Trade Analysis and Tips for Trading the British Pound

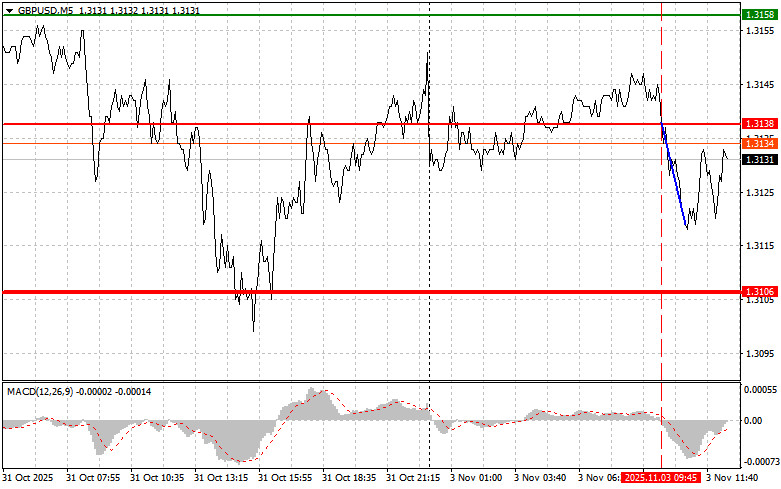

The price test of 1.3138 occurred when the MACD indicator had just begun to move downward from the zero mark, confirming a correct entry point for selling the pound and resulting in a 20-point decline for the pair.

The fact that the UK manufacturing PMI came in slightly better than economists' forecasts limited the pair's downward potential. However, this is only a temporary reprieve. The overall picture for the British economy remains challenging, and fundamental pressure on the pound sterling persists. The manufacturing sector is close to recovery, though the index still remains below the 50-point threshold. In addition, one must not forget the political uncertainty, which continues to affect the investment climate and, consequently, the pound's exchange rate.

In the second half of the day, the focus will shift to the speeches of FOMC members Mary Daly and Lisa D. Cook, as well as to the U.S. ISM Manufacturing Index for October. The remarks by Daly and Cook—essentially a "confession" of monetary policy—will be closely scrutinized for hints about the Fed's future actions. Investors are eager to understand whether the hawkish stance aimed at combating inflation will persist, or whether the regulator will continue to act cautiously in light of slowing economic growth. The ISM index, in turn, will serve as a litmus test for the condition of the U.S. manufacturing sector. A result above expectations, signaling steady growth, would strengthen the dollar and, consequently, put pressure on the pound.

As for the intraday strategy, I will rely mainly on Scenarios No. 1 and No. 2.

Buy Signal

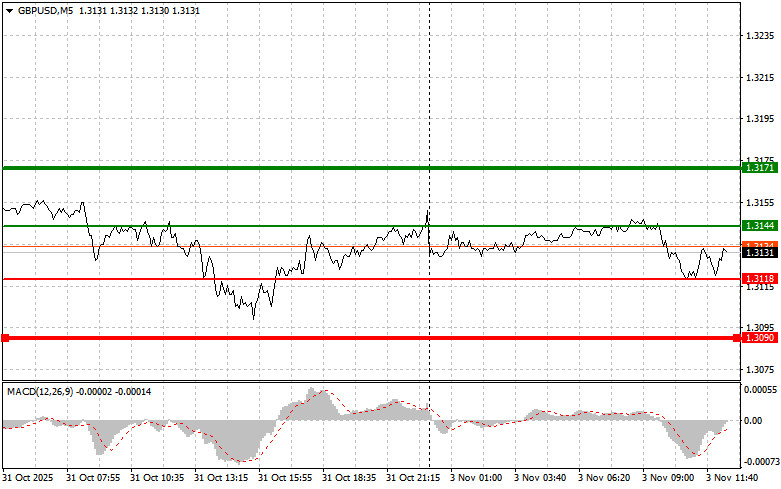

Scenario No. 1: I plan to buy the pound today when the price reaches around 1.3144 (green line on the chart), targeting growth to 1.3171 (thicker green line on the chart). Around 1.3171, I intend to close buy positions and open sales in the opposite direction (expecting a 30–35 point pullback from the level). A rise in the pound today is likely only if the Fed takes a very dovish stance.Important: Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario No. 2: I also plan to buy the pound if the price tests 1.3118 twice in a row, while the MACD is in the oversold zone. This will limit the pair's downward potential and lead to an upward reversal. Growth toward the opposite levels of 1.3144 and 1.3171 can then be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after breaking below 1.3118 (red line on the chart), which should trigger a quick decline in the pair. The key target for sellers will be 1.3090, where I plan to exit sell positions and immediately open buys in the opposite direction (expecting a 20–25 point rebound from the level). The pound could fall sharply only if the Fed adopts a hawkish stance.Important: Before selling, make sure the MACD is below the zero mark and just starting to decline from it.

Scenario No. 2: I also plan to sell the pound if the price tests 1.3144 twice in a row while the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 1.3118 and 1.3090 can then be expected.

Chart Explanation

- Thin green line – entry price for buying the trading instrument;

- Thick green line – suggested level for placing Take Profit or manually fixing profit, as further growth above this level is unlikely;

- Thin red line – entry price for selling the trading instrument;

- Thick red line – suggested level for placing Take Profit or manually fixing profit, as further decline below this level is unlikely;

- MACD Indicator – when entering the market, pay attention to overbought and oversold zones.

Important Notes for Beginner Forex Traders

Beginner traders in the Forex market must be very cautious when deciding to enter trades. Before major fundamental reports are released, it's best to stay out of the market to avoid sharp price fluctuations. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit very quickly—especially if you ignore money management and trade with large volumes.

And remember: To trade successfully, you must have a clear trading plan, like the one outlined above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.