Cryptocurrency funding is not a new concept and is quite popular. However, before we start talking about it, let us discuss perpetual futures.

We also recommend reading further Basics of cryptocurrencies.

Perpetual futures contracts are a type of derivative financial instrument designed to track the prices of cryptocurrencies and related digital assets. Unlike traditional futures contracts, which have a specific expiration date, perpetual futures can be held indefinitely.

Perpetual futures enjoy very high demand among traders, and they can be found on nearly all popular exchanges.

Perpetual futures allow traders to trade digital assets using significant leverage (for example, 50x or even 100x). This gives traders the ability to open positions that far exceed their current balance, which can dramatically increase both their profits and their potential losses.

Let us look at an example. Suppose you want to open a long trading position in Bitcoin for $100,000, but you only have $1,000 in your account. Do not despair, as here you have a unique opportunity to apply 100x leverage. Naturally, you are excited because this kind of strategy can bring you the long-awaited profit if the price of Bitcoin starts rising sharply, since you will earn income on the $100,000 position. But if it happens that the price of Bitcoin suddenly drops even by just 1%, your trading account with $1,000 will be liquidated, along with the position forcibly closed by the exchange. That is a very unfortunate outcome.

Because of these extremely high risks, some regulators require crypto exchanges to severely limit the amount of leverage and to mandate that traders complete special testing before gaining access to these markets. In other words, regulators are trying to protect you from possible problems.

The funding rate (or cryptocurrency funding) is the regular payment made to trading participants who, at their own risk, decided to open positions in perpetual futures.

Funding is calculated by the crypto exchange several times a day. It helps prevent significant deviations between the futures price and the price of the underlying asset.

The funding system automatically deducts funds from some traders and credits them to others. In this way, it is quite effective at maintaining balance across the entire cryptocurrency market.

So, funding (or the funding rate) is a mechanism that keeps perpetual futures quotes in line and aims to ensure that the price of these perpetual contracts does not significantly differ from the quotes of the underlying assets on the spot market. For example, the price of BTC/USDT futures ideally should not deviate from the spot price of Bitcoin.

In this article, we will take a closer look at what cryptocurrency funding actually is, why it exists, how it works, and what nuances it has. We will also explore how traders can earn on funding and how to use this mechanism in market analysis. This is a big topic, but we will tackle it step by step.

What is funding?

So, what exactly is funding? Put in very simple terms, cryptocurrency funding is the percentage fee that a trading platform charges for using borrowed funds.

This percentage was introduced by cryptocurrency exchanges as a way to regulate supply and demand between spot assets and futures markets. In short, funding is essential for maintaining balance in the market between spot and futures.

If the funding rate is positive, the holder of a long position pays the holder of a short position. If the rate is negative, the process works in the opposite way: the one who holds short positions pays the one who holds long positions.

Keep in mind that funding is recalculated regularly, specifically, every 8 hours, so the rate is not fixed. It is always floating. Furthermore, it depends entirely on market positions. The greater the difference between the futures price and the spot price, the higher the funding rate. A high funding rate is unique because it becomes the main incentive for market participants to open positions in the opposite direction.

To better understand this, let us clarify the concepts of perpetual and fixed-term futures.

In case of fixed-term futures, all contracts have a specific expiration date, which eventually arrives. Once this date approaches, the contract must either be executed or sold. The price of such a trade, at both the time of opening and at the time of expiry, always matches the price of the digital asset on the spot market. In this case, funding is not applied.

Now, let us look at an example. Imagine a trader wants to enter into an agreement on a fixed-term futures contract, eagerly expecting the price of the underlying asset to rise soon. However, as often happens, during the life of the contract, the market situation changes sharply, causing the contract price to deviate significantly from the original price of the underlying asset.

If the contract price shoots up and the open position shows a clear profit (PnL), this contract can still be sold successfully before the expiration date. However, if the spot price suddenly drops below the level it was at when the position was opened, the futures contract will irreversibly lose its value. If this happens, the trader must either wait for the price to return to its previous level or close the position and lock in the loss.

These phenomena are called “contango” and “backwardation”—situations when the futures contract price, due to sharp market fluctuations, turns out to be either significantly higher or significantly lower than the current market price.

Perpetual futures are fundamentally different from fixed-term futures. Their first and main distinction is that they do not have an expiration date, which means traders can keep their positions open indefinitely.

