Trade Analysis and Advice for the Japanese Yen

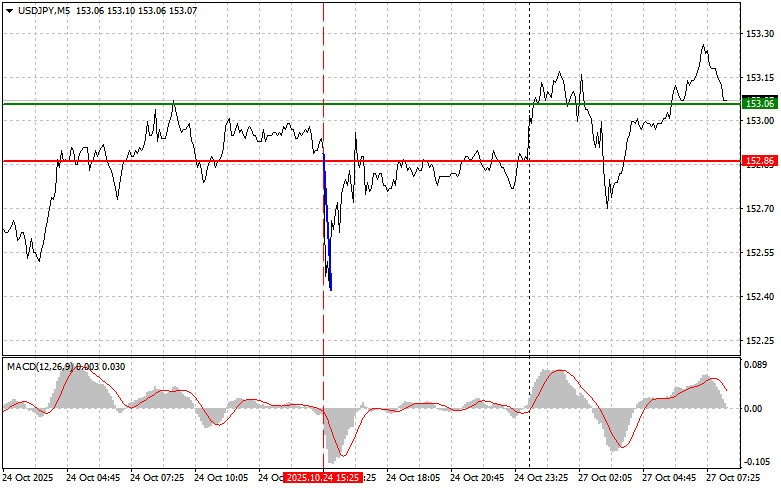

The test of the price at 152.86 occurred at a moment when the MACD indicator was starting to move downwards from the zero mark, confirming the correct entry point for selling the dollar. As a result, the pair decreased by 40 pips.

The Japanese yen did not gain any particular advantage from the decline in U.S. price pressures, as the likelihood of maintaining stimulus for the Japanese economy after the new Prime Minister took office is much higher. The weakening of the dollar, triggered by slowing U.S. inflation, is generally favorable to other currencies; however, for the yen, domestic factors complicate the picture. The new Prime Minister of Japan, upon taking office, made it clear that he intends to continue the course of stimulating the economy. This suggests a continuation of the loose monetary policy that keeps interest rates at extremely low levels. This policy certainly supports exports and economic growth, but it exerts pressure on the yen, reducing its appeal to investors. Low interest rates make holding assets in yen less profitable, pushing investors to seek more lucrative assets in other currencies. Thus, despite the favorable external factors associated with the weakening dollar, the yen remains influenced by internal circumstances that prevent significant strengthening. The market expects the Bank of Japan not to raise rates this year, and it is highly uncertain whether it will do so at the beginning of next year.

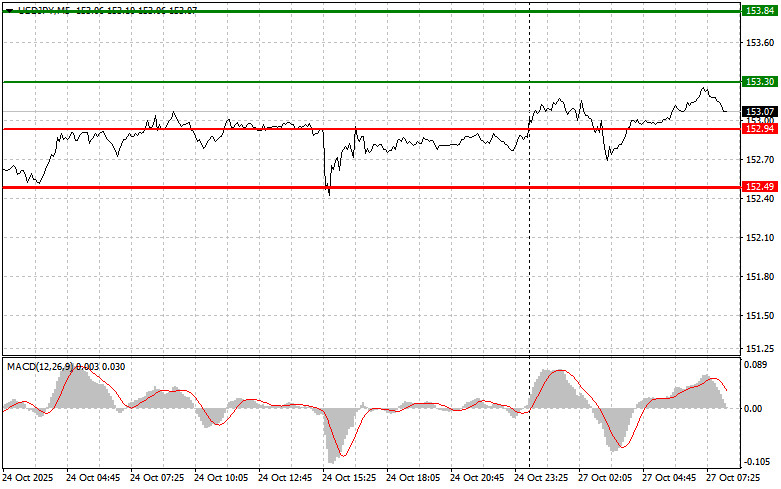

As for the intraday strategy, I will primarily rely on the implementation of scenarios No. 1 and No. 2.

Buy Scenarios

Scenario No. 1: I plan to buy USD/JPY today at the entry point around 153.30 (green line on the chart), aiming to reach 153.46 (thicker green line on the chart). Around 153.84, I intend to exit the buys and open sales in the opposite direction (expecting a movement of 30-35 pips in the opposite direction from the level). It is best to return to buying the pair on corrections and significant dips in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today if there are two consecutive tests of 152.94 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a market reversal. One can expect growth towards the opposite levels of 153.30 and 153.84.

Sell Scenarios

Scenario No. 1: I plan to sell USD/JPY today only after updating the level at 152.94 (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the 152.49 level, where I intend to exit sales and open buys in the opposite direction (expecting a 20-25-pip move). It is better to sell at the highest possible price. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today if there are two consecutive tests of 153.30 when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal. One can expect a decline towards the opposite levels of 152.94 and 152.49.

Chart Details:

Thin green line – entry price for buying the trading instrument;

Thick green line – estimated price where take profits can be set or profits can be manually secured since further growth above this level is unlikely;

Thin red line – entry price for selling the trading instrument;

Thick red line – estimated price where take profits can be set or profits can be manually secured since further decline below this level is unlikely;

MACD indicator. When entering the market, it is crucial to be guided by the overbought and oversold zones.

Important. Beginner traders in the Forex market need to make entry decisions very cautiously. It is best to stay out of the market before important fundamental reports to avoid sharp currency fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade in large volumes.

And remember: to trade successfully, you need a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.