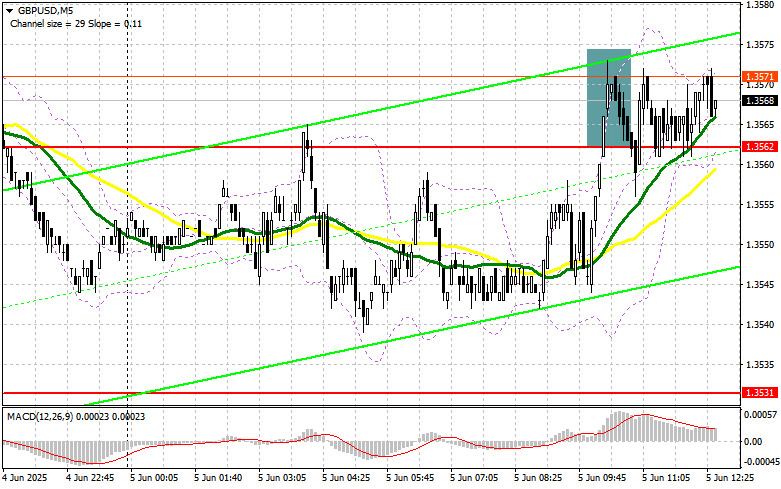

In my morning forecast, I focused on the 1.3562 level and planned to make market entry decisions around it. Let's look at the 5-minute chart and see what happened. Growth and the formation of a false breakout around 1.3562 led to an entry point for selling the pound, but as you can see on the chart, a major decline in the pair did not occur. The technical picture was revised for the second half of the day.

For opening long positions on GBP/USD:

