Trade analysis and recommendations for trading the British pound

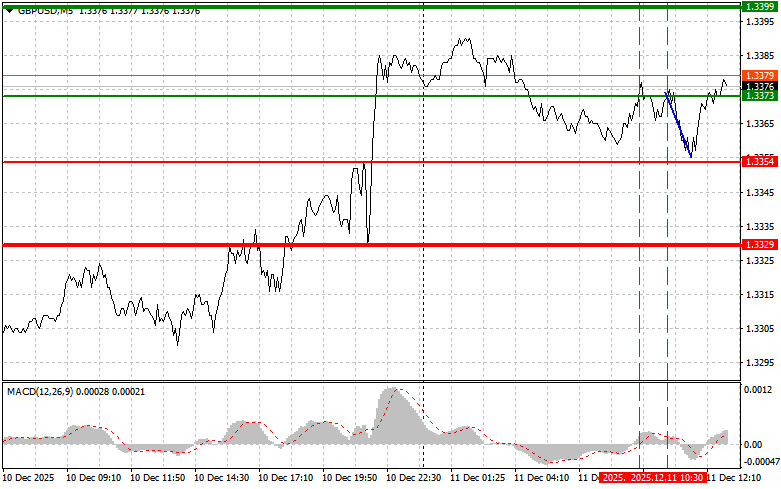

The first test of 1.3373 occurred when the MACD indicator had already moved far above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the pound. The second test of 1.3373 shortly afterward coincided with the MACD being in the overbought zone, which allowed scenario No. 2 (selling the pound) to play out. As a result, the pair fell by 20 points.

In the absence of important fundamental statistics from the UK, the British pound made several attempts to continue its bullish momentum, but without much success. The pound's further movement will largely depend on the release of key U.S. macroeconomic data scheduled for the second half of the day. Figures are expected on U.S. initial jobless claims and the trade balance. If the actual numbers turn out significantly worse than forecast, this may increase pressure on the dollar and trigger a new wave of buying in GBP/USD.

Traders will closely monitor the difference between expectations and actual data to assess the potential impact on the currency market. Particular attention will be paid to components of the jobless claims report. A significant increase in continued claims may indicate deeper labor market issues than previously assumed. As for the trade balance, a substantial increase in the deficit may signal weakening competitiveness of the U.S. economy and encourage further dollar weakening.

As for the intraday strategy, I will mainly rely on implementing scenarios No. 1 and No. 2.

Buy Signal

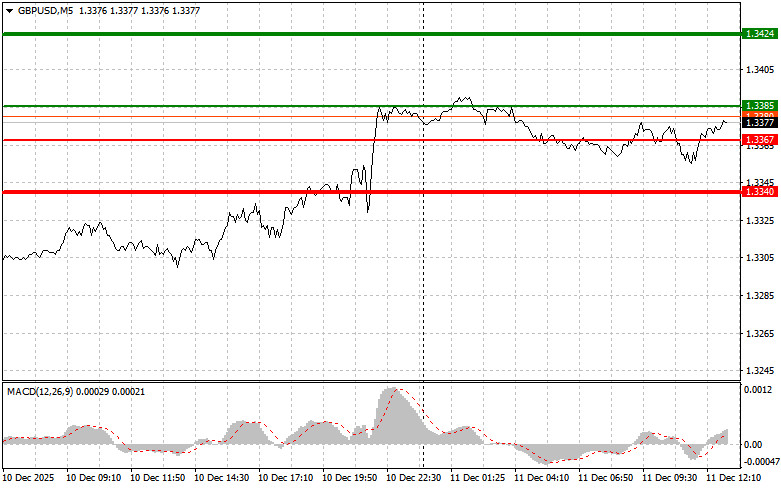

Scenario No. 1: Today, I plan to buy the pound at the entry point around 1.3385 (green line on the chart) with the goal of rising to 1.3424 (thicker green line on the chart). Around 1.3424, I will exit buy trades and open sell trades in the opposite direction (expecting a 30–35-point move back from this level). Pound growth today is likely only after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today if there are two consecutive tests of 1.3367 while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal upward. Growth toward the opposite levels of 1.3385 and 1.3424 can be expected.

Sell Signal

Scenario No. 1: Today, I plan to sell the pound after the level of 1.3367 (red line on the chart) is broken, which will lead to a rapid decline of the pair. Sellers' key target will be 1.3340, where I will exit sell trades and immediately open buy trades in the opposite direction (expecting a 20–25-point move back from the level). Pressure on the pound may return today if U.S. data is strong. Important! Before selling, make sure the MACD indicator is below the zero mark and is just beginning to fall from it.

Scenario No. 2: I also plan to sell the pound today in case of two consecutive tests of 1.3385 while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline toward 1.3367 and 1.3340 can be expected.

Chart Legend:

- Thin green line – entry price for buying the trading instrument

- Thick green line – suggested price for placing Take Profit or manually locking in profit, as further growth above this level is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – suggested price for placing Take Profit or manually locking in profit, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones

Important

Beginner Forex traders must be very cautious when making entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid sudden price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly, especially if you ignore money management and trade large volumes.

And remember: to trade successfully, you need a clear trading plan, like the one presented above. Spontaneous trading decisions based solely on the current market situation are, from the outset, a losing strategy for an intraday trader.