The EUR/USD currency pair traded fairly calmly again on Tuesday, as if nothing dramatic or significant had happened the previous week. But that's not the case. Simply listing all the events of last week could fill an entire article. The key day was Friday, when labor market data completely reversed the market's view on Donald Trump's policies. On top of that, the U.S. President dismissed Erica McEntarfer, head of the National Bureau of Statistics. One might think—so what, another dismissal, what's the big deal? It's not like Trump hadn't already fired others simply because he wanted to. But the essence of this event runs much deeper.

On Friday, Trump showed that he wants to control even such agencies as the Bureau of Statistics. In other words, he wants complete control over the macroeconomic information released to the public. In Trump's view, the Bureau of Statistics should not have published the revised NonFarm Payrolls data. This is just an assumption, but if that's not the reason, then why was McEntarfer dismissed? After all, her agency only collects data. She's not responsible for the low number of new jobs or for delays in delivering accurate information.

However, this data allowed many in the market to draw certain conclusions regarding Trump's policy. The U.S. President had barely finished basking in the glow of the strong Q2 GDP report when a thunderclap struck out of nowhere—the labor market essentially froze and stopped creating new jobs. This has now continued for three consecutive months, coinciding with the period during which Trump's tariffs were in effect. It turns out that the Republicans' trade policy is significantly slowing down the labor market. Meanwhile, Trump had promised to create tens of thousands of new jobs and bring manufacturing back to the U.S. In reality, things are looking quite different.

To avoid such "embarrassments" in the future, someone more loyal to Trump will surely take over—and then U.S. data might no longer be trustworthy. Of course, we're not outright claiming that the data will be manipulated, but we certainly don't rule out the possibility. Trump needs numbers to justify his chosen course. And this is especially true of inflation, which has been rising lately and is likely to continue doing so.

If Trump has found ways to bypass many U.S. laws, he'll probably find a way to "adjust" certain statistics as well. And to ensure that no one in America can disprove the new data, all independent institutions need to be brought under control—especially the Federal Reserve. On Monday, FOMC member Adriana Kugler resigned ahead of schedule. Trump immediately announced that he had several candidates to fill the vacant position. It's now likely that three FOMC members will vote in favor of cutting the key rate. And perhaps later, another member might "coincidentally" decide to step down. The once-independent Fed is slowly turning into Trump's personal bank.

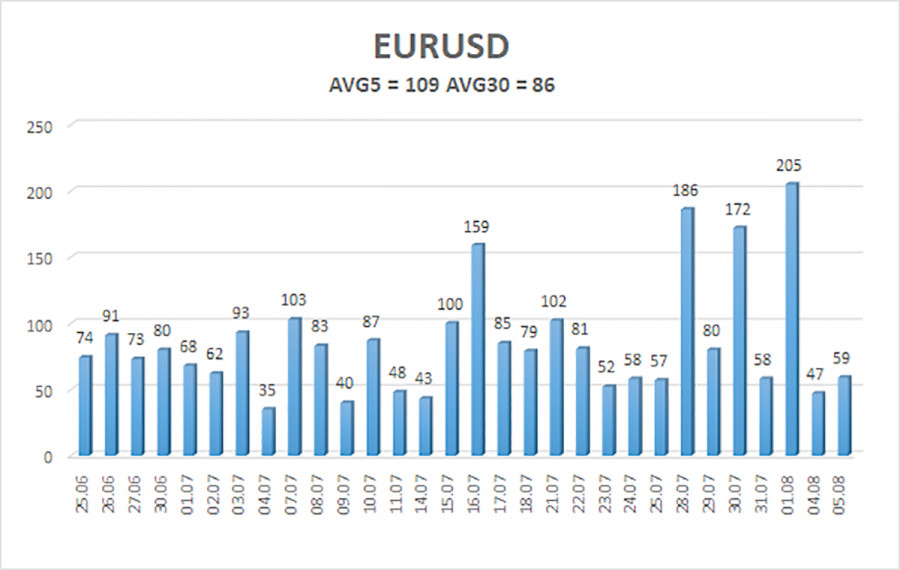

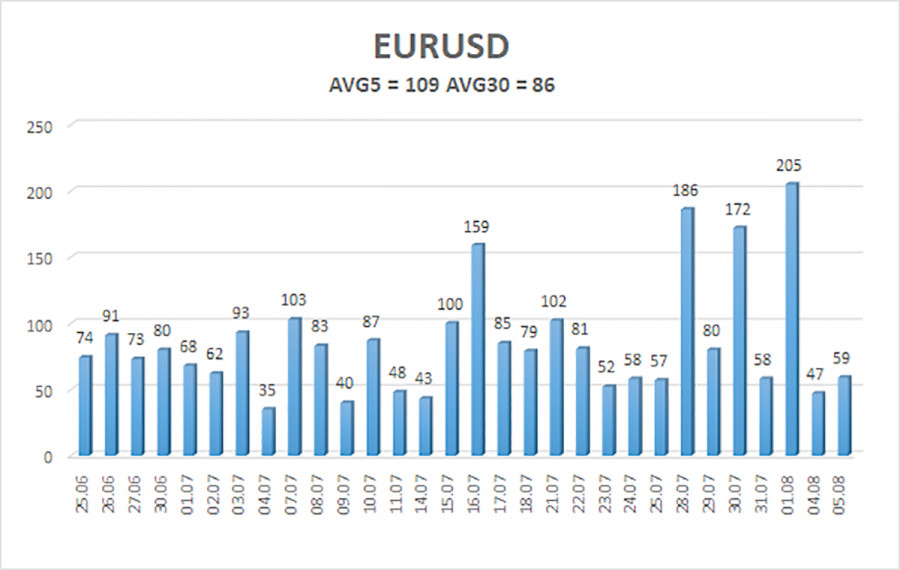

The average volatility of the EUR/USD currency pair over the last five trading days as of August 6 is 109 pips, which is considered "high." We expect the pair to move between the levels of 1.1466 and 1.1684 on Wednesday. The long-term linear regression channel is pointing upward, still indicating an uptrend. The CCI indicator has entered the oversold area for the third time, once again signaling a possible resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1536

S2 – 1.1475

S3 – 1.1414

Nearest Resistance Levels:

R1 – 1.1597

R2 – 1.1658

R3 – 1.1719

Trading Recommendations:

The EUR/USD pair may resume its upward trend. The U.S. dollar remains heavily influenced by Trump's policies, and last week, the entire world saw the consequences. The dollar had been rising for as long as it could, but now it seems a prolonged decline may be ahead. If the price settles below the moving average, small short positions can be considered with targets at 1.1475 and 1.1466. If the price remains above the moving average line, long positions remain valid with targets at 1.1658 and 1.1684, continuing the trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.