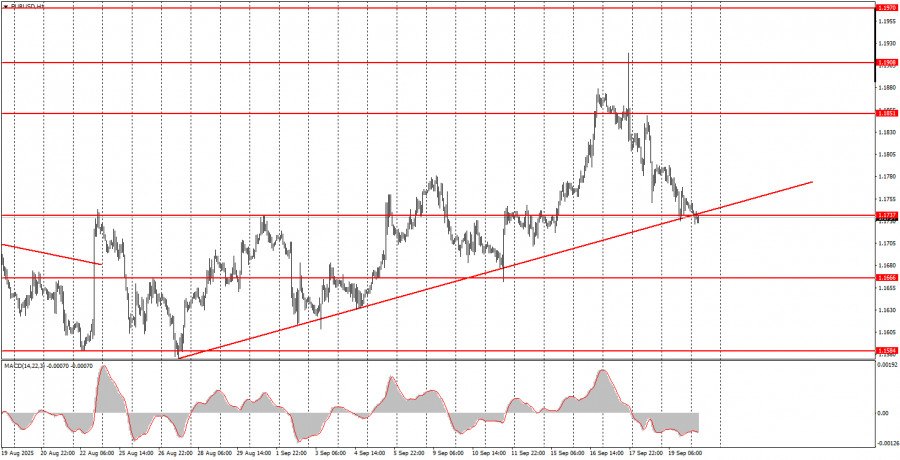

Friday Trade Analysis:1H EUR/USD Chart

The EUR/USD currency pair continued its downward movement on Friday and may break through the ascending trend line as early as today. The euro has been falling for three consecutive days now, which is somewhat puzzling. Most recent data and news have not been negative for the euro or particularly positive for the dollar. The pair began its decline last Wednesday evening, right after the Fed announced the dovish results of its meeting. The fall continued through Thursday and Friday, driven in part by strong pressure on the pound sterling due to renewed budget and debt issues in the UK. However, this process should come to an end soon. Nothing has changed recently for the U.S. dollar that would justify a strong recovery. However, if the price breaks through the trend line, the current trend will turn bearish, and further decline should be expected. There were no noteworthy events on Friday in either the Eurozone or the UK.

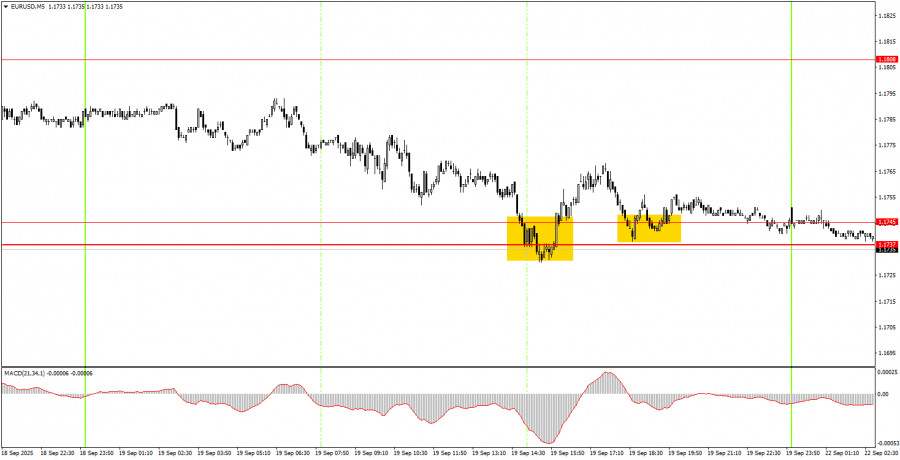

5M EUR/USD Chart

On the 5-minute timeframe, two buy signals formed on Friday around the 1.1737–1.1745 level. Both turned out to be false, and the second one ideally should not have been executed, since it occurred just a few hours before market close and didn't allow for a breakeven Stop Loss to be placed safely. In the first case, the price moved up 15 points, which allowed for setting a breakeven Stop Loss.

How to Trade on Monday:On the hourly timeframe, the EUR/USD pair has good potential for growth, but in the short term, the trend may change to bearish. The fundamental and macroeconomic background remains negative for the USD, so we still do not expect strong appreciation of the U.S. currency. From our perspective, the dollar may rely only on technical corrections. The Fed meeting brought no significant changes for the dollar's outlook.

On Monday, the EUR/USD pair may resume its upward movement if it bounces off the ascending trend line. If it doesn't, further decline should be expected, with a target in the 1.1655–1.1666 level. However, since the price has been falling for three straight days, a pullback upward may occur before a new wave of decline.

On the 5-minute TF, the following levels should be considered:1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1737–1.1745, 1.1808, 1.1851, 1.1908, 1.1970–1.1988.

On Monday, there are no important or interesting events scheduled in either the Eurozone or the U.S. Traders will have nothing significant to react to, so volatility may be low.

Main Rules of the Trading System:

- The strength of a signal depends on how quickly the signal is formed (bounce or breakout). The faster the formation, the stronger the signal.

- If two or more false signals form around a specific level, all subsequent signals from that level should be ignored.

- During flat (sideways) markets, any currency pair may generate many false signals—or none at all. At the first sign of a flat market, it's better to stop trading.

- Trade entries should be made between the beginning of the European session and the middle of the U.S. session. All open trades should be closed manually by the end of this period.

- Signals from the MACD indicator on the hourly TF should only be used when there is good volatility and a confirmed trend (validated by a trend line or trend channel).

- If two levels are located too close to each other (between 5 to 20 points), consider them as a price area (support or resistance zone), not as individual levels.

- After 15 pips of movement in the correct direction, set the Stop Loss to breakeven.

What's Displayed on the Charts:

- Support and resistance price levels – these are target zones for opening buy or sell trades. Take Profit levels can be placed near them.

- Red lines – channels or trend lines that show the current trend and the preferable direction for trading.

- MACD Indicator (14,22,3) – histogram and signal line – an auxiliary tool that can serve as a signal source.

- Important speeches and reports (always listed in the economic news calendar) can significantly influence currency pair movements. During their release, it's recommended to trade cautiously or exit the market altogether to avoid sharp price reversals.

Beginners in forex trading should remember that not every trade can be profitable. Developing a solid strategy and practicing sound money management are key elements for long-term success in trading.