Analysis of Friday's Trades

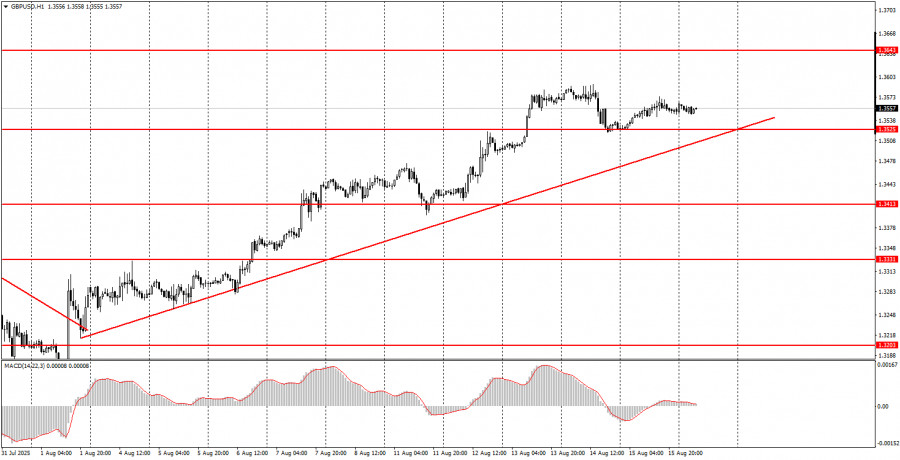

1H Chart of GBP/USD

The GBP/USD pair also traded higher on Friday, though with minimal volatility. Three U.S. reports failed to trigger any reaction from traders. We can certainly note the weak University of Michigan Consumer Sentiment Index and weak industrial production, yet the market still faces several global themes that prevent it from seriously considering medium-term dollar purchases. Thus, we continue to believe that the U.S. currency will keep declining in almost any case.

Late Saturday night, it became known that the meeting between Donald Trump and Vladimir Putin went fairly well. The parties agreed to continue working on resolving the conflict in Ukraine. Today, a meeting between the presidents of the U.S. and Ukraine is scheduled to take place in Washington. Trump will also hold a rally with European leaders. This week could see the resolution of many important issues concerning the war in Eastern Europe.

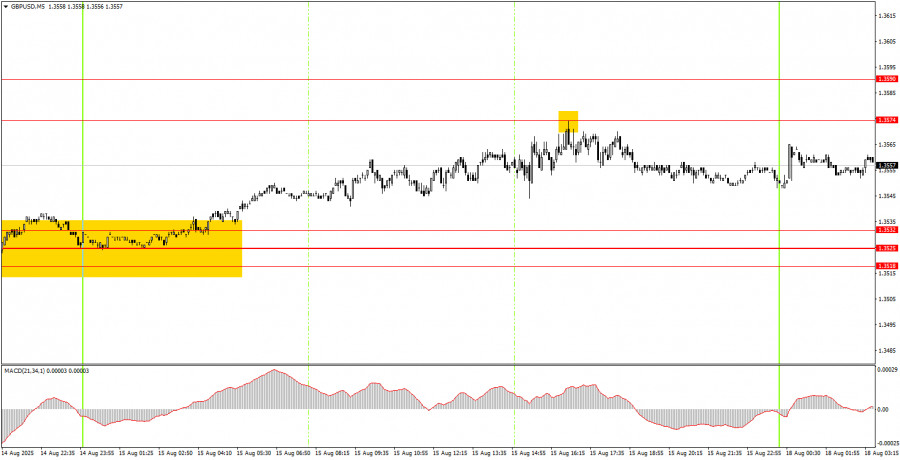

5M Chart of GBP/USD

On the 5-minute timeframe, two trading signals formed on Friday. During the night, the price rebounded from the 1.3518–1.3532 area, and during the U.S. session, from the 1.3574 level. Thus, novice traders could first open longs and later shorts. Due to the low volatility, it was quite difficult to generate a profit. The night signal was quite hard to execute, while the daytime signal may not have been worth executing at all.

Trading Strategy for Monday:

On the hourly timeframe, GBP/USD shows that the downward trend has ended. After the events of the past two weeks, we wouldn't bet a penny on the U.S. currency rising. The dollar continues to decline steadily and consistently. A new ascending trendline supports the bulls, and grounds for expecting a decline in the pair will only appear once the price consolidates below it.

On Monday, GBP/USD may well continue its upward movement, as it failed to break through the 1.3518–1.3532 area. Thus, long positions with targets at 1.3574–1.3590 and 1.3643 remain relevant. Short positions should only be considered if the pair breaks below the ascending trendline on the hourly timeframe.

On the 5-minute timeframe, current trading levels are: 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466–1.3475, 1.3518–1.3532, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763. No significant events are scheduled in the U.S. or the U.K. on Monday, aside from Trump's meetings with Volodymyr Zelensky and European leaders. In any case, since these meetings will take place late in the evening, volatility during the day may remain low.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.