In this case, funding must always be applied because there is no expiration date, and, as a result, the contract prices cannot naturally settle into equilibrium with spot market prices.

Since the contract has an indefinite duration (or, more precisely, no duration at all), its price can diverge significantly from the spot price in either direction. This is dangerous, as it can lead to completely unpredictable consequences across the entire market.

Such spontaneous surges or drops in the prices of these contracts could destabilize the market, ultimately making trading either simply unprofitable (which would be the lesser evil) or heavily loss-making (which is nearly catastrophic).

Situations like these could occur quite frequently in the crypto industry, crashing prices and inflicting damage—sometimes irreparable—on holders of crypto assets. However, cryptocurrency funding prevents these treacherous scenarios from unfolding because it allows the potential difference between perpetual contract prices and spot market prices to be controlled, leaving no room for spontaneous spikes or collapses.

Funding is advantageous and almost priceless because it also gives traders the opportunity to earn decent profits, though we will cover that a bit later.

It is important to understand that funding is not a trading commission. Funding is a payment exchanged between traders. On some crypto exchanges, this rate consists of a base percentage and a reward.

Funding (that is, the rate) is calculated as a fraction of a percent of the total trade position and is paid once every interval, every 1 hour, 4 hours, or 8 hours. A commission fee is added for opening or closing the position. The funding percentage will continue to be charged as long as the trade position remains open.

For example, if your positive funding rate is 0.0152% and you have a long position worth $5,000, then over 8 hours, you must pay $0.76 to the trader holding the short position.

How funding works

Funding, or the funding rate, is a type of incentive paid to traders that encourages them to take specific actions necessary to maintain the price of a perpetual contract. This rate helps push prices upward when a futures contract lags behind the spot market, or it pushes prices downward if the contract starts trading above spot prices.

To increase the value of a derivative, a cryptocurrency exchange begins encouraging traders to actively buy by opening long positions. For this reason, the exchange introduces a positive funding rate to stimulate the opening of long positions.

The funding rate becomes negative for those who choose to open short positions. The fee paid to buyers comes out of the margin funds of sellers. Sellers lose a portion of their expected profit equal to the rate, which motivates them to eventually close their short positions and open long ones instead.

This mechanism can significantly reduce bearish pressure on the contract, push prices higher, and even bring them closer to spot levels.

Regarding negative funding rates, they operate in the opposite way: traders with long positions lose a portion of their income, as that part is transferred to sellers. Consequently, funding simultaneously encourages short-sellers and discourages buyers.

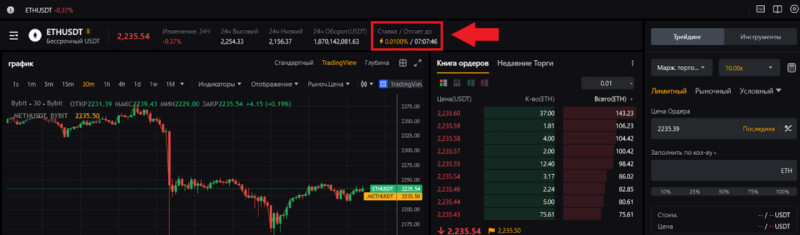

The current funding rate is displayed on the trading instrument card and can also be found in the exchange's trading interface.

How is funding calculated?

Funding is available only to traders with open positions on the exchange. If the trade is closed before the scheduled calculation time, no funding will be credited.

Funding can be earned daily, but only at specific times: 04:00, 12:00, and 20:00 UTC.

The formula used to calculate funding is:

Funding = position size × funding rate

However, there are two important notes:

1. The position size does not take leverage into account; it is based solely on the nominal value of the trade.

2. The funding rate can be either positive or negative.

Remember, when the rate is positive, traders with long positions who are optimistic about a Bitcoin price rise will be required to pay traders holding short positions who are betting on a decline.

Therefore, the entire passive income strategy is based on the expectations of market participants who believe in the growth of cryptocurrency. In essence, it is precisely for these expectations that one has to pay.

The funding rate consists of two main components:

· interest rate

· premium (reward)

The primary goal of funding is to align the interests of sellers and buyers in order to ensure maximum liquidity on the exchange.

