Trade Analysis and Tips for Trading the Japanese Yen

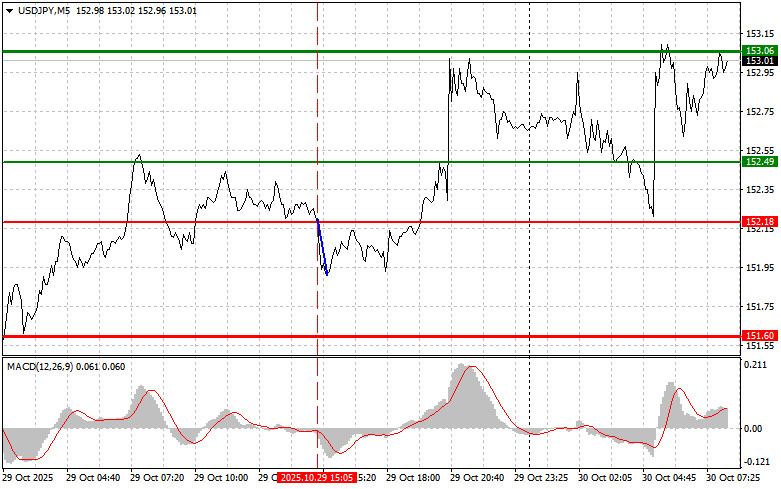

The test of the price at 152.18 coincided with the moment when the MACD indicator began to move down from the zero mark, confirming a good entry point to sell the dollar. As a result, the pair declined by approximately 25 pips.

Following Powell's speech yesterday, in which he emphasized that future rate decisions depend on economic indicators, the Japanese yen declined against the US dollar. According to the Federal Reserve Chair, the October rate cut was more of a risk-management tool, and the future remains uncertain. The reaction of the currency markets was predictable: uncertainty prompted investors towards safe-haven assets, diminishing the yen's attractiveness. After the Fed Chair's comments, the market, which had previously anticipated a more aggressive easing of monetary policy in the US, adjusted its expectations, putting additional pressure on the Japanese currency.

During today's Asian session, the yen again lost ground after the Bank of Japan left its base interest rate unchanged. Bank board members Naoki Tamura and Hajime Takata voted against the decision for the second consecutive time. Investor attention is now focused on the press conference with the bank's governor, Kazuo Ueda, to gain insights into future actions, as high inflation and persistent weakness of the yen continue to push the central bank towards responses.

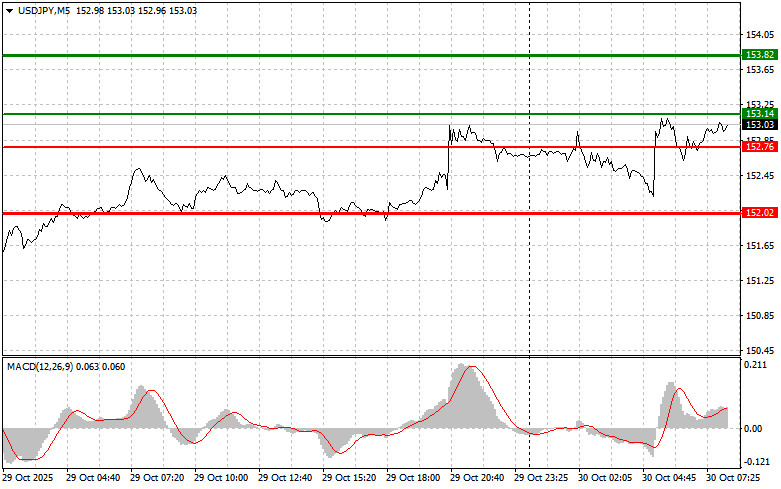

Regarding the intraday strategy, I will focus more on implementing scenarios №1 and №2.

Buying Scenarios

- Scenario №1: I plan to buy USD/JPY today upon reaching an entry point around 153.14 (green line on the chart), with a target for growth to 153.82 (thicker green line on the chart). At 153.82, I plan to exit my long positions and begin selling in the opposite direction (anticipating a movement of 30-35 pips in the opposite direction from this level). It is best to return to buying the pair during corrections and significant pullbacks in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise from it.

- Scenario №2: I also plan to buy USD/JPY today if the price tests 152.76 twice and the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a market reversal. An increase can be expected toward opposing levels of 153.14 and 153.82.

Selling Scenarios

- Scenario №1: I plan to sell USD/JPY today only after the 152.76 level is updated (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be the 152.02 level, where I plan to exit my shorts and immediately open longs in the opposite direction (anticipating a 20-25-pip move from that level). It is better to sell as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning its decline from it.

- Scenario №2: I also plan to sell USD/JPY today if the price tests 153.14 twice and the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decrease can be expected toward opposing levels of 152.76 and 152.02.

What's on the Chart:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price for setting Take Profit or personally taking profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price for setting Take Profit or personally taking profits, as further declines below this level are unlikely.

- MACD Indicator: When entering the market, it is important to consider the overbought and oversold zones.

Important: Beginner traders in the Forex market need to exercise caution when making entry decisions. It is advisable to stay out of the market before significant fundamental reports to avoid sharp price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not employ money management and trade large volumes.

Remember that to trade successfully, you need to have a clear trading plan, similar to the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.