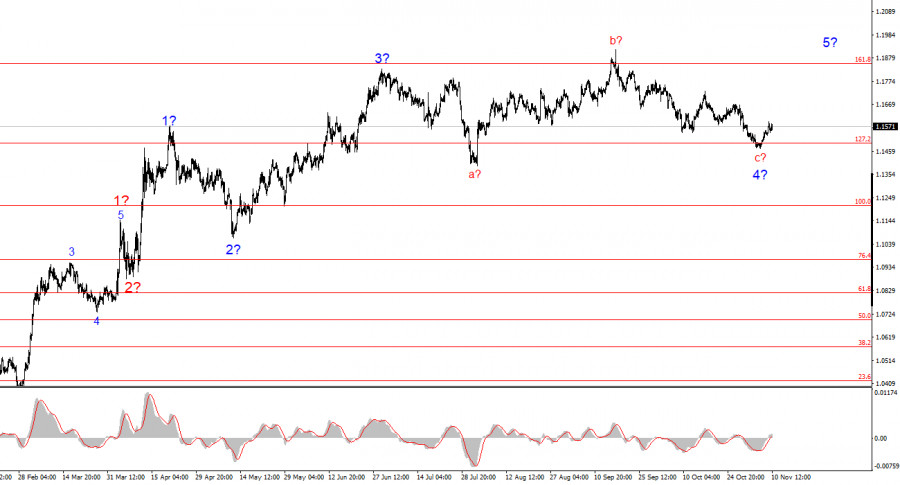

The wave pattern on the 4-hour EUR/USD chart has changed — unfortunately, not for the better. While there is no reason yet to cancel the upward trend section that began in January 2025, the wave pattern since July 1 has become much more complex and extended. In my view, the instrument is currently forming corrective wave 4, which has taken on an unusual shape. However, the latest five-wave corrective structure suggests that the decline phase may be coming to an end.

The upward trend formation continues, while the news background mostly does not favor the dollar. The trade war launched by Donald Trump continues. The president's confrontation with the Federal Reserve also continues. The market's "dovish" expectations regarding Fed interest rates remain high — particularly looking ahead to 2026. Meanwhile, the U.S. government shutdown drags on, and the labor market continues to cool. In my opinion, the recent strengthening of the dollar is somewhat paradoxical — but paradoxes often occur in financial markets.

I believe the upward trend segment is not yet complete, and its targets may extend as high as the 1.25 level. The a-b-c-d-e wave sequence appears complete, so I expect the instrument to rise further from current levels.

The EUR/USD rate rose by 10 basis points on Monday. This movement was not driven by a clear market reaction to any particular event — rather, it reflected the low volatility and narrow trading range, showing that the market lacks interest in active trading.

Over the past month and a half, demand for the U.S. dollar has been increasing, but in recent months, overall market activity has been very subdued. In my opinion, we are facing a classic sideways trend (range-bound market), which has all the typical characteristics: weak movements, horizontal direction, and complex internal corrective structures.

From this, I conclude that the market continues to ignore the news backdrop. A government shutdown is not an ordinary event — it's an extraordinary one. Economists agree that it will leave a negative mark on the U.S. economy. So how is it that the shutdown — a negative event — is accompanied by rising demand for the dollar? The answer is simple: the market is acting inversely and inconsistently — just as the end of the shutdown (a positive event) leads to a decline in demand for the dollar. The market continues to ignore fundamentals.

At the same time, there is little reason for optimism. Senators have taken the first step toward ending the shutdown, but this is merely a temporary truce. In essence, lawmakers agreed only to temporarily fund the government until January 31, and the bill must now pass the House of Representatives and avoid being vetoed by Trump. It is worth noting that the agreement was reached between Democrats and Republicans, not between Donald Trump and the Democrats. Therefore, the U.S. president may object to certain provisions — for example, the clause requiring mandatory negotiations in December to maintain healthcare subsidies.

General Conclusions

Based on the EUR/USD analysis, I conclude that the instrument continues to build an upward trend. Over the past few months, the market has paused, but the policies of Donald Trump and the Federal Reserve remain significant factors that could weaken the U.S. dollar in the future. The targets of the current trend segment could extend up to the 1.25 level.

At the moment, corrective wave 4 is still forming — it has taken on a very complex and extended shape. Its latest internal structure, a-b-c-d-e, is nearing completion or already complete. Therefore, I once again consider long positions, with targets around the 1.19 level.

At a smaller scale, the entire upward trend is visible. The wave structure is not entirely standard, as the corrective waves differ in size. For example, the larger wave 2 is smaller than the internal wave 2 within wave 3 — though such variations do happen. I would like to emphasize that it is better to focus on clear, readable structures on the chart rather than labeling every single wave. At present, the bullish structure appears unquestionable.

Main Principles of My Analysis

- Wave structures should be simple and clear. Complex structures are hard to interpret and often signal potential changes.

- If you are uncertain about what is happening in the market, do not enter it.

- Absolute certainty about market direction is impossible. Always use protective Stop Loss orders.

- Wave analysis can and should be combined with other forms of analysis and trading strategies.