Unlike casinos or forex brokers, the crypto market does not rely on the price of the main cryptocurrency rising or falling. Its main objective is to match trades efficiently without exposing the exchange itself to risk.

For example, if all traders suddenly rush to buy XBT driven by hype, fear of missing out, or plain greed, there simply will not be enough sellers in the market. In such cases, the funding rate acts as an incentive to draw sellers back in, thus helping to cool excessive demand and balance the overheating situation.

Notably, the fewer sellers in the market, the higher the funding rate will be.

Conversely, during periods of panic when most traders begin opening short positions, buyers start receiving generous rewards.

Such market storms occur frequently, sometimes even within a single trading day.

The funding rate mechanism is not secret. The current rate is always publicly available and can be easily found on the exchange’s website. However, it is important to remember that this rate can fluctuate until it is locked in for the hourly interval.

How to earn from funding

Cryptocurrency funding offers an excellent opportunity for traders to earn a significant profit, especially when using a delta-neutral strategy. This approach is not based on price direction, but rather on the price divergence between an asset and its derivatives. The core idea is to open and close positions in a timely manner to profit directly from the funding rate.

As a reminder, the funding rate is publicly visible, and the market tends to react to it very sensitively.

A trader can utilize the funding rate in two main ways:

· Earn profit when opening a position

If the funding rate is positive, traders open long positions. If it is negative, they open short positions.

To benefit, a trader must enter the position shortly before the funding payment is made. On crypto exchanges, the timing varies. For instance, on the popular Binance platform, funding is calculated and distributed every 8 hours.

· Trade the price movement triggered by funding

A negative funding rate often encourages traders to open shorts right before the payout, which can result in a bearish move just before the funding interval.

Subsequent price action will largely depend on the next funding rate.

With a positive funding rate, short sellers may close their positions and switch to longs, potentially driving prices higher. If the rate remains negative, a continued bearish trend is likely.

It is important to note that this strategy is effective only in calm market conditions. Strong price impulses caused by external events or large players can override the funding-based behavior of traders and nullify its expected outcomes.

Arbitrage

Arbitrage is the practice of trading on the difference in funding rates across different exchanges simultaneously and strategically.

For example, let us say the funding rate for the same cryptocurrency is 0.06% on exchange N and 0.03% on exchange F. Since funding is paid out every 8 hours, long position holders pay short position holders that rate on each platform. In this case, buyers on exchange N pay more than buyers on exchange F, and vice versa.

Hedging

Futures positions can also be hedged using spot market positions. This strategy involves holding a spot position while simultaneously opening a futures position of equal value but opposite direction.

Imagine you have $22,200. Bitcoin is trading at $20,000 on the spot market and $22,000 on the perpetual futures market. You purchase 1 BTC at $20,000 on the spot market and simultaneously short BTC worth $2,200 on the futures market using 10x leverage. These two positions hedge each other, protecting you from volatility.

If the funding rate is 0.06% every 8 hours, the theoretical daily profit could be:

- Without leverage:

$2,200 × 0.06% × 3 = $3.96 (excluding trading fees) - With 10x leverage:

$39 (also excluding fees)

Keep in mind, derivative positions are exposed to liquidation risks. To mitigate this, you can increase margin or use a stop-loss.

Funding rate as market signal

Funding rates are often a reflection of the prevailing market trend. High positive rates typically indicate a bullish trend, while high negative rates suggest a bearish trend.

When crafting a trading strategy, always compare the funding rate with the current market trend. The basic logic is as follows:

- Positive funding rate = futures price exceeds spot price → It may be profitable to short.

- Negative funding rate = futures price is below spot price → It may be profitable to go long.

Now, if the funding rate contradicts the market trend—say, the funding rate is positive, but the market is clearly falling—this indicates that long position holders may have overestimated their advantage.

Opening a long position in such conditions, despite the risk, could result in a highly rewarding outcome.

The same principle works perfectly in reverse. A negative funding rate during an upward market trend will indicate an excess of short positions. If, in this case, you suddenly decide to open a short position, keep in mind that you may receive the long-awaited and much-needed payouts from short sellers.

It is important to constantly check the rates. Otherwise, when trading based on the funding rate, one may end up trading at a loss. There are crypto platforms with algorithmic trading functions that offer users funding bots to automate the entire process.

