Trade Review and Advice on Trading the Japanese Yen

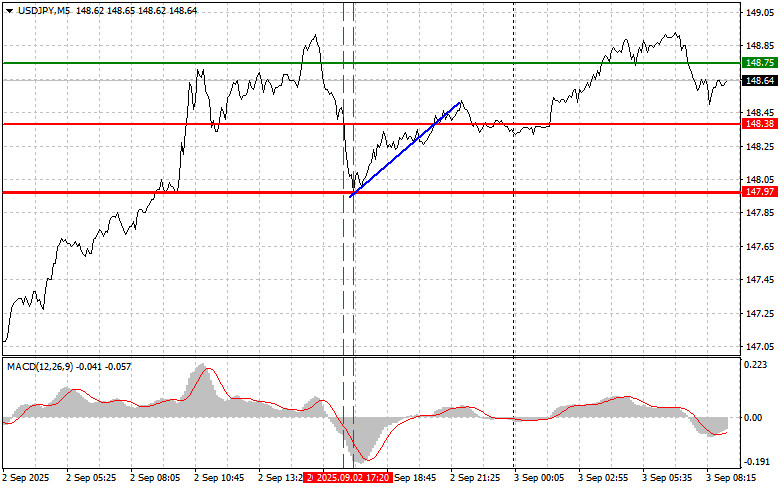

The test of the 148.38 level occurred when the MACD indicator had already dropped significantly below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the dollar. However, the trend-trading buys on the bounce from 147.97, as I mentioned in my forecast, yielded over 50 points of profit from the market.

The USD/JPY correction in the second half of the day happened against the backdrop of weak US manufacturing activity data. However, the brief weakening of the dollar triggered by the economic data could not reverse the strong uptrend observed in USD/JPY. The main driver of USD/JPY growth remains the difference in monetary policy between the US Federal Reserve and the Bank of Japan. The Fed continues with its restrictive policy to fight inflation, while the Bank of Japan maintains an accommodative stance, despite ongoing market expectations for a rate hike by year-end.

Today, strong growth figures for Japan's services PMI at 53.1 supported the yen. This figure, above the 50-point mark, indicates expansion in the sector, inspiring optimism for the state of the Japanese economy. Such improvement in the services index is positive for the overall risk perception related to the yen. It is worth noting that the services PMI data is an important indicator as it reflects consumer demand trends, business sentiment, and the general economic situation in the country. Higher readings point to increased economic activity, creating a favorable environment for job growth and rising household income.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

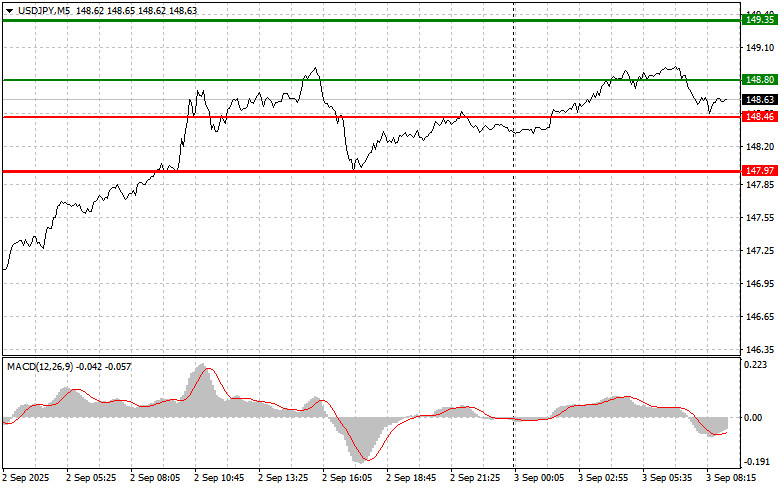

Scenario #1: Today, I plan to buy USD/JPY when the entry point of around 148.80 (green line on the chart) is reached, with a target of rising to 149.35 (thicker green line on the chart). Around 149.35, I plan to exit longs and open shorts in the opposite direction (looking for a move of 30–35 points the other way). It's best to return to buying the pair on pullbacks and major dips in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy USD/JPY today in the event of two consecutive tests of the 148.46 level when the MACD is in the oversold zone. This will limit the pair's downside potential and lead to an upward reversal. Growth can be expected towards the opposite levels at 148.80 and 149.35.

Sell Scenario

Scenario #1: Today, I plan to sell USD/JPY only after the 148.46 level (red line on the chart) is updated, which will result in a rapid decline in the pair. The key target for sellers will be 147.97, where I plan to exit shorts and immediately open long positions in the opposite direction (looking for a move of 20–25 points the other way). It's best to sell as high as possible. Important! Before selling, ensure the MACD indicator is below the zero mark and is just starting to fall from it.

Scenario #2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 148.80 level when the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a reversal down. A decline can be expected towards the opposite levels of 148.46 and 147.97.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.