Analysis of Trades and Trading Tips for the British Pound

The test of the 1.35700 price level occurred when the MACD indicator had already moved significantly down from the zero mark, which limited the pair's downside potential. For this reason, I did not sell and missed the downward move. Buying on a rebound from 1.3534 yielded about 20 points of profit.

The British pound fell sharply, while the U.S. dollar rose after it became known that U.S. producer prices jumped by 0.9% in July, exceeding economists' forecasts.

The market reaction was immediate and quite understandable. Inflation, despite all the central bank's efforts, remains stubbornly high, and the strong rise in producer prices is yet another confirmation of this. In turn, this strengthens expectations that interest rates will remain unchanged for longer. The dollar's appreciation is typically a direct reaction to such signals. Higher interest rates in the U.S. make American assets more attractive to investors, which increases demand for the dollar and, consequently, pushes its value higher. The pound, on the other hand, is under pressure due to recession fears in the UK and the relatively more accommodative policy of the Bank of England. However, the long-term effects of this spike in producer prices and the stronger dollar are yet to be assessed.

Today, there are no UK data releases, so pound buyers will have a chance to push the price higher as early as the first half of the day. However, it is essential to keep in mind that the lack of fundamental drivers today may make the market more sensitive to technical factors and speculative moves. An important reference point for buyers will be breaking through the nearest resistance level, which would open the way to higher price marks. Otherwise, consolidation within the current range is possible. One should also not ignore potential profit-taking in continuation of yesterday's trend, which could further weaken the upward momentum observed since early August.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

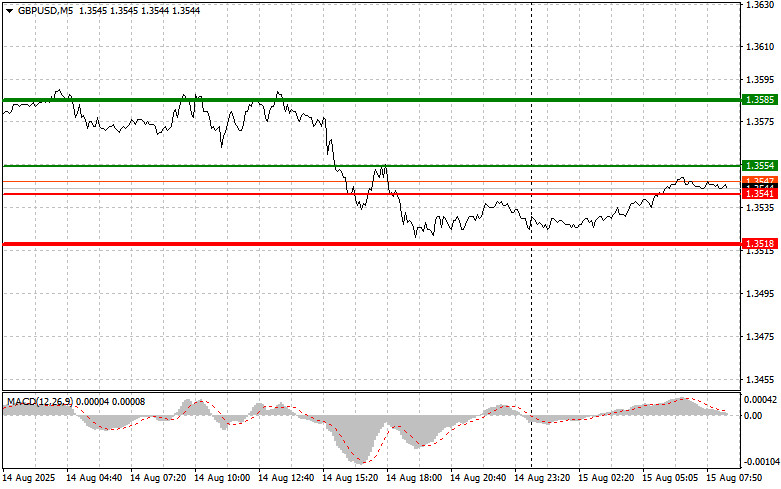

Scenario #1: Today, I plan to buy the pound upon reaching the entry point around 1.3554 (green line on the chart) with the goal of rising to 1.3585 (thicker green line on the chart). Around 1.3585, I plan to exit purchases and open sales in the opposite direction (expecting a 30–35 point move in the opposite direction from this level). Pound growth is possible today, but it is unlikely to be strong. Important: Before buying, ensure the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3541 price level when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward reversal. Growth can be expected toward the opposite levels of 1.3554 and 1.3585.

Sell Scenario

Scenario #1: Today, I plan to sell the pound after updating the 1.3541 level (red line on the chart), which will lead to a quick drop in the pair. The key target for sellers will be 1.3518, where I plan to exit sales and immediately open purchases in the opposite direction (expecting a 20–25 point move in the opposite direction from this level). Selling the pound could resume at any moment today. Important: Before selling, ensure the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3554 price level when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a reversal downward. A decline toward the opposite levels of 1.3541 and 1.3518 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.