Trade Review and Tips for Trading the British Pound

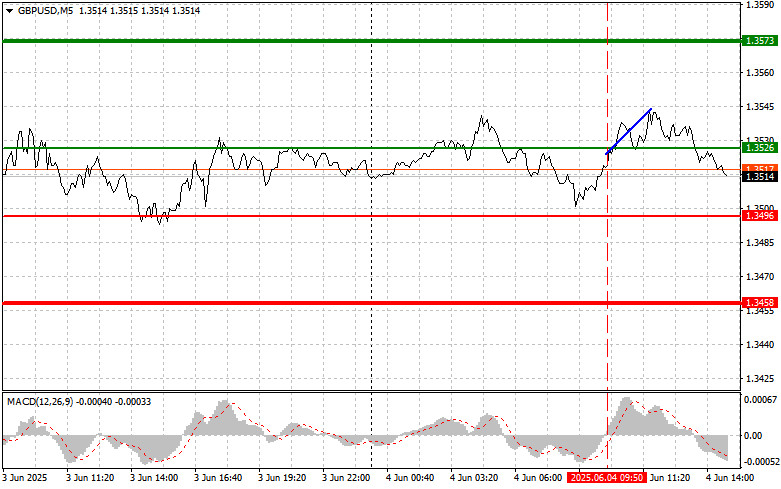

The price test at 1.3526 in the first half of the day occurred when the MACD indicator had just started moving upward from the zero mark, confirming a proper entry point for buying the pound — although the pair did not achieve significant growth.

More positive-than-expected revised data on U.K. services sector activity for May served as a catalyst for a notable strengthening of the British pound and, consequently, a weakening of the U.S. dollar. Investors took this as a signal that the British economy is more resilient than previously thought, easing recession fears and supporting expectations that the Bank of England will maintain high interest rates.

Clearly, in the second half of the day, all eyes will be on the U.S. ADP labor market report, along with similar data for the services PMI and the composite PMI for May. These data are like litmus tests, capable of instantly shifting investor sentiment to either optimistic or pessimistic tones, depending on how much the actual figures deviate from expectations. Minor deviations are likely to be ignored, but significant discrepancies could trigger notable market volatility. Special attention is, of course, on the labor market: If ADP shows a significant increase in employment, it would reinforce confidence in the stability of the U.S. economy. Conversely, weak data may signal slowing economic growth and prompt the Fed to consider pausing interest rate hikes.

The PMI indexes are equally important as they reflect the sentiment of purchasing managers in key sectors of the economy and provide insight into current business activity. A rise in these indexes indicates an expansion of economic activity, while a decline suggests contraction.

For the intraday strategy, I will mainly rely on the execution of scenarios #1 and #2.

Buy Signal

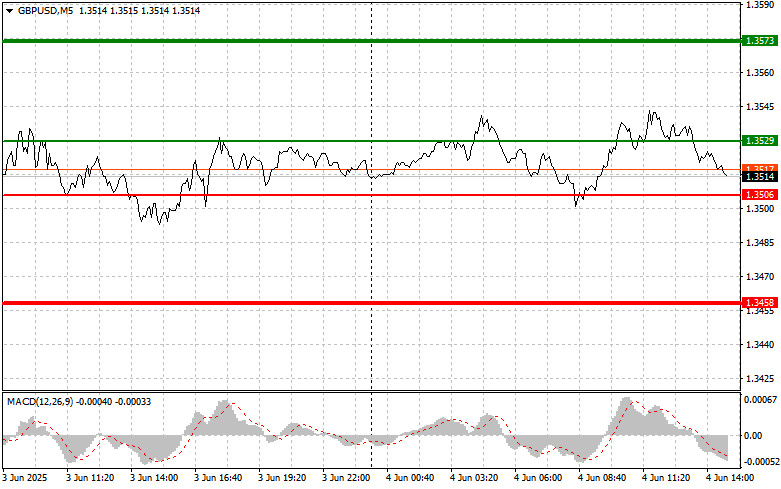

Scenario #1:Today, I plan to buy the pound at the entry point around 1.3529 (green line on the chart), targeting a rise to 1.3573 (thicker green line on the chart). Around 1.3573, I plan to exit long positions and open sell positions in the opposite direction, aiming for a 30–35 point pullback from that level. Pound growth today is likely only after weak U.S. data.Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2:I also plan to buy the pound today in case of two consecutive tests of the 1.3506 level when the MACD is in oversold territory. This will limit the downward potential of the pair and lead to a market reversal upward. Growth can be expected toward the opposite levels of 1.3529 and 1.3573.

Sell Signal

Scenario #1:I plan to sell the pound today after the 1.3506 level is updated (red line on the chart), which should quickly push the pair lower. The key target for sellers will be 1.3458, where I will exit short positions and immediately open long positions in the opposite direction, aiming for a 20–25 point pullback from that level. Sellers are expected to show strength if strong statistics are released.Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2:I also plan to sell the pound today in case of two consecutive tests of the 1.3529 level when the MACD is in overbought territory. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.3506 and 1.3458 can be expected.

What's on the Chart:

- Thin green line – entry price where you can buy the trading instrument;

- Thick green line – estimated price where you can set Take Profit or manually lock in profits, as further growth above this level is unlikely;

- Thin red line – entry price where you can sell the trading instrument;

- Thick red line – estimated price where you can set Take Profit or manually lock in profits, as further decline below this level is unlikely;

- MACD Indicator – When entering the market, it is important to follow overbought and oversold areas.

Important:Beginner Forex traders must be very cautious when deciding to enter the market. It is best to stay out of the market before the release of major fundamental reports to avoid sudden price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not practice proper money management and trade with large volumes.

And remember, successful trading requires a clear trading plan, like the one I presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.