MobileTrader

MobileTrader: plataforma de negociação sempre à mão!

Baixe agora e comece a negociar!

04.09.2025 12:48 AM

04.09.2025 12:48 AMThe global oil market is once again shaken: prices are confidently heading downward following news of a possible production increase by major exporters in the coming weekend. The upcoming OPEC+ alliance meeting could bring decisions that significantly change the demand-and-supply balance in the global fuel market—and traders are already preparing for new earning opportunities.

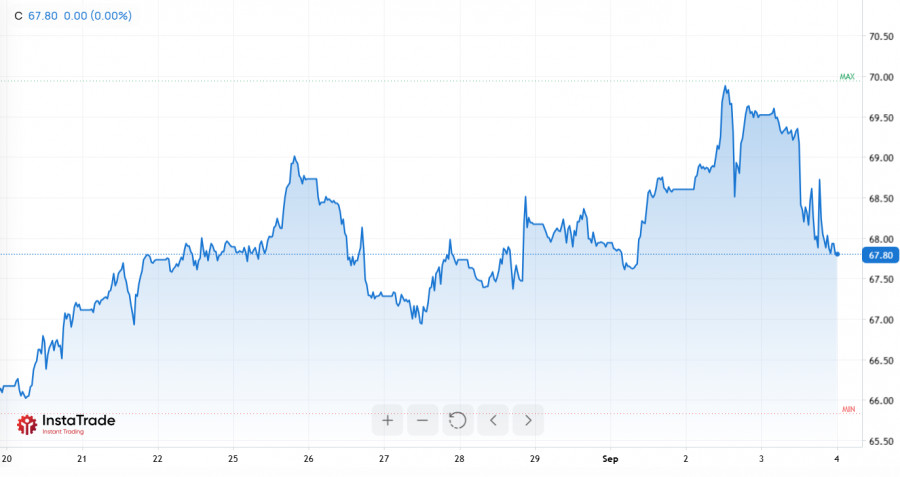

On Tuesday, Brent oil futures on the London exchange hit a monthly high, but after fresh news from Reuters, citing two insiders, the market sharply dropped. Brent instantly lost 2%, accelerating its morning losses, as investors responded to reports of the upcoming OPEC+ meeting, where on Sunday an additional round of supply increases may be discussed.

Experts and market participants had previously bet that the cartel would opt to pause and leave October production plans unchanged. However, a source within OPEC hinted last month that all scenarios are on the table, and neither an increase nor even a production cut is off the cards.

This year, the OPEC+ alliance has already surprised the market several times by returning barrels unexpectedly, despite forecasts for a sharp rise in supply from non-cartel producers by the end of 2025. Experts warn that such developments could bring about an oil surplus in the fourth quarter and a new round of price wars.

Although the actual future volumes of supply remain unclear, one thing is certain—any new influx of barrels could compound the supply glut and further pressure prices. Geopolitics adds to the tension: former US President Donald Trump is urging India to reduce purchases of Russian oil, which only exacerbates uncertainty.

The latest Bloomberg research showed that last month, OPEC countries themselves brought an extra 400,000 barrels per day back to the market. Total production rose to 28.55 million barrels per day, with Saudi Arabia accounting for more than half the total increase. This rapid "regaining" of market share is happening amid only moderate downward pressure on prices, but the International Energy Agency (IEA) warns that if the trend continues, the oil market risks facing a serious surplus in the coming months.

For end consumers, this is certainly good news: since the start of the year, Brent has dropped 9% and is hovering around $68 per barrel. American consumers, as well as the Trump administration, welcome the correction. However, oil giants such as Saudi Arabia—facing budget deficits—and the US shale industry are suffering from the drop in revenues.

Already this Sunday, OPEC+ exporters will hold a videoconference to discuss further strategy, and this very decision could become the starting point for the next price move. Investors are watching the news closely: fears of another supply increase have already pushed the market down 2%.

Current volatility opens up broad opportunities for speculative strategies. Traders should pay special attention to news flow around the OPEC+ meeting this weekend: a quick reaction to the final decisions may be key to success.

Both shorting in anticipation of a possible supply increase and going long—in case of a delay to new supplies or an unexpected output cut—remain relevant strategies. Don't forget to hedge risks, as geopolitical factors and statements from world leaders can change the oil market's trend direction at any moment.

MobileTrader: plataforma de negociação sempre à mão!

Baixe agora e comece a negociar!

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Se você tiver alguma dúvida sobre conteúdo, por favor, entre em contato com editorial-board@instaforex.com

Se você tiver alguma dúvida sobre conteúdo, por favor, entre em contato com editorial-board@instaforex.com