Trade Review and Advice on Trading the Japanese Yen

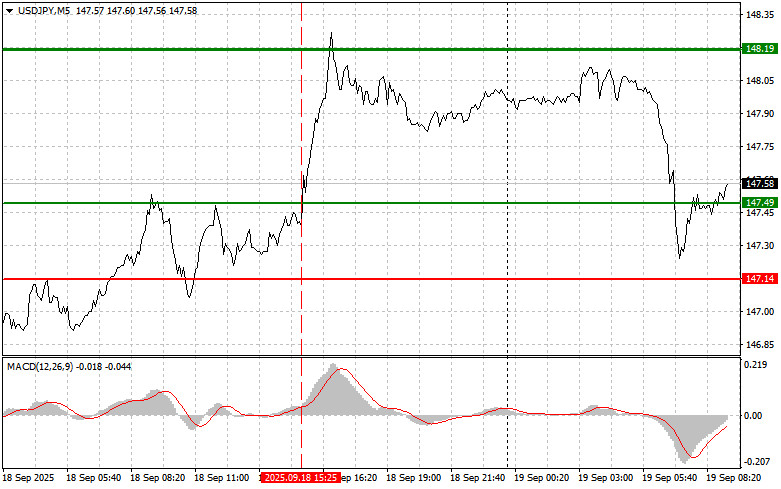

The test of the 147.49 price level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. For this reason, I did not buy the dollar and missed a good upward move.

The jump in the Philadelphia Manufacturing Index to 21 points in August led to instant dollar buying and a drop in the Japanese yen. This surge took most analysts by surprise—forecasts had called for much lower readings—and triggered an immediate reassessment of the US economic outlook. Investors eager to catch any signs of recovery quickly turned to the dollar as a safe haven and profit instrument. The increased demand for dollars, in turn, put pressure on the yen.

Today's Bank of Japan decision to keep rates unchanged at 0.5% provided some support for the yen, as many investors and traders anticipate a rate hike in the medium term. This hope is buoyed by growing inflationary pressures in Japan. Still, the market reaction remains subdued. On one hand, holding rates steady signals the Bank of Japan's caution and unwillingness to risk slowing economic growth. On the other hand, investors know the current situation cannot last forever. Inflation, while not yet at target, continues to rise steadily. The key factor for the yen's future will be the pace and scale of changes in BoJ policy. If the central bank moves too slowly, the yen may keep weakening, but a sharp rate hike could shock the economy and trigger a recession. Ultimately, BoJ will need to find a delicate balance between controlling inflation and supporting growth.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

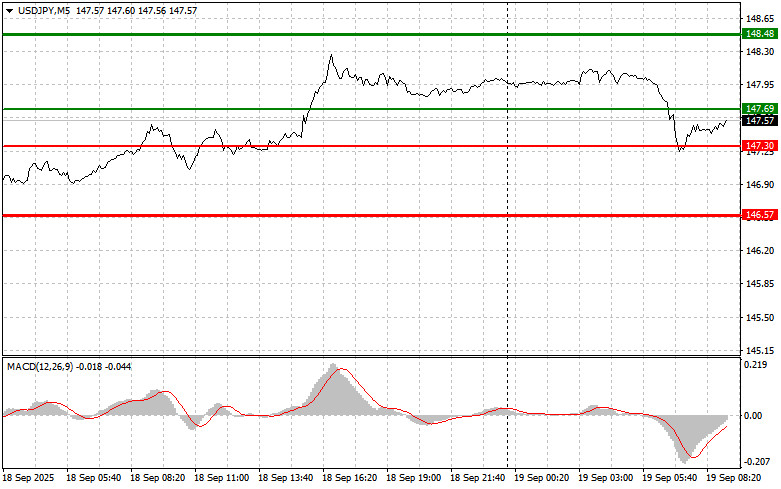

Scenario #1: Today, I plan to buy USD/JPY at the entry point around 147.69 (green line on the chart), targeting a move to 148.48 (thicker green line). Near 148.48, I'll exit longs and open shorts in the opposite direction, aiming for a 30–35 pip reversal from the level. It's best to return to buying the pair on corrections and significant drawdowns in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I'll also look to buy USD/JPY if there are two consecutive tests of the 147.30 price while the MACD is in oversold territory. This will limit the pair's downside and prompt a reversal upward. Gains to the next levels at 147.69 and 148.48 can then be expected.

Sell Scenario

Scenario #1: Today, I plan to sell USD/JPY only after a break below 147.30 (red line on the chart), which should lead to a quick drop in the pair. The main target for sellers will be 146.57, where I'll close shorts and immediately open longs in the opposite direction (looking for a 20–25 pip rebound from this level). The higher you sell from, the better. Important! Before selling, ensure the MACD indicator is below the zero line and is just starting to decline from it.

Scenario #2: I'll also look to sell USD/JPY if there are two consecutive tests of the 147.69 price while the MACD is in the overbought zone. This will cap the upside potential and trigger a bearish reversal, with an expected decline to the 147.30 and 146.57 levels.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.