Less popular but effective way to earn from funding

Typically, the initial funding rate is 0.01% of the open position amount and is paid to short positions, as long positions dominate the market more frequently.

In a bullish trend, this rate may increase twenty or even thirty times, sometimes reaching levels of 0.2–0.3%, due to the mass opening of long positions.

It is not difficult to calculate the return when holding a short position of $100,000 for one month (standard 30 days) at a funding rate of 0.2%. The rate will be accrued three times a day at 8-hour intervals.

The calculation will be as follows: 0.2% × 3 = 0.6% per day × 30 days = 18% per month or $18,000 from $100,000 per month.

However, it is necessary to remember some rather unpleasant nuances. First, excessively high funding values are not always available (although the rate can sometimes reach 0.4%). To assess monthly profitability, it is better to use values from 8% to 15% per month (which is approximately 80% annually).

Second, there is a high risk of liquidation losses on the short position if the price of the underlying asset (for example, the BTC/ETH pair) increases. However, if you open a short position with 1x isolated leverage on an inverse BTC/USD contract, there will be no liquidation price, and the size of the open trading position in dollars will not change.

Let us give an example. A trader opens a short position with 1x leverage in the amount of $30,000 using 1 BTC on an inverse contract (there are $30,000 in the account). Later, the price of BTC increases to $35,000. The trader sees a loss of $5,000 on the short position, but the BTC exchange rate stands at $35,000, which means there are still $30,000 in the trader's account. Throughout this process, the funding rate continues to be accrued.

This non-obvious way of earning from funding minimizes the risk of liquidation. This approach makes it possible to receive stable profit from funding while reducing potential losses caused by market fluctuations. However, it is worth noting that this method has its own nuances and associated risks. Therefore, it should be used with extreme caution, while carefully studying the principles of how inverse contracts work.

This technology, at any time, regardless of profit or loss on the short position, allows one to close the position and immediately convert bitcoins or ethers back into USDT, without changing the total value in US dollars. The rise in the price of the main digital asset eventually offsets the loss from the short position, in a 1:1 ratio. This is precisely why there is an opportunity to take a short position on an inverse contract.

The step-by-step algorithm for implementing such a strategy is as follows:

- Fund your account using USDT.

- Exchange USDT for BTC/ETH.

- Open a short position with 1x isolated leverage on an inverse contract (BTC/USD or ETH/USD) for the desired amount.

- Receive funding every 8 hours (this is the profit).

It is also advisable to simultaneously open short positions on both Bitcoin and Ethereum, since the funding rates may differ.

It is very important to closely monitor the funding rate, which must always be positive. It can be tracked through special services or directly on the exchange.

Crowd sentiment and funding

The funding rate for perpetual contracts largely depends on global market trends or, to put it simply, on crowd sentiment. The amount of payment is formed based on the price of the underlying asset, that is, the cryptocurrency itself, rather than the derivative.

The entire process can be summarized as follows:

• Bitcoin increases in value on the spot market, which provokes a rise in the funding rate of the futures contract.

• The crypto exchange increases the funding rate in order to narrow the spread between the price of the main asset and the derivative.

• As soon as the futures price approaches the spot price of the cryptocurrency, the funding begins to decrease.

In a downtrend, the process unfolds in the same manner, but in the opposite direction.

Conclusion

Crypto funding is, without exaggeration, a unique mechanism invented and implemented by crypto exchanges to prevent significant discrepancies between futures prices and the spot price of a cryptocurrency.

Funding, also known as the funding rate, is a regular payment that is credited several times a day to traders with open positions in the perpetual futures market. These payments may be either positive or negative and are calculated by the exchange multiple times per day.

Funding is extremely important because:

• It stabilizes prices, preventing large deviations of futures quotes from the spot price of the asset.

• It provides traders with additional profit: through it, they can earn on funding rates by holding positions aligned with the current rate.

• It enables risk management: it allows traders to better plan their strategies, knowing in advance that the futures price will always tend to align with the spot price.

To check the funding rate, it is sufficient to look at the trading instrument’s data card or the trading interface of the exchange.

Since the principles for calculating the rate may vary significantly from one exchange to another, it is essential to carefully study all the nuances of your chosen trading platform before beginning to buy or sell futures.

Recommended

Types of cryptocurrency

Fear & greed index for cryptocurrency

Crypto nodes

Back to articles

Back to articles