Trade Analysis and Tips for Trading the Euro

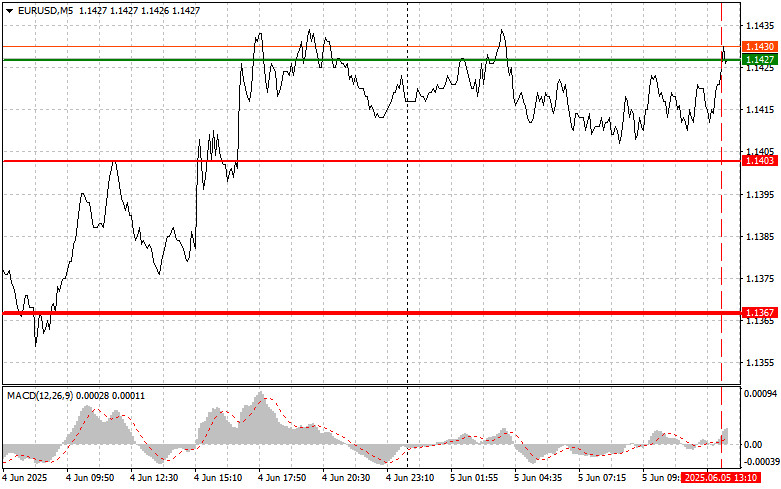

The price test at 1.1427 occurred when the MACD indicator had moved significantly above the zero line, which limited the upward potential. For this reason, I did not buy the euro.

Ahead of the European Central Bank's announcement on the key interest rate and the release of updated economic forecasts, macroeconomic indicators from Germany and the eurozone were largely ignored. All attention is focused on the ECB President Christine Lagarde's press conference, where further measures aimed at stimulating economic growth are expected to be presented. Special importance is placed on the ECB's new economic outlooks, which should clarify the prospects for growth and inflation. Investors will pay close attention to signals regarding potential recession risks and the pace of monetary policy easing.

We are also expecting initial jobless claims data from the U.S., nonfarm labor productivity figures, and changes in labor costs. However, these reports are of limited interest, except perhaps for the labor market data, as the market's current focus is on more significant factors such as inflationary pressure, Federal Reserve interest rate policy, and geopolitical tensions over trade tariffs. These macroeconomic indicators have a decisive impact on investor sentiment and their investment decisions.

As for intraday strategy, I will mostly rely on implementing scenarios #1 and #2.

Buy Signal

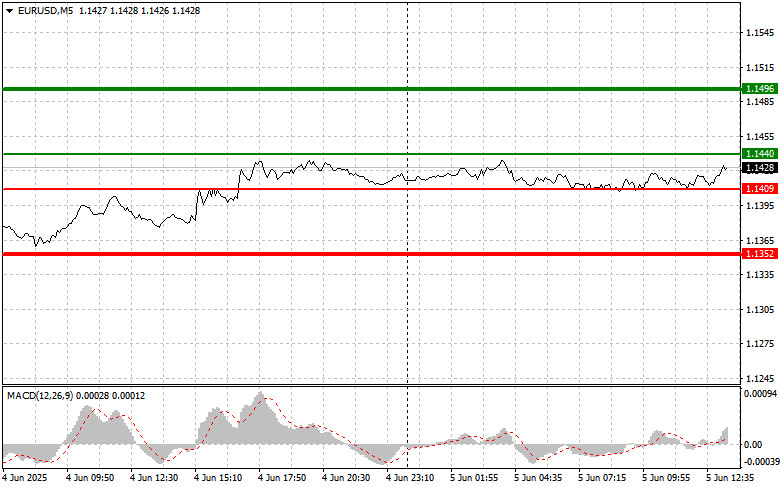

Scenario #1: Today, buying the euro is possible upon reaching the price area around 1.1440 (green line on the chart) with the target of rising to 1.1496. At 1.1496, I plan to exit the market and sell the euro in the opposite direction, targeting a 30–35 point move from the entry point. Counting on euro growth today is only possible after weak U.S. statistics. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1409 level, at a moment when the MACD indicator is in the oversold zone. This will limit the downward potential of the pair and lead to a market reversal upward. A rise can be expected toward the opposite levels of 1.1440 and 1.1496.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1409 level (red line on the chart). The target will be the 1.1352 level, where I plan to exit the market and immediately buy in the opposite direction (targeting a 20–25 point move in the opposite direction from the level). Pressure on the pair may return today after strong U.S. data.Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1440 level, at a moment when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward the opposite levels of 1.1409 and 1.1352.

What's on the Chart:

- Thin green line — entry price for buying the trading instrument;

- Thick green line — the assumed price for placing Take Profit or manually locking profits, as further growth above this level is unlikely;

- Thin red line — entry price for selling the trading instrument;

- Thick red line — the assumed price for placing Take Profit or manually locking profits, as further decline below this level is unlikely;

- MACD indicator — when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner Forex traders must be very cautious when deciding to enter the market. Before the release of important fundamental reports, it is best to stay out of the market to avoid being caught in sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember, for successful trading, you need to have a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for an intraday trader.