Ethereum has been experiencing significant volatility lately. Yesterday, we saw a sharp surge in Ethereum's value, following Bitcoin's lead, but this surge quickly subsided, with prices returning to more stable levels. Currently, Bitcoin is trading at $119,000, while Ethereum has stabilized above $4,300, which suggests potential for further growth and the possibility of reaching a new all-time high.

The massive inflow of funds also supports such forecasts. On Monday, U.S.-listed Ethereum exchange-traded funds exceeded the 1-billion-dollar mark in net inflows for the first time since their launch in July last year. Investors are increasingly recognizing the value of Ethereum as both a store of value and a foundation for decentralized finance and Web3 innovation. This underscores the growing confidence in Ethereum as a mature and promising cryptocurrency. Surpassing the billion-dollar mark in ETF inflows is not just a number; it is evidence of recognition of the platform's long-term potential, its resilience to market fluctuations, and the active development of its ecosystem.

Both institutional and retail investors are increasingly viewing Ethereum not only as a speculative asset but also as a reliable tool for portfolio diversification and participation in the emerging digital economy. The decentralized finance (DeFi) sector, built on Ethereum, continues to expand, offering alternative financial services such as lending, borrowing, and trading without the intermediation of traditional banks. In turn, Web3 technology, based on the Ethereum blockchain, offers new opportunities for creating decentralized applications and services focused on privacy and user data control.

According to SoSoValue, yesterday nine Ethereum ETFs attracted a total of 1.02 billion U.S. dollars in inflows, led by BlackRock's ETHA, with net inflows of 639.8 million dollars. Fidelity's FETH fund recorded positive inflows of 277 million dollars — the largest daily inflow for the fund to date. Grayscale's Mini Ether Trust reported net inflows of 66.57 million dollars, while its ETHE fund attracted 13 million dollars.

As for the intraday strategy in the cryptocurrency market, I will continue to act based on any major pullbacks in Bitcoin and Ethereum, expecting the medium-term bullish market trend — which is still intact — to persist.

For short-term trading, the strategy and conditions are outlined below.

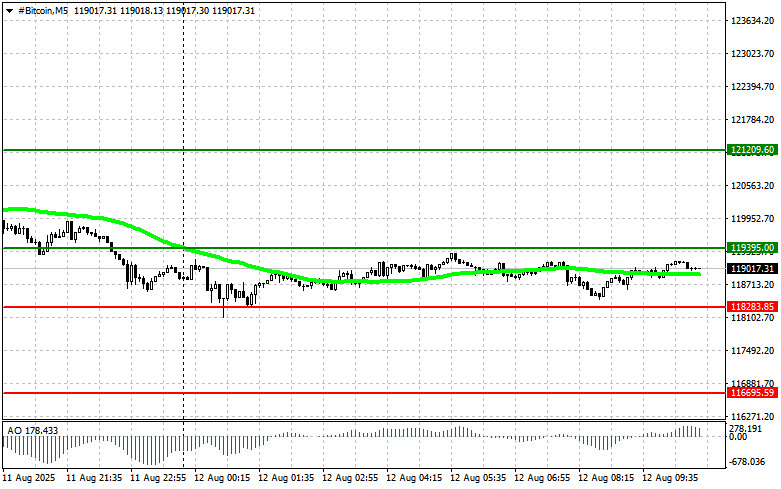

Bitcoin

Buy Scenario

Scenario No. 1: Today, I will buy Bitcoin when the entry point reaches around $119,300, targeting a rise to the $121,200 level. Around $121,200, I will exit buy positions and sell immediately on the rebound. Before buying on the breakout, make sure that the 50-day moving average is below the current price and the Awesome Oscillator is in the zone above zero.

Scenario No. 2: Bitcoin can also be bought from the lower boundary of $118,200 if there is no market reaction to its breakout, with a move back toward the levels of $119,300 and $121,200.

Sell Scenario

Scenario No. 1: Today, I will sell Bitcoin when the entry point reaches around $118,200, targeting a decline to the $116,600 level. Around $116,600, I will exit sell positions and buy immediately on the rebound. Before selling on the breakout, make sure that the 50-day moving average is above the current price and the Awesome Oscillator is in the zone below zero.

Scenario No. 2: Bitcoin can also be sold from the upper boundary of $119,300 if there is no market reaction to its breakout, with a move back toward the levels of $118,200 and $116,600.

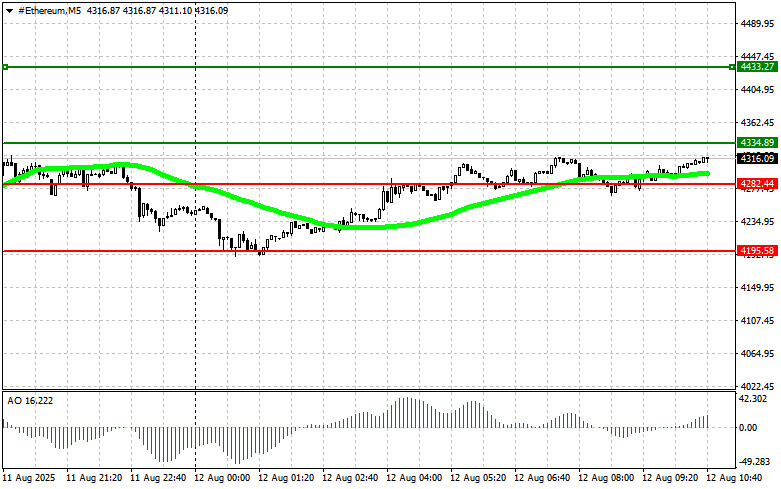

Ethereum

Buy Scenario

Scenario No. 1: Today, I will buy Ethereum when the entry point reaches around $4,334, targeting a rise to the $4,433 level. Around $4,433, I will exit buy positions and sell immediately on the rebound. Before buying on the breakout, make sure that the 50-day moving average is below the current price and the Awesome Oscillator is in the zone above zero.

Scenario No. 2: Ethereum can also be bought from the lower boundary of $4,282 if there is no market reaction to its breakout, with a move back toward the levels of $4,334 and $4,433.

Sell Scenario

Scenario No. 1: Today, I will sell Ethereum when the entry point reaches around $4,282, targeting a decline to the $4,195 level. Around $4,194, I will exit sell positions and buy immediately on the rebound. Before selling on the breakout, make sure that the 50-day moving average is above the current price and the Awesome Oscillator is in the zone below zero.

Scenario No. 2: Ethereum can also be sold from the upper boundary of $4,334 if there is no market reaction to its breakout, with a move back toward the levels of $4,282 and $4,195.