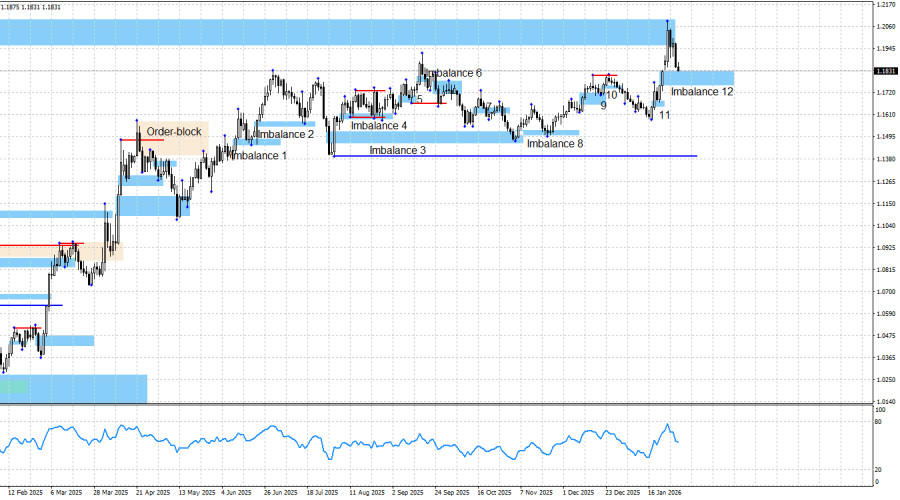

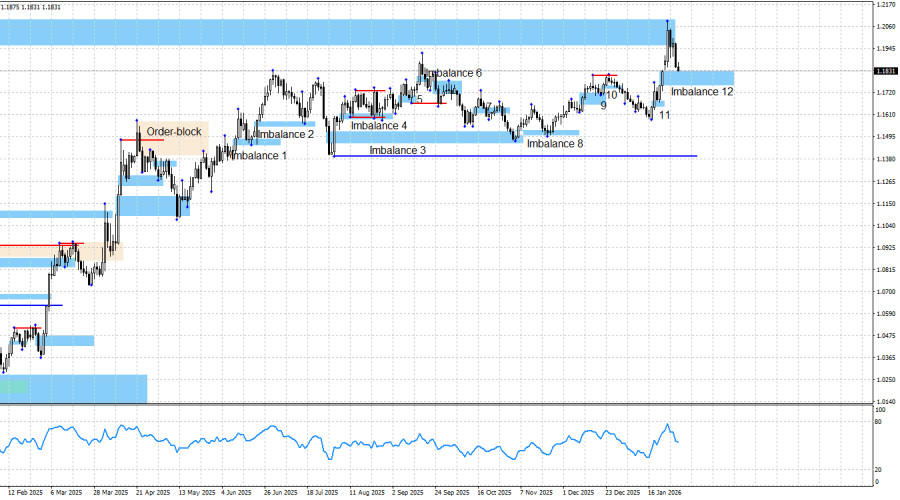

The EUR/USD pair has reversed in favor of the U.S. dollar and has been declining for the fourth consecutive day. Today, the price reached the only bullish imbalance 12, which serves as support for the bullish trend and provides bulls with an opportunity to open new positions. A similar imbalance is present on GBP/USD, and it was also worked off today. Thus, a new bullish signal for traders may be formed as early as tomorrow or the day after. Let me remind you that the bullish trend remains intact, which means that any buy signal is an important moment in a trader's decision-making process.

I would also like to note that the current decline in the pair looks somewhat unjustified from the standpoint of the fundamental backdrop. However, the price reacted to a weekly bearish imbalance, which I had been pointing to as a target for a long time. Now, either the bullish trend will be preserved and continue, or both currency pairs will transition into a bearish trend. I still find the latter scenario highly unlikely. Let me remind you that the fundamental backdrop is so poor—and, most importantly, so dangerous—for the U.S. dollar that I continue to seriously doubt the bears' capabilities. There were few major news events on Monday, but there will be many more throughout the week.

The technical picture continues to signal bullish dominance. The bullish trend remains intact despite the sideways movement during the second half of last year. A bullish signal was formed at imbalance 11, followed shortly afterward by a new imbalance 12. Traders should now expect either a new buy signal from imbalance 12 or an invalidation of this pattern. In the latter case, the decline in the pair will continue.

The fundamental backdrop on Monday was fairly positive for the euro, as all three reports released in the Eurozone came in better than traders' expectations. I am referring to the PMI indices for the German and Eurozone manufacturing sectors, as well as German retail sales. An important ISM index is still due in the U.S. today, but in my opinion, technical analysis is currently more important than fundamentals.

Bulls have had plenty of reasons for a new offensive for the past 6–7 months, and with each new day, those reasons only grow. These include the dovish (in any case) outlook for FOMC monetary policy, Donald Trump's overall political stance (which has not changed recently), the U.S.–China confrontation (where only a temporary truce has been reached), public protests in the U.S. against Trump under the banner "No Kings", weakness in the labor market, bleak prospects for the U.S. economy (recession), the shutdown that lasted a month and a half, and the potential for a new shutdown, which could begin as early as Sunday. Added to this are U.S. military aggression toward certain countries, the criminal prosecution of Jerome Powell, the "Greenland controversy", and deteriorating relations with Canada and South Korea. As a result, further growth in the pair appears entirely logical to me.

I still do not believe in a bearish trend. The fundamental backdrop remains extremely difficult to interpret in favor of the dollar, and therefore I do not attempt to do so. The blue line marks the price level below which the bullish trend could be considered finished. Bears would need to push the price down by about 570 points to reach that level, which I believe is impossible under the current fundamental backdrop and circumstances.

The nearest upside target for the euro was the weekly bearish imbalance at 1.1976–1.2092, which was formed back in June 2021. This pattern has been fully filled this week. Above that, only two levels can be highlighted: 1.2348 and 1.2564. These levels represent two peaks on the monthly chart, where liquidity could potentially be taken.

News Calendar for the U.S. and the Eurozone

- U.S. – JOLTS Job Openings Change (15:00 UTC)

On February 3, the economic calendar contains only one event of medium importance. The impact of the news background on market sentiment on Tuesday may be weak.

EUR/USD Forecast and Trading Advice

In my view, the pair remains in the formation stage of a bullish trend. Despite the fact that the fundamental backdrop remains on the bulls' side, bears have launched regular attacks over recent months. However, I still see no realistic reasons for the start of a bearish trend.

From imbalances 1, 2, 4, 5, 3, 8, and 9, traders had opportunities to buy the euro. In all cases, we saw a certain degree of growth, and the bullish trend remained intact. Last week, a new bullish signal from imbalance 11 was formed, once again allowing traders to open buy positions with a target of 1.1976. That target was reached. Later, another bullish imbalance 12 was formed. This means that traders may receive a new buying opportunity this week.