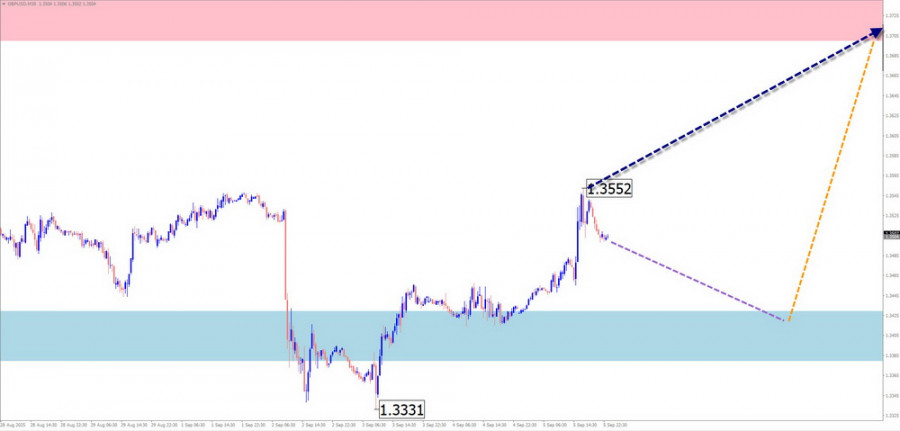

GBP/USD

Brief analysis:Since the beginning of this year, the British pound has been steadily rising against the U.S. dollar. A corrective phase of the wave began at the end of June and is still unfinished. The structure shows the final part (C) is not complete. The calculated resistance passes along the lower boundary of the potential daily reversal zone.

Weekly forecast:In the first days, the pair will likely decline and trade sideways along the support zone. Then, a reversal and renewed upward movement should follow. A brief breakout below the support boundary is possible before the turn. The resistance zone marks the probable upper boundary of the weekly range.

Potential reversal zones

- Resistance: 1.3700/1.3750

- Support: 1.3430/1.3380

Recommendations

- Sales: risky due to limited downward potential.

- Purchases: relevant after confirmed reversal signals near support.

AUD/USD

Brief analysis:The Australian dollar's uptrend over the past two months brought prices into a large potential reversal zone on the higher timeframe. The current bearish wave began on August 29 and remains incomplete.

Weekly forecast:In the next few days, price is expected to move sideways, possibly dipping to the upper boundary of support. Afterward, renewed bullish movement is likely. The calculated resistance lies at the lower edge of a major reversal zone, where the entire wave may end.

Potential reversal zones

- Resistance: 0.6620/0.6670

- Support: 0.6530/0.6480

Recommendations

- Sales: limited potential; safer to reduce volume size.

- Purchases: possible after reversal signals appear near support.

USD/CHF

Brief analysis:Since April, the Swiss franc pair has been in an uptrend, forming as a contracting flat. The pair is still in correction, nearing the upper boundary of a strong potential reversal zone, which acts as support.

Weekly forecast:Early in the week, sideways trading near support is likely. Toward the weekend, the chance of a reversal and renewed bullish momentum increases. The rate could reach resistance levels during this week.

Potential reversal zones

- Resistance: 0.8170/0.8220

- Support: 0.7930/0.7880

Recommendations

- Sales: not advisable this week.

- Purchases: valid after confirmed reversal signals from your systems.

EUR/JPY

Brief analysis:For the past month, EUR/JPY has been trending upward. Within the unfinished final wave, a counter pullback is forming as a sideways flat. The structure is not yet complete.

Weekly forecast:Sideways movement with a downward bias is expected in the coming days. In the second half of the week, reversal signals near support may trigger renewed upward movement. A volatility spike is possible.

Potential reversal zones

- Resistance: 175.00/175.50

- Support: 171.00/170.50

Recommendations

- Sales: possible in small volumes intraday.

- Purchases: suitable after confirmed reversal signals near support.

AUD/JPY

Brief analysis:Since April, AUD/JPY has been trending upward. Since mid-July, the wave has been forming its middle part (B), mostly sideways as a contracting flat.

Weekly forecast:The pair is expected to continue sideways this week, with a downward bias early on. From support, a reversal upward toward the top of the range may occur by the weekend.

Potential reversal zones

- Resistance: 100.00/100.50

- Support: 95.00/94.50

Recommendations

- Purchases: valid after signals of trend reversal.

