The EUR/USD currency pair traded much more calmly on Monday compared to Friday, as we had expected. Instead of further growth, the pair showed a moderate decline, which can be seen as a correction within the new upward trend or the next stage of the broader "2025 uptrend." Thus, we witnessed another convulsion of the U.S. dollar. We have said many times that the American currency still has no chance for growth. And since the dollar is not Bitcoin—where mere belief in its eternal rise can be enough—the U.S. currency is unlikely to strengthen out of thin air.

It's worth recalling one of the most important but not obvious factors: the U.S. dollar had been rising for 16 years. Market trends, like cycles, eventually end. There is every reason to assume that the "dollar cycle" has finished. This conclusion is even easier to accept given Donald Trump's policies, aimed at boosting exports and sales from the U.S., as well as balancing the trade deficit. The simple takeaway—even voiced by the U.S. president himself—is that a "strong dollar" is unnecessary. So perhaps Trump is not waging a deliberate war against the dollar, but he certainly is not going to save it from decline.

Meanwhile, at the same Jackson Hole symposium, European Central Bank President Christine Lagarde gave a speech on central bank independence. In her view, central bank independence is crucial for the economy of any country. If a central bank is subject to political influence, it ultimately leads to negative long-term consequences. "A central bank must be accountable to the government, but its activities should not depend on the short-term goals of administrations that change every few years. Political courses may shift, but stability in the economy, low inflation, and full employment are always necessary," she stated.

But hold on! The ECB has no problems with the European Parliament or other EU institutions. The issues lie with the Federal Reserve, under constant pressure from Trump by every possible means. That means Lagarde was really speaking about the Fed's independence. Why? Because Fed policy directly impacts the European economy, and the ECB has little interest in ultra-low U.S. rates. If U.S. rates fall to the 1–2% range, as Trump wants, the dollar will weaken even further while the euro rises higher. A stronger euro will then weigh on EU exports, which are already struggling, and suppress GDP growth, which is already sluggish. Lagarde's position is therefore entirely understandable. But the ECB chief has virtually no influence over the U.S. president. Looking ahead to 2025–2026, unless a "black swan" appears, we would still expect continued U.S. dollar weakness.

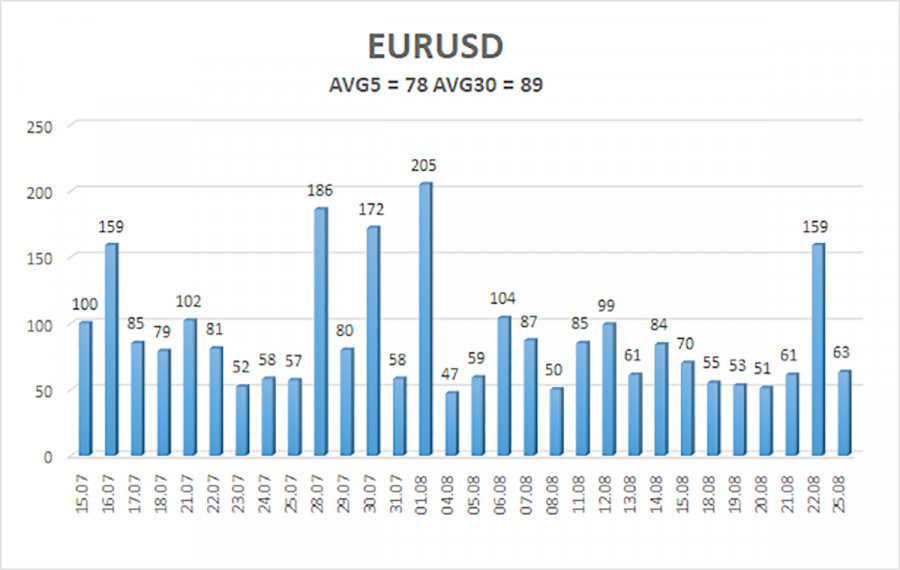

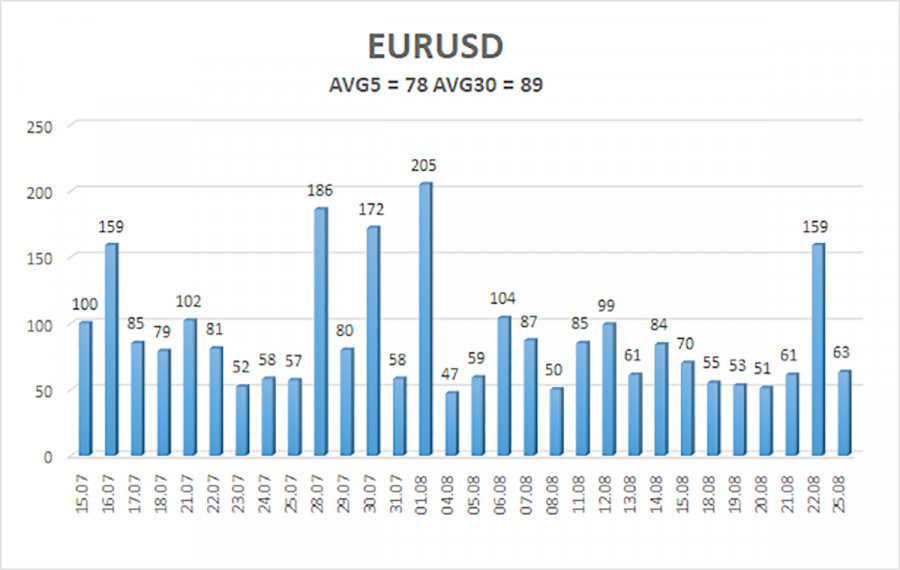

Average volatility of the EUR/USD pair over the last five trading days as of August 26 is 78 pips, classified as "moderate." On Tuesday, we expect movement between 1.1588 and 1.1744. The long-term linear regression channel is pointing upward, still indicating an uptrend. The CCI indicator has entered oversold territory three times, signaling the resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

Nearest Resistance Levels:

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair may resume its upward trend. The U.S. dollar remains under intense pressure from Trump's policies, and he has no intention of "stopping here." The dollar has risen as much as it could, but now it seems time for a new round of protracted decline. If the price is below the moving average, small shorts can be considered with targets at 1.1597 and 1.1588. Above the moving average, long positions remain relevant with targets at 1.1719 and 1.1744, in line with the prevailing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.