Trade Analysis and Advice for Trading the British Pound

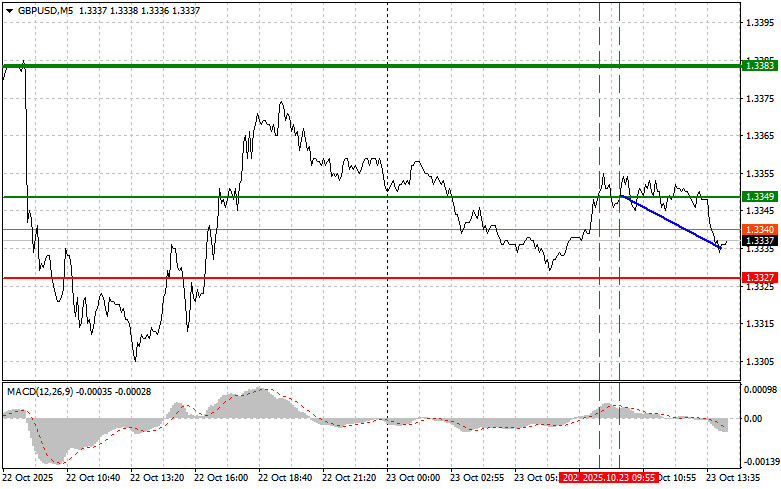

The first test of the 1.3349 price occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. The second test of 1.3349 coincided with the MACD being in the overbought area, which allowed scenario #2 for selling the pound to materialize, resulting in a 15-point decline in the pair.

News about a decrease in the U.K. industrial order balance limited the pound's upward potential. This signal, indicating a slowdown in manufacturing activity, made investors more cautious toward the British currency. The data, which came in worse than expected, reminded markets of the ongoing recession risks in the United Kingdom, putting pressure on the pound sterling. However, the overall weakness of the U.S. dollar—caused by expectations of further rate cuts from the Federal Reserve—helped contain GBP/USD's decline.

We'll get more clarity on this situation later in the day. The speeches from Barr and Bowman are essentially a lottery. Any mention of the need to maintain a tight policy, even in the most cautious form, could trigger a sharp rise in the dollar. On the other hand, a dovish tone or signals of readiness to lower rates will quickly put pressure back on the dollar, just like yesterday. This is precisely the scenario many market participants are expecting, hoping for a continuation of the dollar's downward trend.

As for intraday strategy, I'll focus mainly on scenarios #1 and #2.

Buy Signal

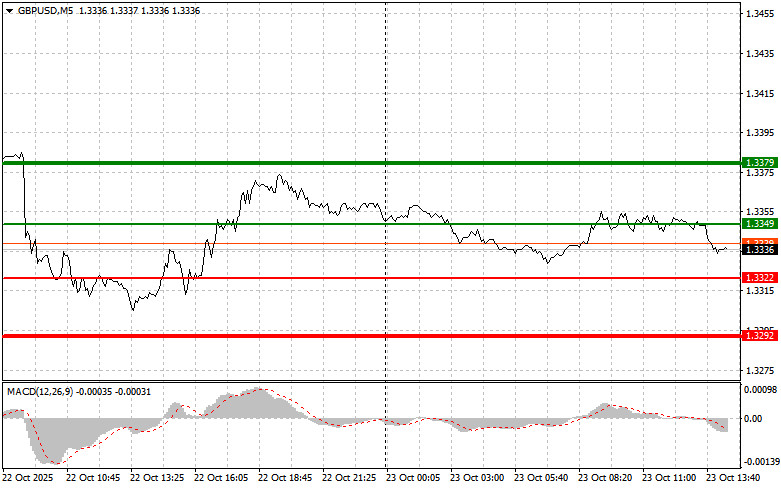

Scenario #1: I plan to buy the pound today at around the 1.3349 entry point (green line on the chart) with a target of rising to 1.3379 (thicker green line on the chart). Around 1.3379, I will close my buy trades and open sell positions in the opposite direction (expecting a 30–35-point move downward from that level). A strong rise in the pound today can only be expected if the Federal Reserve takes a very dovish stance.Important! Before buying, make sure that the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3322 price, at a moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. A rise to the opposite levels of 1.3349 and 1.3379 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after the price updates the 1.3322 level (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 1.3292, where I plan to exit sell positions and immediately open buys in the opposite direction (expecting a 20–25-point move upward). The pound could experience a sharp drop in the second half of the day.Important! Before selling, make sure that the MACD indicator is below the zero line and just starting to fall from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.3349 price, at a moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.3322 and 1.3292 can be expected.

Chart Key:

- Thin green line – the entry price at which the trading instrument can be bought;

- Thick green line – the approximate price level where Take Profit orders can be placed or profits can be manually fixed, as further growth above this level is unlikely;

- Thin red line – the entry price at which the trading instrument can be sold;

- Thick red line – the approximate price level where Take Profit orders can be placed or profits can be manually fixed, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it's important to use overbought and oversold zones as guidance.

Important Notice

Beginner Forex traders should make market entry decisions very carefully. Before the release of major fundamental reports, it's best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you don't use money management and trade with large volumes.

And remember: to trade successfully, you need to have a clear trading plan, like the one presented above. Spontaneous trading decisions based on current market conditions are, from the start, a losing strategy for an intraday trader.