Analysis of Trades and Trading Tips for the Euro

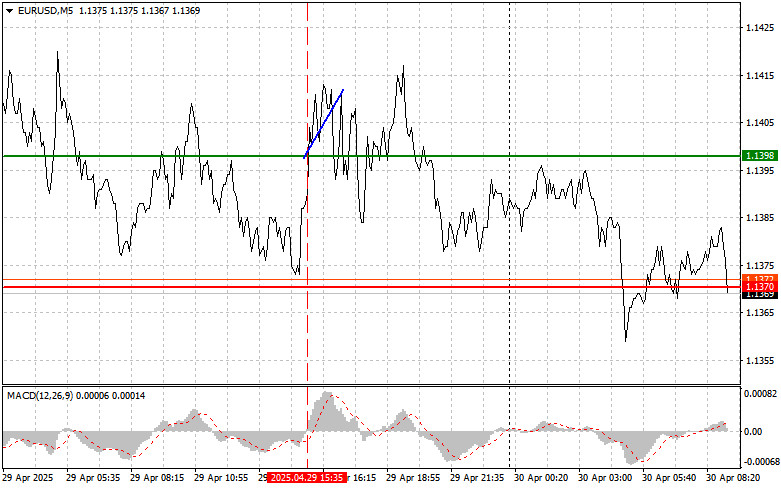

The test of the 1.1398 level in the second half of the day occurred when the MACD indicator had just begun to move upward from the zero line, confirming a correct entry point for buying the euro. This resulted in a 15-pip rise in the pair, after which the bullish momentum faded.

Yesterday's release of disappointing U.S. consumer confidence data had a negative impact on the dollar, which in turn supported the euro. The confidence index came in well below analysts' expectations, signaling increased concern among American consumers about the economic outlook. This is primarily linked to Trump's trade tariffs, which could lead to significant price hikes on goods. The dollar's decline created favorable conditions for the euro's rise. The European currency also received additional support from encouraging credit market data in the eurozone.

Today brings a wealth of data that could shift the current market landscape. In the first half of the day, data will be released on Eurozone Q1 GDP, Germany's consumer price index, employment figures, and retail sales dynamics. The publication of eurozone GDP figures will allow markets to assess how much the economy has recovered after the winter months and will help shape expectations for further development—particularly in light of the European Central Bank's recent rate cuts.

The German data is equally important. The CPI will help evaluate inflation trends in the eurozone's largest economy. Employment data will reflect labor market conditions, and retail sales performance will indicate consumer spending levels. Together, these figures will shape the broader picture of the region's economic climate, influencing the outlook for the euro.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: Today, I plan to buy the euro at the 1.1386 level (green line on the chart) with a target of rising to 1.1440. Around 1.1440, I plan to exit the market and open short positions in the opposite direction, expecting a 30–35 pip move from the entry point. Bullish momentum in the first half of the day is only realistic if the data comes out strong.

Important: Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the euro today if the price tests the 1.1365 level twice in a row while the MACD is in the oversold zone. This would limit the pair's downside potential and trigger a reversal to the upside. A move back toward 1.1386 and 1.1440 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after the price reaches 1.1365 (red line on the chart). The target will be 1.1313, where I will exit short positions and immediately buy in the opposite direction, aiming for a 20–25 pip retracement. Selling pressure could return at any moment today.

Important: Before selling, ensure the MACD indicator is below the zero line and starting to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1386 level while the MACD is in the overbought zone. This would limit the pair's upside potential and lead to a downward reversal. A drop toward 1.1365 and 1.1313 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.