Trade analysis and advice for trading the European currency

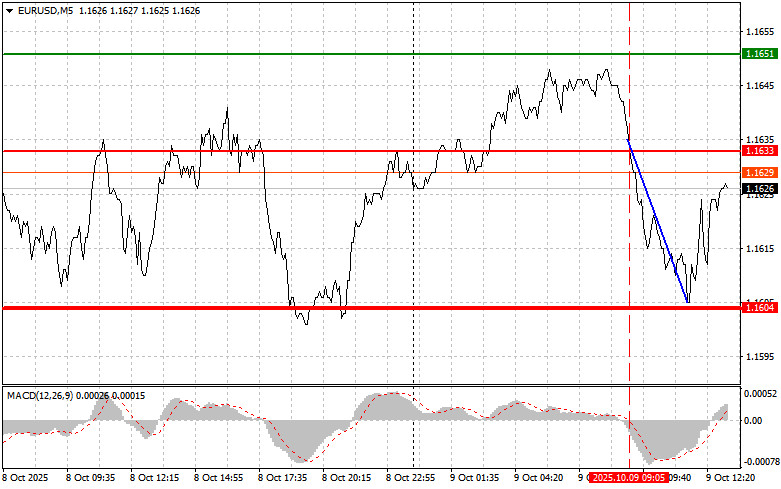

The price test of 1.1633 occurred at the moment when the MACD indicator had just begun moving downward from the zero mark, which confirmed a correct entry point for selling the euro. As a result, the pair declined toward the 1.1604 level, allowing for about 30 points of profit.

Despite favorable statistics showing an increase in Germany's trade balance surplus, pressure on the euro persists. The European currency continues to be influenced by a set of unfavorable factors. In particular, investors are concerned about a potential slowdown in eurozone economic growth, the uncertainty surrounding the European Central Bank's monetary policy outlook, and ongoing geopolitical instability in the region.

Even though data on Germany's trade surplus expansion — typically considered a supportive factor for the national currency — was published, the euro showed no strengthening. This indicates that broad macroeconomic and political risks outweigh local positive signals. Investors are likely concerned about the overall stability of the eurozone economy and its implications for the euro's exchange rate.

In this environment, the European Central Bank faces a dilemma. On one hand, it needs to keep inflation under control, the trajectory of which remains uncertain by year-end. On the other hand, the lack of rate-cut momentum could deepen the recession and increase pressure on the euro.

In the second half of the day, attention will naturally shift to speeches by Federal Reserve representatives. Diverging views regarding the future path of interest rates are becoming increasingly noticeable. Scheduled speakers include Fed Chair Jerome Powell, along with FOMC members Michelle Bowman and Michael S. Barr. Market participants will carefully analyze every statement, looking for signals about the regulator's future policy. Internal disagreements within the Fed add to uncertainty, exerting a restraining influence on currency markets.

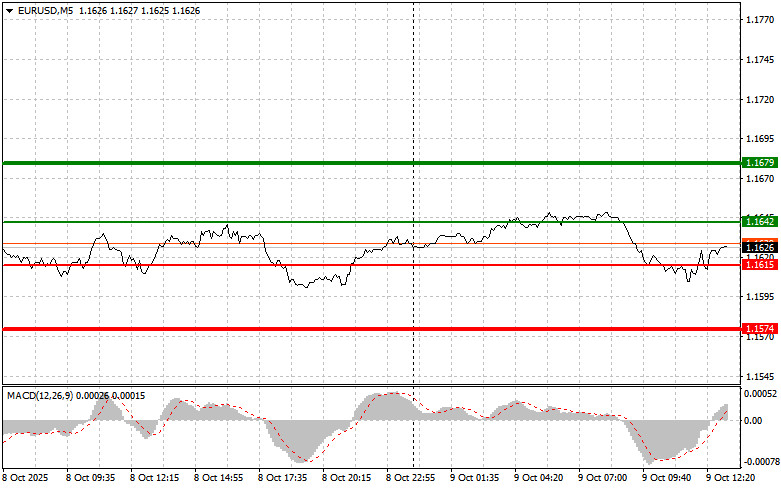

As for the intraday strategy, I will rely mainly on Scenarios #1 and #2.

Buy Signal

Scenario #1: Buying the euro today is possible around 1.1642 (green line on the chart) with a target rise to 1.1679. At 1.1679, I plan to exit the market, also selling the euro in the opposite direction with the expectation of a 30–35 point move from the entry point. Euro growth today can only be expected after dovish remarks from Fed representatives.Important! Before buying, make sure the MACD indicator is above the zero mark and has just begun rising from it.

Scenario #2: I also plan to buy the euro if the price tests 1.1615 twice in a row, while the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a reversal upward. Growth to the opposite levels of 1.1642 and 1.1679 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1615 (red line on the chart). The target will be 1.1574, where I intend to exit the market and immediately buy in the opposite direction (expecting a 20–25 point rebound from this level). Selling pressure on the pair could return at any moment today.Important! Before selling, make sure the MACD indicator is below the zero mark and has just begun declining from it.

Scenario #2: I also plan to sell the euro if the price tests 1.1642 twice in a row, while the MACD indicator is in overbought territory. This will limit the pair's upward potential and trigger a downward reversal. A decline toward 1.1615 and 1.1574 can be expected.

Chart Notes:

- Thin green line – entry price for buying the instrument;

- Thick green line – projected price for setting Take Profit or manually fixing profit, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – projected price for setting Take Profit or manually fixing profit, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to use overbought and oversold zones as guidance.

Important: Beginner Forex traders should be very cautious when making market entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember: for successful trading, you need a clear trading plan, like the one I've outlined above. Spontaneous decisions based on the current market situation are an inherently losing strategy for intraday traders.