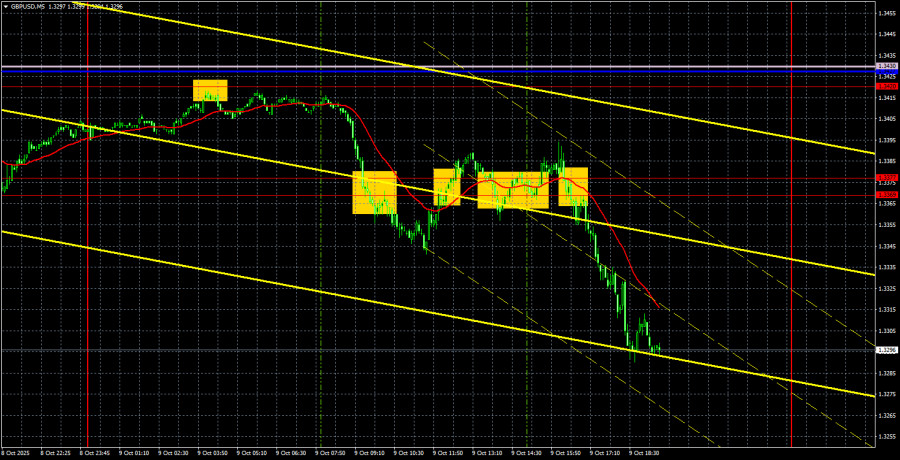

GBP/USD 5M Analysis

The GBP/USD currency pair continued its steady decline on Thursday. Interestingly, the drop didn't start after Jerome Powell's speech — the only major event of the day — but rather in the morning. It's unlikely the market was still reacting to the French political crisis for the fourth day in a row. It's becoming clear — something in the market isn't right: either market makers are manipulating price to feign the start of a downtrend, or market sentiment toward Donald Trump's policies has shifted. Either way, the pound continues falling and the dollar continues to rise.

Powell said nothing new or significant in his speech, but at this point, the market doesn't seem to care about fundamentals or substance. It simply needs an excuse to buy dollars. On Monday and Tuesday, that excuse was France. On Wednesday, it was Germany's weak industrial production report. On Thursday, it was Powell's speech. And it doesn't matter that the first two events had absolutely nothing to do with the British pound.

From a technical point of view, the downtrend has resumed — no doubt about it. There's no active trendline at the moment, but traders can use EUR's trendline as a rough guide, since GBP/USD appears to be falling "not by its own will." That is, it seems to be pulled down alongside the euro, regardless of whether there's a rationale for it. Recent moves remain chaotic and illogical.

On the 5-minute chart, many trading signals were generated throughout the day, most of which were false. We've been saying the same thing all week: market movements are irrational, and many levels or zones are being ignored altogether. The pound is collapsing like a stone, as if the Federal Reserve had suddenly turned hawkish.

COT Report

Recent COT (Commitment of Traders) reports for the British pound show that commercial traders' sentiment has been constantly shifting over the years. The red and blue lines — representing net positions of commercial and non-commercial traders — frequently cross and generally hover near the zero level. At the moment, they are nearly identical, indicating a reasonably balanced number of long and short positions.

The dollar continues to fall due to Donald Trump's policy stance, which means demand for the pound from market makers is currently less important. The trade war will likely persist in one form or another for a long time, and regardless of specifics, the Fed will likely continue to lower its key rate over the next year. That means demand for the dollar should decline.

According to the latest COT report for the British pound:

- The "Non-commercial" group opened 3,700 long contracts (BUY)

- Closed 900 short contracts (SELL)

- Resulting in a net increase of 4,600 contracts

The pound has risen sharply in 2025, mainly due to one driver — Trump's policies. Once that factor is neutralized, the dollar could begin to rebound. But no one knows when that turning point will arrive.

It doesn't matter much how quickly the pound's net positions shift; what matters is that the dollar's net positioning continues to deteriorate — and faster in relative terms.

GBP/USD 1H Analysis

On the hourly chart, GBP/USD has resumed a downward trend — yet another sign of how illogical market behavior has become. The U.S. dollar still lacks any long-term drivers for strengthening, so we expect a resumption of the broader 2025 uptrend in GBP/USD under normal circumstances. For now, it's a waiting game for panic dollar buying to subside.

Important levels for October 10: 1.3125, 1.3212, 1.3369–1.3377, 1.3420, 1.3533–1.3548, 1.3584, 1.3681, 1.3763, 1.3833, 1.3886. Key Ichimoku levels: Senkou Span B (1.3431) and Kijun-sen (1.3394) may also serve as signal levels. It's recommended to move the Stop Loss to breakeven when a trade moves 20 pips in the right direction. Ichimoku indicator lines may shift during the day — this must be considered when analyzing signals.

No important events are scheduled for Friday in the UK, while in the U.S., the University of Michigan Consumer Sentiment Index is set for release. This isn't a major report under normal circumstances, but given the current irrationality of the market, even a neutral reading may fuel further dollar strength. The market currently doesn't care why it's buying dollars — it just needs a trigger.

Trading Recommendations

On Friday, traders should be prepared for any movement. There are no nearby critical levels or zones to offer clear technical guidance. Market conditions remain chaotic and unpredictable. This is not the most favorable environment for traders. Caution is advised.

Notes on the Illustrations:

- Support and resistance levels (thick red lines) — levels where price movement may end. These are not sources of trading signals.

- Kijun-sen and Senkou Span B lines — Ichimoku indicator lines, carried over to the 1-hour chart from the 4-hour chart. Treated as significant reference levels.

- Swing highs and lows (thin red lines) — previous reversal points serving as trade signal levels.

- Yellow lines — trendlines, trend channels, and other technical patterns.

- Indicator 1 in COT charts — reflects the net position size for each trader category.