Analysis of Trades and Trading Tips for the British Pound

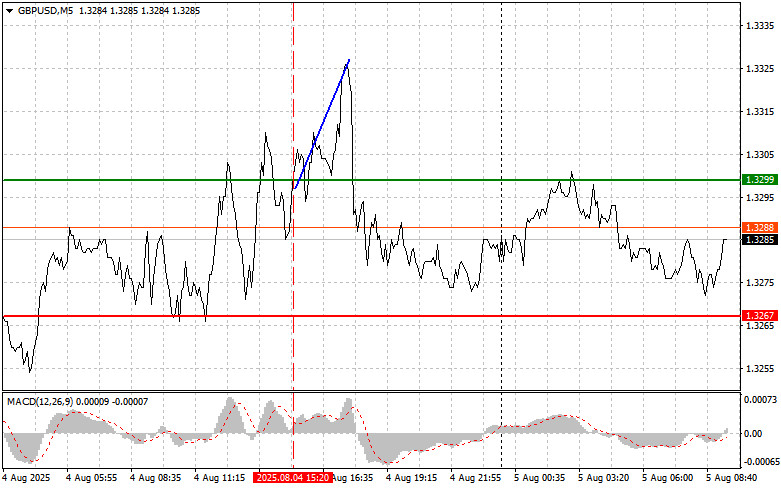

The price test at 1.3299 occurred when the MACD indicator was just beginning to move upward from the zero mark, confirming a valid entry point for buying the pound, which resulted in a rise of over 25 pips.

Today's session will be marked by the release of data on the UK services PMI and the composite PMI. Given that the services sector is a key driver of the country's economic growth, these indicators are of particular interest. Analysts and market participants closely monitor these indicators to assess the outlook for the British economy, especially amid ongoing instability. The services PMI is an important barometer of the sector's health, as it makes a significant contribution to the UK's GDP. Strong PMI figures can support the British pound and boost investor confidence in the resilience of the UK economy. Conversely, weak data may heighten concerns about slowing growth and a potential recession. It is important to understand that various factors influence PMI dynamics, such as inflation, interest rates, geopolitical developments, and consumer sentiment. A comprehensive analysis of these figures in the context of the overall economic environment will allow for a more accurate forecast of the UK's economic prospects. Any positive surprises in today's PMI release may trigger significant volatility in the currency markets and support a stronger pound. Weak data, on the other hand, would likely renew strong pressure on the GBP/USD pair.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

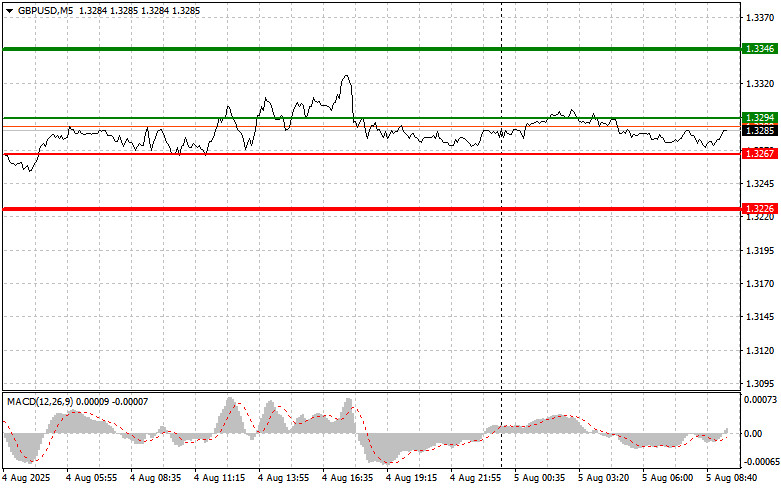

Scenario #1: I plan to buy the pound today when the entry point is reached around 1.3294 (green line on the chart), with a target of rising to 1.3346 (thicker green line on the chart). Near 1.3346, I intend to exit long positions and open short positions in the opposite direction (expecting a 30–35 pip move from that level). A bullish move in the pound today is only likely after strong data.

Important! Before buying, ensure the MACD indicator is above the zero line and is just starting to rise from it.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3267 price level while the MACD indicator is in the oversold area. This would limit the downside potential of the pair and lead to an upward reversal. A rise toward the opposite levels of 1.3294 and 1.3346 can then be expected.

Sell Scenario

Scenario #1: I plan to sell the pound today after breaking below 1.3267 (red line on the chart), which would likely lead to a quick decline in the pair. The key target for sellers will be the 1.3226 level, where I plan to exit short positions and immediately open long positions in the opposite direction (expecting a 20–25 pip rebound from the level). Selling the pound today is advisable only in case of very weak data.

Important! Before selling, ensure the MACD indicator is below the zero line and is just starting to decline from it.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3294 level while the MACD indicator is in the overbought area. This would limit the upside potential of the pair and lead to a reversal downward. A decline toward 1.3267 and 1.3226 can then be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.