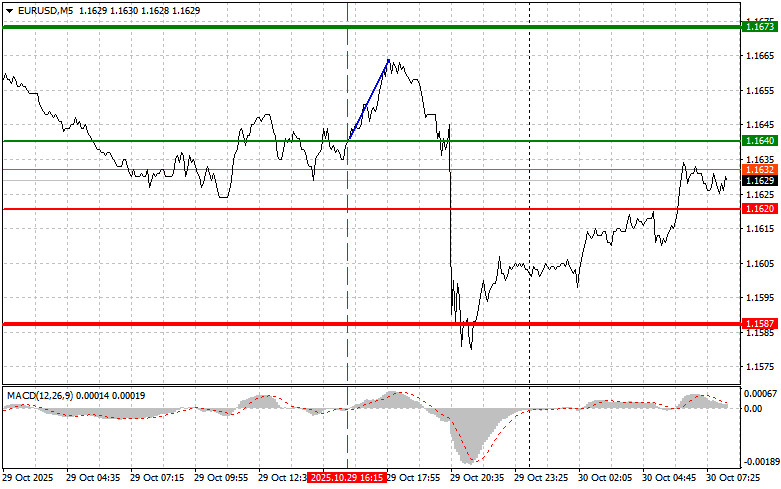

The test of the price at 1.1640 coincided with the MACD indicator just starting to move above the zero mark, confirming a good entry point for buying euros, which led to an upward move of more than 25 pips.

In the context of slowing global economic growth and persistent trade tensions, the Federal Reserve made a decision yesterday aimed at supporting economic growth in the United States. It was expected that the rate cut would reduce the dollar's appeal to investors seeking higher returns in other currencies, but that did not occur. Jerome Powell's speech modified market forecasts. His cautious tone and hint at a pause in the process of rate cuts in the near future restored demand for the dollar. Investors interpreted the signal that the Fed does not plan to continue aggressive rate cuts, despite the pressure the White House administration is exerting on the committee.

Today, attention is focused on the upcoming economic reports for the Eurozone. The market is closely monitoring the forthcoming economic reports from the European region and Germany, as they can significantly influence the short-term exchange rate of the euro. GDP data for the Eurozone will provide an insight into the current economic situation and growth rates in the region. If the actual figures exceed expectations, it may indicate greater economic resilience than previously thought, which, in turn, could support the euro.

The unemployment rate in the Eurozone is also an important indicator. Its decrease is usually interpreted as a favorable sign, indicating an improvement in economic conditions and increased consumer activity. This could enhance the euro's appeal. The consumer price index in Germany is also quite significant. Inflation is one of the key factors the German central bank considers. An increase in the consumer price index could signal a possible tightening of monetary policy by the ECB in the future. Therefore, the combination of today's published data may significantly affect the future dynamics of the European currency. Investors will carefully analyze each indicator to assess the Eurozone's outlook and make informed investment decisions.

Regarding the intraday strategy, I will focus more on implementing scenarios №1 and №2.

Buying Scenarios

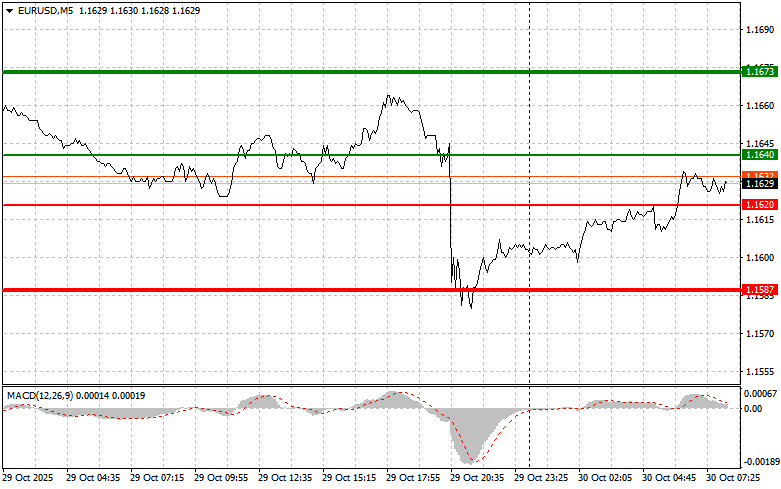

- Scenario №1: Today, I plan to buy euros when the price reaches around 1.1640 (green line on the chart), targeting a move to 1.1673. At 1.1673, I plan to exit my long positions and also sell euros in the opposite direction, anticipating a movement of 30-35 pips from the entry point. Growth in the euro today can only be expected as part of a correction. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting an upward move.

- Scenario №2: I also plan to buy euros today if the price tests 1.1620 twice in a row, when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a market rebound. An increase can be expected toward the opposing levels of 1.1640 and 1.1673.

Selling Scenarios

- Scenario №1: I plan to sell euros today after reaching the level of 1.1620 (red line on the chart). The target will be 1.1587, where I plan to exit the market and immediately open longs in the opposite direction (anticipating a move of 20-25 pips from that level). Pressure on the pair may return at any moment today. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting its downward move.

- Scenario №2: I also plan to sell euros today if the price tests 1.1640 twice in a row, when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal. A decrease can be expected toward the opposing levels of 1.1620 and 1.1587.

What's on the Chart:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price for setting Take Profit or personally taking profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price for setting Take Profit or personally taking profits, as further declines below this level are unlikely.

- MACD Indicator: When entering the market, it is important to consider the overbought and oversold zones.

Important: Beginner traders in the Forex market need to exercise caution when making entry decisions. It is advisable to stay out of the market before significant fundamental reports to avoid sharp price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not employ money management and trade large volumes.

Remember that to trade successfully, you need to have a clear trading plan, similar to the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.