The EUR/USD currency pair continued a mild downward movement throughout Thursday, still largely unfounded from a fundamental perspective. To recap, the U.S. dollar currently has far more new bearish factors than it has bullish ones. Yet, for nearly two weeks now, the market has been ignoring the overwhelmingly negative fundamental and macro backdrop for the dollar. The reason for this happening is difficult to explain.

We believe there's no need to force an explanation for every single move. Who could have predicted two weeks ago that the dollar would rally against the backdrop of a government shutdown, disappointing labor data, and dovish comments from the Federal Reserve? We think no one. So what's the point of trying to explain this move in hindsight? It's irrational — that's all traders need to recognize.

On Wednesday evening, the Fed released minutes from its September monetary policy meeting. Unsurprisingly, those minutes changed nothing. In September, Jerome Powell suggested that the Fed might cut rates two more times before year-end — and the minutes confirmed that most FOMC members support continued easing due to the sharp slowdown in the labor market. So what's changed? Nothing.

Markets were already pricing in two more rate cuts in October and December — and still are.

It's worth remembering that Fed minutes are usually just a formality. Markets receive key information immediately after the meeting in the Fed's statement and press conference. Therefore, it's no surprise that the market reaction to the minutes was minimal or absent.

What is surprising is that the dollar continues to strengthen. But glance at the daily timeframe, and you'll see — the U.S. dollar isn't actually showing significant upward momentum. Over the past few weeks, it has regained around 300 pips, but since the beginning of 2025, it has lost 1,700 pips overall. So this recovery doesn't even count as a minimal 23.6% Fibonacci correction.

Yes, the dollar is currently rising — irrationally — but what does it change? The long-term trend remains bullish for the euro.

It's also worth noting that this week featured very few important economic events. The main one was Powell's speech, which we'll address further in another section. Even if the pair's downward move continues in the short term, our broader expectation remains the same: upside potential.

The daily chart also suggests a possible range-bound movement (flat) forming in both EUR and GBP. If that's the case, the price may continue swinging 400–500 pips up and down for an extended period. On smaller timeframes, this range will look like a sequence of trend segments. And in a flat market, price moves don't always require strong fundamental drivers — so don't be surprised by the dollar's seemingly illogical strength.

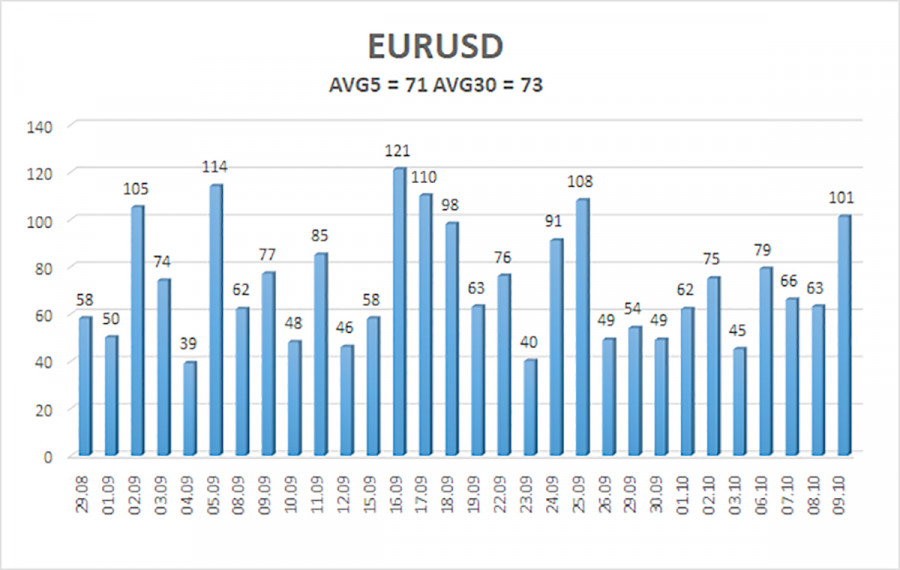

The average volatility of the EUR/USD pair over the past five trading days, as of October 10, is 71 pips, which is considered "moderate." On Friday, we expect the pair to move between 1.1484 and 1.1626. The higher linear regression channel is still pointed upward, indicating a broader bullish trend. The CCI indicator had entered the oversold zone, which could signal the beginning of a new bullish phase.

Nearest Support Levels:

- S1 – 1.1536

- S2 – 1.1414

- S3 – 1.1353

Nearest Resistance Levels:

- R1 – 1.1597

- R2 – 1.1658

- R3 – 1.1719

Trading Recommendations

The EUR/USD pair remains in a corrective phase, but the overall uptrend remains valid across higher timeframes. U.S. dollar performance is still heavily influenced by Donald Trump's policy agenda, which shows no signs of slowing down. The dollar may be rising at the moment, but the rationale behind it is weak at best.

If the price moves below the moving average, small short positions can be considered with targets at 1.1536 and 1.1484 based on technical analysis alone. If the price remains above the moving average, long positions remain relevant with targets at 1.1841 and 1.1902, continuing the longer-term trend.

Chart Notes:

- Linear Regression Channels help define the current trend. If both channels are sloping in the same direction, the trend is strong.

- The Moving Average (setting 20.0, smoothed) indicates short-term direction.

- Murrey Math Levels (support/resistance lines) are used for key movement/correction levels.

- Volatility Levels (red lines) represent the probable price range for the day based on current volatility metrics.

- CCI Indicator – if CCI moves below -250 (oversold) or above +250 (overbought), a trend reversal may be nearing.