Trade Analysis and Tips for Trading the Japanese Yen

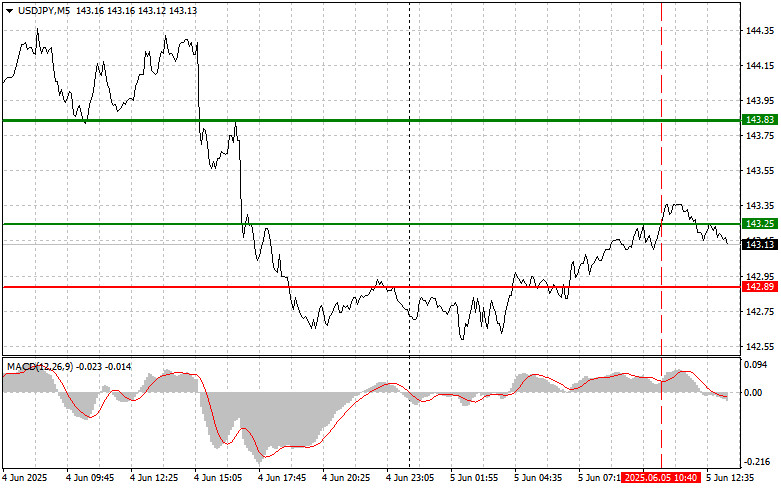

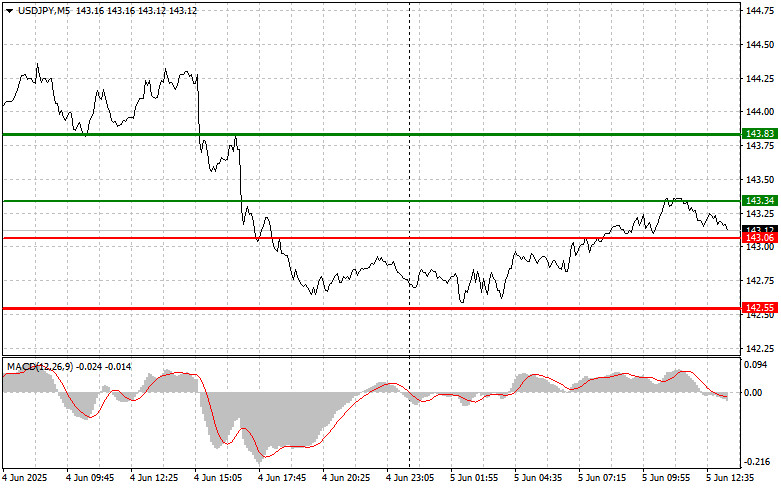

The price test at 143.25 during the first half of the day occurred when the MACD indicator had moved significantly above the zero line, which limited the pair's upward potential.

The U.S. initial jobless claims data is perhaps the most important indicator to watch today. A deterioration in this figure would provide further evidence of the challenging situation the Federal Reserve may face in the near future. It is also worth listening to the final speeches of FOMC members Patrick T. Harker and Jeffrey Schmid before the usual Fed blackout period ahead of the meeting. These speeches are important because they can provide valuable clues regarding the current sentiment within the Federal Open Market Committee and potential future steps in monetary policy. Analyzing the rhetoric and the emphasis placed by the speakers can help investors better understand which factors are currently in the Fed's focus and what decisions are likely to be made at the upcoming meeting.

In particular, attention should be paid to how Harker and Schmid assess the current inflation situation, their views on the labor market, and their readiness for further interest rate cuts.

As for intraday strategy, I will mostly rely on implementing scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy USD/JPY upon reaching the entry point around 143.34 (green line on the chart) with the target of rising to 143.83 (thicker green line on the chart). Around 143.83, I plan to exit the buy trades and open sell positions in the opposite direction (targeting a 30–35 point move in the opposite direction). A strong rally in the pair today can be expected after strong statistics. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today in the case of two consecutive tests of the 143.06 level, at a moment when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. Growth can be expected toward the opposite levels of 143.34 and 143.83.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after an update of the 143.06 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be the 142.55 level, where I plan to exit the sell trades and immediately open buys in the opposite direction (targeting a 20–25 point move in the opposite direction). Pressure on the pair will return in case of weak statistics. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today in the case of two consecutive tests of the 143.34 level, at a moment when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward the opposite levels of 143.06 and 142.55.

What's on the Chart:

- Thin green line — entry price for buying the trading instrument;

- Thick green line — suggested price for placing Take Profit or manually locking in profits, as further growth above this level is unlikely;

- Thin red line — entry price for selling the trading instrument;

- Thick red line — suggested price for placing Take Profit or manually locking in profits, as further decline below this level is unlikely;

- MACD indicator — when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner Forex traders must be very cautious when deciding to enter the market. Before the release of important fundamental reports, it is best to stay out of the market to avoid getting caught in sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade with large volumes. And remember, for successful trading, you must have a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for an intraday trader.