Trade Analysis and Tips for the British Pound

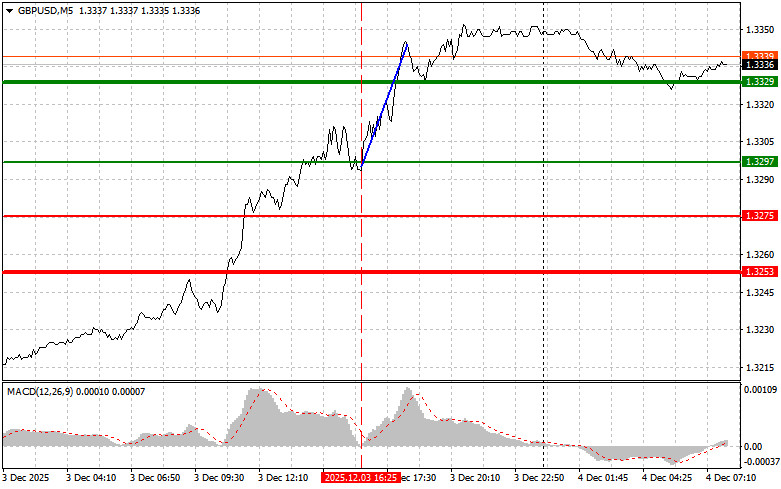

The price test at 1.3297 occurred when the MACD indicator was just beginning to move upwards from the zero mark, confirming an appropriate entry point for buying the pound. As a result, the pair rose by more than 40 pips.

The British pound continued its rapid rise against the dollar following news of a decline in U.S. ADP employment for November. The figure of 32,000 came as a shock to analysts who had forecast an increase of 13,000. This sharp decline indicates a potential slowdown in the U.S. economy, heightening concerns over a weak end to the year. The pound strengthened against the dollar, reaching new multi-month highs. This rise reflects market confidence in the relative resilience of the British economy compared to the U.S. economy.

The movement may also be attributed to expectations regarding the future policies of the U.S. Federal Reserve. Weak employment data may prompt the Fed to reconsider its interest rate plans, which, in turn, would weaken the dollar.

This morning, market attention will be focused on the release of the UK construction PMI and a speech by Bank of England Monetary Policy Committee member Catherine L. Mann. The PMI index, as an indicator of construction activity, will provide valuable insight into the current state and prospects of this crucial sector of the British economy. Market participants will closely analyze this report to gauge economic growth rates, employment situation, and investment levels. Simultaneously, Mann's speech may reveal the Bank's current stance regarding economic realities and future monetary policy. Experts will look for signals on the BoE's further actions on interest rates. The interplay between the PMI data and the BoE representative's comments will shape a holistic view of the UK's economic environment, and positive signals could allow the British pound to continue its ascent against the dollar.

Regarding the intraday strategy, I will focus on implementing Scenarios #1 and #2.

Buy Scenarios

- Scenario #1: I plan to buy the pound today when the price reaches around 1.3344 (the green line on the chart), with a target for growth to 1.3372 (the thicker green line on the chart). Around 1.3372, I plan to exit my long positions and sell back, aiming for a movement of 30-35 pips in the opposite direction from the level. Strong pound growth can only be anticipated after good data. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just beginning to rise from there.

- Scenario #2: I also plan to buy the pound today if there are two consecutive tests of 1.3324 while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. A rise to the opposite levels of 1.3344 and 1.3372 can be expected.

Sell Scenarios

- Scenario #1: I plan to sell the pound today after it reaches 1.3324 (the red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be the 1.3295 level, where I plan to exit my shorts and also buy back immediately (aiming for a 20-25-pip move in the opposite direction from that level). Pound sellers will emerge in the case of weak data. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting its decline from there.

- Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3344 while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decrease to the opposite levels of 1.3324 and 1.3295 can be expected.

What's on the Chart:

- Thin green line – entry price at which you can buy the trading instrument;

- Thick green line – estimated price where you can set Take Profit or take profit yourself, as further growth above this level is unlikely;

- Thin red line – entry price at which you can sell the trading instrument;

- Thick red line – estimated price where you can set Take Profit or take profit yourself, as further decline below this level is unlikely;

- MACD Indicator. When entering the market, it is essential to be guided by overbought and oversold zones.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.