Trade Analysis and Advice for the Euro Currency

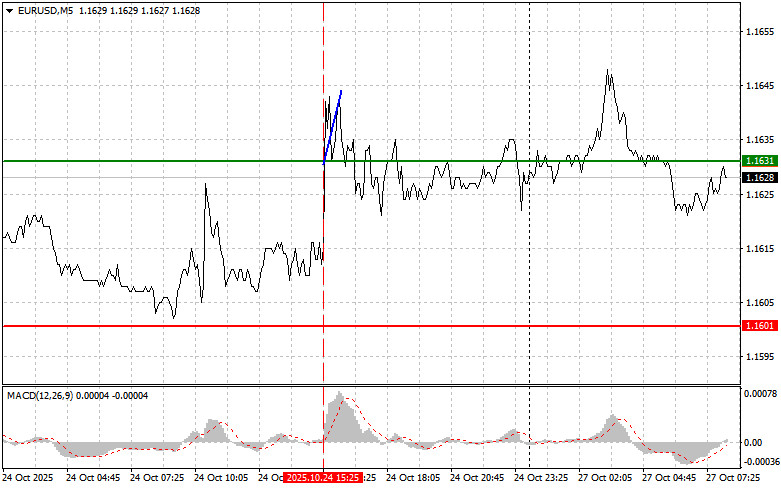

The test of the price at 1.1631 coincided with the moment when the MACD indicator was starting to move upwards from the zero mark, confirming the correct entry point for buying the euro. As a result, the pair increased by just 15 pips.

Data showed that inflation in the United States is developing much more slowly than economists had anticipated, which led to a decline in the value of the American currency and an increase in the value of the euro last Friday. Investors who were expecting a softer stance from the Federal Reserve regarding interest rates are now fully convinced that the central bank no longer needs to focus on rising prices but must instead work on restoring the labor market, which can only be achieved through more aggressive interest rate cuts.

Today, IFO data for Germany is expected. The assessment of the current situation will provide investors and analysts with insight into how German businesses evaluate their current position. Elevated values of this component indicate confidence in current economic activity, while low values might suggest a slowdown in growth or even an economic downturn. The economic expectations indicator, in turn, reflects German entrepreneurs' sentiment regarding prospects. It plays a particularly important role, allowing for predictions of upcoming events and assessment of potential risks and favorable opportunities for the German economy. In addition to the IFO data, reports on private-sector lending volumes in the Eurozone and on the dynamics of M3 money supply will be released today. These indicators will enable the assessment of lending activity and money supply in the region, which could significantly impact inflation and economic recovery.

As for the intraday strategy, I will primarily rely on the implementation of scenarios No. 1 and No. 2.

Buy Scenarios

Scenario No. 1: Today, the euro can be bought at around 1.1631 (green line on the chart), with a target of 1.1660. At point 1.1660, I plan to exit the market and also sell the euro in the opposite direction, expecting a movement of 30-35 pips from the entry point. One can only expect euro growth after good indices. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of 1.1612 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a market reversal. One can expect growth towards the opposite levels of 1.1631 and 1.1660.

Sell Scenarios

Scenario No. 1: I plan to sell the euro once it reaches 1.1612 (red line on the chart). The target will be 1.1585, where I intend to exit the market and immediately buy in the opposite direction (expecting a 20-25-pip move). Pressure on the pair will return today if the reports are weak. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro today if there are two consecutive tests of 1.1631 when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal. One can expect a decrease towards the opposite levels of 1.1612 and 1.1585.

Chart Details:

Thin green line – entry price for buying the trading instrument;

Thick green line – estimated price where take profits can be set or profits can be manually secured since further growth above this level is unlikely;

Thin red line – entry price for selling the trading instrument;

Thick red line – estimated price where take profits can be set or profits can be manually secured since further decline below this level is unlikely;

MACD indicator. When entering the market, it is crucial to be guided by the overbought and oversold zones.

Important. Beginner traders in the Forex market need to make entry decisions very cautiously. It is best to stay out of the market before important fundamental reports to avoid sharp currency fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade in large volumes.

And remember: to trade successfully, you need a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.