Trade Analysis and Tips for Trading the British Pound

The test of the 1.3304 price level in the first half of the day coincided with the MACD indicator just starting to move upward from the zero line, confirming a valid entry point for buying the pound and resulting in a 40-point rise in the pair.

Strong lending data from the UK supported the British pound in the first half of the day, which may indicate continued activity in the housing market and consumer spending. The increase in mortgage lending also reflects sustained consumer confidence in the UK economy, particularly in the real estate sector. Despite multiple rate cuts by the Bank of England, housing demand remains relatively steady—likely due to limited housing supply keeping prices elevated.

Today's weekly U.S. initial jobless claims data will reflect the state of the labor market. A rise in claims could signal an economic slowdown and increased layoffs, while a decline could indicate labor market strength. However, traders are unlikely to react strongly to this data. More focus will likely be placed on the ISM Manufacturing PMI for April. This index is a leading indicator of U.S. manufacturing activity. A value above 50 suggests expansion, while a value below 50 indicates contraction. Traders use this index to assess the overall economic outlook and predict future corporate earnings. A weak ISM print, as expected, may indicate soft economic growth, putting pressure on the U.S. dollar and supporting risk assets, including the pound.

As for the intraday strategy, I will rely more on the execution of scenarios #1 and #2.

Buy Signal

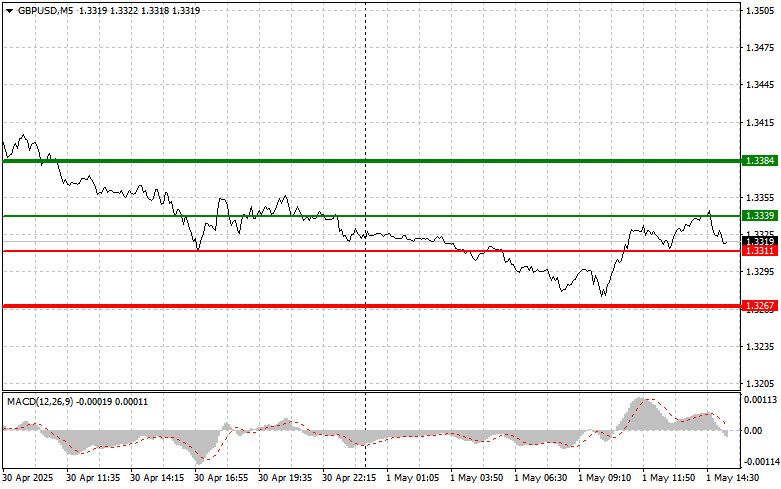

Scenario #1: I plan to buy the pound today upon reaching the entry point at 1.3339 (green line on the chart), targeting a rise to 1.3384 (thicker green line on the chart). Around 1.3384, I plan to exit long positions and open short positions in the opposite direction, expecting a 30–35 point pullback. Pound growth today can only be expected after weak data. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3311 level at a time when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. A rise toward the opposite levels of 1.3339 and 1.3384 can be expected

Sell Signal

Scenario #1: I plan to sell the pound today after the 1.3311 level (red line on the chart) is updated, which will lead to a sharp decline in the pair. The key target for sellers will be 1.3267, where I will exit short positions and immediately open long positions in the opposite direction, expecting a 20–25 point rebound. Sellers will likely assert themselves if the data is strong. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3339 level at a time when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.3311 and 1.3267 can be expected.

What's on the chart:

- Thin green line – the entry price for buying the trading instrument;

- Thick green line – the expected level for placing Take Profit or manually securing gains, as growth above this level is unlikely;

- Thin red line – the entry price for selling the trading instrument;

- Thick red line – the expected level for placing Take Profit or manually securing gains, as a decline below this level is unlikely;

- MACD indicator – when entering the market, it's important to follow overbought and oversold zones.

Important: Beginner Forex traders must be very cautious when deciding to enter the market. It's best to stay out before major fundamental reports are released to avoid being caught in sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you could quickly lose your entire deposit, especially if you ignore money management and trade large volumes.

And remember, for successful trading, you must have a clear trading plan — like the one I've outlined above. Spontaneous decision-making based on current market conditions is an inherently losing intraday trading strategy.