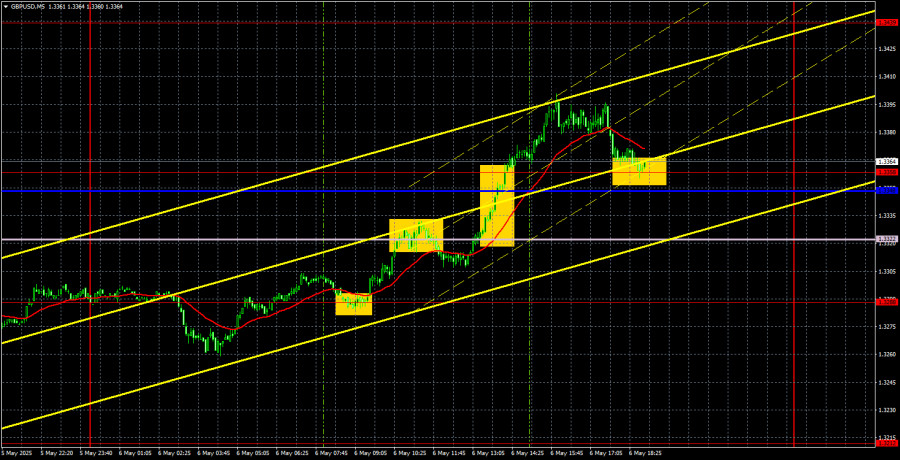

GBP/USD 5-Minute Analysis

On Tuesday, the GBP/USD currency pair suddenly and unexpectedly resumed upward movement. While the euro was stuck in a flat market, the British pound showed a strong rally, and again, without any apparent reason. Recall that earlier this week, Trump imposed new tariffs on the film industry, which gave the dollar a fundamental reason to depreciate. Yet, the dollar did not fall against the euro, and the tariffs were introduced on Monday, not Tuesday.

One might assume the movement was tied to the upcoming Federal Reserve meeting, but such a meeting should influence both major currency pairs equally. And yet the euro remained flat for the first two days of the week. The last possible explanation is the Bank of England meeting, which will conclude on Thursday afternoon. However, this also doesn't add up — the BoE is almost certain to cut the key interest rate, which is a bearish factor for the national currency. Therefore, the pound should have been trading lower, not higher. In short, the pound's rise on Tuesday cannot be reasonably explained.

From a technical perspective, the picture isn't any clearer. Ichimoku indicator levels and lines remain ignored, and price movements remain highly erratic, even though this is not a classic flat market.

On the 5-minute timeframe, several decent trading signals were formed due to the pair trending in one direction for most of the day. However, the pound encountered multiple obstacles along the way. Each time the price broke through one level, it immediately ran into another. In the end, long positions could only be opened near 1.3288 and after breaking above 1.3358. Modest profits could be made in both cases — but only modest ones.

COT Report

COT reports for the British pound show that commercial traders' sentiment has constantly shifted in recent years. The red and blue lines—representing net positions of commercial and non-commercial traders—frequently intersect and mostly hover near the zero mark. That's the case now, indicating a relatively balanced number of long and short positions.

On the weekly timeframe, the price initially broke through the 1.3154 level, then surpassed the trend line, returned to 1.3154, and broke it again. Breaking the trend line suggests a high probability of further pound depreciation. However, the dollar continues to fall due to Donald Trump. Therefore, despite technical signals, news about the trade war could keep pushing the pound higher.

According to the latest report on the British pound, the "Non-commercial" group closed 2,900 BUY contracts and 6,400 SELL contracts. As a result, the net position of non-commercial traders increased by 3,500 contracts.

The fundamental backdrop still does not justify long-term buying of the pound sterling, and the currency remains at real risk of resuming a broader downtrend. The pound has gained significantly recently, but it's important to understand that this was due to Donald Trump's policies.

GBP/USD 1-Hour Analysis

On the hourly chart, GBP/USD continues to trend upward, though not as strongly as before, with occasional pullbacks. The pound has shown impressive growth in recent months, though it has little to do with the currency itself. The rally is mostly the result of dollar weakness, driven by Donald Trump, and that trend hasn't ended. The market is largely overlooking macroeconomic data. Consequently, chaos and inconsistency prevail, revealing a clear absence of logic in price movements.

For May 7, we highlight the following key levels: 1.2691–1.2701, 1.2796–1.2816, 1.2863, 1.2981–1.2987, 1.3050, 1.3125, 1.3212, 1.3288, 1.3358, 1.3439, 1.3489, 1.3537. The Senkou Span B line (1.3322) and the Kijun-sen line (1.3348) may also serve as sources of trading signals. Setting Stop Loss orders at breakeven once the price moves 20 pips in the favorable direction is recommended. Remember that Ichimoku lines may shift during the day and should be considered when interpreting trading signals.

No major events are scheduled for the UK on Wednesday, but the U.S. will release the outcome of the Fed meeting, the results of which are already widely anticipated. The only real intrigue lies in Jerome Powell's remarks during the press conference: their tone and general message. If Powell hints at a possible return to a monetary easing cycle, it could spell serious trouble for the dollar.

Illustration Explanations:

- Support and resistance price levels – thick red lines where movement may end. They are not trading signal sources.

- Kijun-sen and Senkou Span B lines—These are strong Ichimoku indicator lines transferred to the hourly timeframe from the 4-hour one.

- Extremum levels – thin red lines where the price has previously rebounded. These act as trading signal sources.

- Yellow lines – trend lines, trend channels, and other technical patterns.

- COT Indicator 1 on the charts – the size of the net position for each category of traders.