- Sales: possible intraday in small volumes.

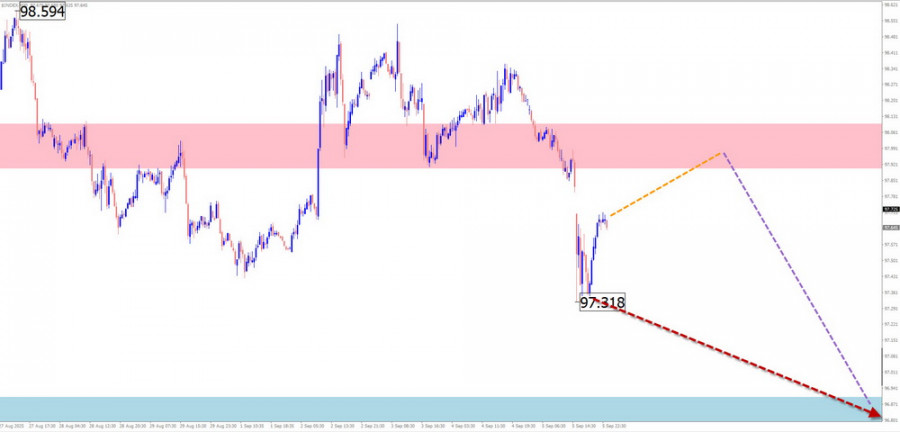

USD Index

Brief analysis:This year, the U.S. dollar index has been trending downward. Prices have reached the top of the potential reversal zone. Recent months have seen horizontal correction near this area. The unfinished segment began on August 1, and for three weeks the pair has formed a flat correction.

Weekly forecast:In the first half of the week, sideways movement near resistance is likely, with pressure on the upper boundary. Increased volatility and renewed decline may follow toward the weekend, possibly triggered by economic data releases.

Potential reversal zones

- Resistance: 97.90/98.10

- Support: 96.90/96.70

RecommendationsDollar purchases in major pairs may be short-lived. After confirmed reversal signals near resistance, trades should account for the dollar's further weakening.

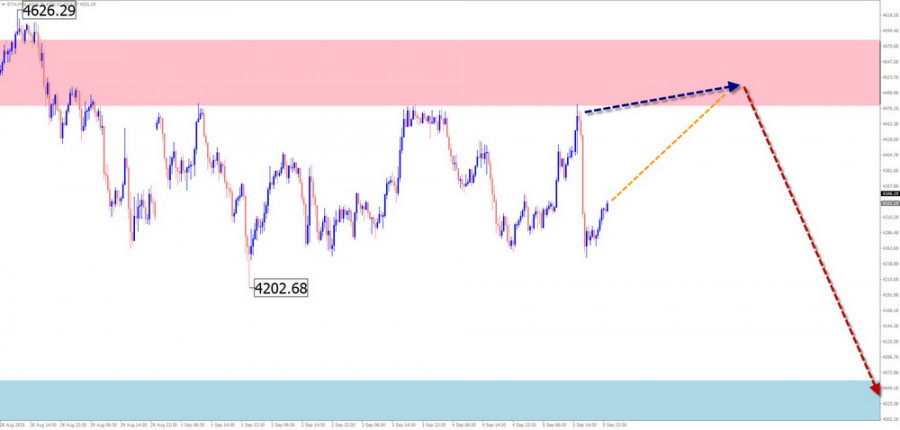

Ethereum (#ETH)

Brief analysis:Since August 22, Ethereum has been correcting the previous upward move. The wave has reversal potential and may mark the start of a new bearish phase. For three weeks, price has been consolidating sideways, forming the middle part (B), still unfinished.

Weekly forecast:Sideways trading will likely continue in the coming days. Early in the week, the pair may rise toward resistance. By the weekend, volatility should increase, bringing a reversal and downward movement.

Potential reversal zones

- Resistance: 4480.0/4580.0

- Support: 4060.0/3960.0

Recommendations

- Purchases: possible intraday in small volumes.

- Sales: not recommended until reversal signals near resistance appear.

Notes: In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). On each timeframe, the focus is on the last unfinished wave. Expected movements are shown with dashed lines.

Attention: The wave algorithm does not account for the time duration of price movements!