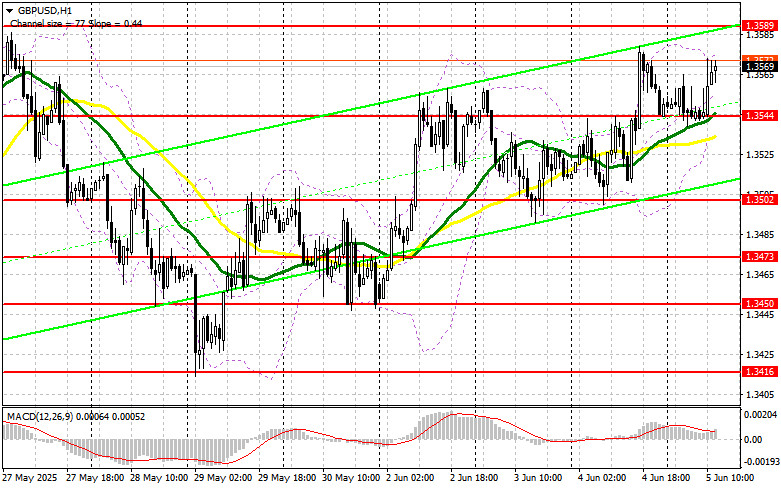

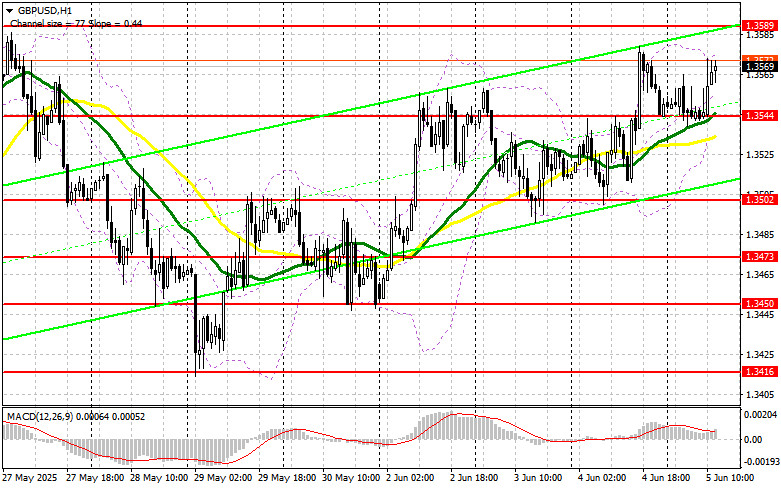

Data on U.K. construction sector activity for May supported the pound, but a sharp move upward has yet to materialize. Perhaps something more significant will happen after the release of U.S. weekly initial jobless claims and changes in labor productivity in the non-manufacturing sector. The speeches of FOMC members Patrick T. Harker and Jeffrey Schmid will also be in focus. In the case of strong U.S. statistics, the pound is likely to react with a decline. In that case, I prefer to act around the support level of 1.3544, which was formed in the first half of the day. A false breakout there will provide a good entry point for long positions with the target of returning to the 1.3589 resistance, which is the monthly high. A breakout and a retest from top to bottom of this range will provide a new entry point for long positions, continuing the bullish market trend, with the prospect of updating 1.3626. The ultimate target will be the level around 1.3659, where I plan to take profit. If GBP/USD declines and there is no bullish activity around 1.3544 in the second half of the day, pressure on the pound could increase significantly. In that case, only the formation of a false breakout around 1.3502 would provide a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.3473 support, aiming for an intraday correction of 30–35 points.

For opening short positions on GBP/USD:

Sellers have tried, but so far the market remains on the side of the buyers, and only very strong U.S. statistics — which is unlikely — could limit the pair's upward potential. In the case of a spike upward in GBP/USD after the data, I plan to act after a false breakout around the 1.3589 resistance. This will be enough to open short positions in anticipation of a fall to the 1.3544 support, where the moving averages supporting the bulls are located. A breakout and retest from bottom to top of this range would trigger stop-loss orders and open the way to 1.3502. The ultimate target will be the area around 1.3473, where I plan to take profit. If demand for the pound persists in the second half of the day and bears do not show activity around 1.3589, it is better to postpone sales until testing the 1.3626 resistance. I will open short positions there only after a false breakout. If there is no downward move even there, I will look for short positions on a rebound from the 1.3659 level, but only aiming for an intraday correction of 30–35 points.

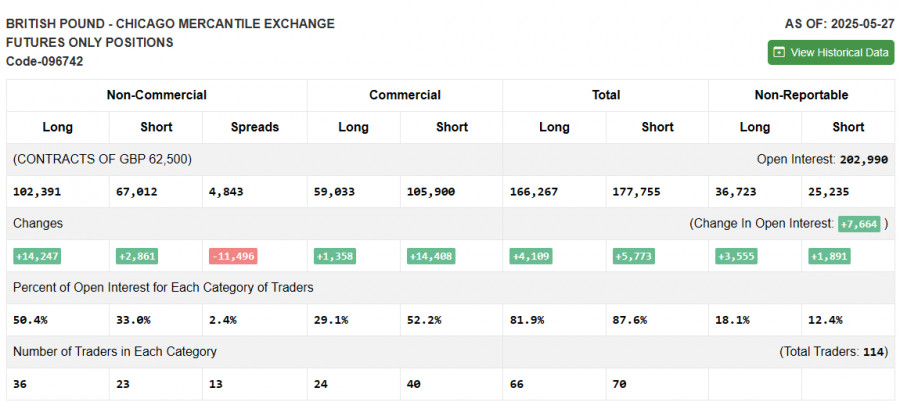

In the COT report (Commitment of Traders) for May 27, there was a sharp increase in long positions and a less active rise in short positions. After the U.K. and U.S. concluded a trade agreement, demand for the pound remains strong. Given that the Bank of England is still staying on the sidelines and not intervening in monetary policy, the chances for further strengthening of the pound are quite good. Add to that the ongoing trade disagreements between China and the U.S., and the weakness of the U.S. dollar, and it becomes clear that the medium-term bullish trend for the pound is not over yet. In the latest COT report, long non-commercial positions rose by 14,247 to 102,391, while short non-commercial positions rose by 2,861 to 67,012. As a result, the gap between long and short positions narrowed by 11,469.

Indicator signals:

Moving Averages

Trading is conducted above the 30- and 50-period moving averages, indicating further growth in the pound.

Note: The periods and prices of the moving averages are based on the author's analysis of the H1 chart and differ from the classic daily moving averages on the D1 chart.

Bollinger Bands

In the case of a decline, the lower boundary of the indicator around 1.3544 will act as support.

Indicator descriptions: • Moving Average: Determines the current trend by smoothing out volatility and noise. 50-period — marked in yellow; 30-period — marked in green; • MACD (Moving Average Convergence/Divergence): Fast EMA — 12-period; Slow EMA — 26-period; SMA — 9-period; • Bollinger Bands: 20-period; • Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes; • Long non-commercial positions: The total long open positions held by non-commercial traders; • Short non-commercial positions: The total short open positions held by non-commercial traders; • Net non-commercial position: The difference between short and long non-commercial trader positions.