Trade Analysis and Recommendations for the British Pound

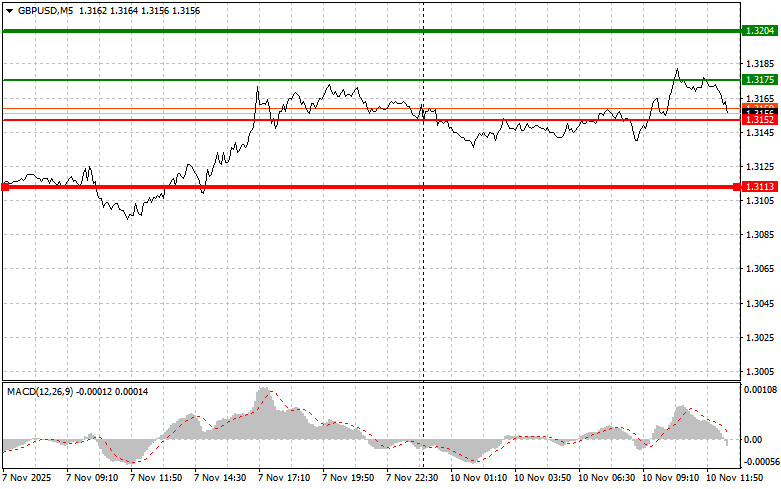

The price test at 1.3144 occurred when the MACD indicator had just begun moving downward from the zero line, confirming a valid entry point for selling the pound. However, the trade resulted in a loss. The pair then rose. When the price tested 1.3162, the MACD indicator had just started to move upward from the zero line, allowing a buy of the pound. As a result, growth occurred toward the target level of 1.3184.

In the absence of significant economic data, traders responded by buying the pound against the dollar. Considering that there are no major U.S. reports scheduled for the second half of the day, the focus will shift to the U.S. budget vote results. The market is closely watching developments in Washington, recognizing that prolonged uncertainty could negatively impact the U.S. economy and, consequently, the global markets. Investors fear slower economic growth, deteriorating consumer confidence, and potential issues with financing government obligations.

In this challenging environment, the British pound appears relatively attractive, especially amid expectations that the Bank of England may lower interest rates next year. Buying the pound against the dollar has become something of a safe haven strategy for traders seeking to minimize risks associated with U.S. political instability. However, it is important to remember that the UK economy faces similar challenges, and difficulties faced by Chancellor Reeves in passing the budget scheduled for November 26 could quickly bring renewed pressure on the GBP/USD pair.

As for the intraday strategy, I will rely primarily on the implementation of scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound when the entry point reaches around 1.3175 (green line on the chart), targeting growth toward 1.3204 (the thicker green line on the chart). Around 1.3204, I plan to exit buy positions and open sell positions in the opposite direction, expecting a 30–35 point move in the opposite direction from the level. Pound growth today can be expected if the U.S. government shutdown ends.Important! Before buying, make sure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3152 level at a time when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels of 1.3175 and 1.3204 can be expected.

Sell Signal

Scenario #1: Today, I plan to sell the pound after the 1.3152 level (red line on the chart) is updated, which should lead to a rapid decline in the pair. The main target for sellers will be 1.3113, where I plan to exit sell positions and immediately open buy positions in the opposite direction (expecting a 20–25 point rebound from the level). The pound could fall further if new disagreements arise in the Senate.Important! Before selling, make sure that the MACD indicator is below the zero line and just beginning to fall from it.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.3175 level at a time when the MACD indicator is in the overbought area. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward the opposite levels of 1.3152 and 1.3113 can be expected.

Chart Legend

- Thin green line – entry price at which the trading instrument can be bought

- Thick green line – projected level for placing Take Profit or manually locking in profit, as further growth above this level is unlikely

- Thin red line – entry price at which the trading instrument can be sold

- Thick red line – projected level for placing Take Profit or manually locking in profit, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones

Important Note

Beginner Forex traders should be very cautious when deciding to enter the market. Before the release of important fundamental reports, it is best to stay out of the market to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit very quickly, especially if you neglect money management and trade with large volumes.

And remember: for successful trading, you must have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.