Wall Street Edges Up: Nvidia Lifts Market Amid Tariff Turmoil

U.S. stocks advanced on Thursday, buoyed by a solid performance from Nvidia following its latest earnings report, while investors digested a late-night court ruling that reinstated former President Donald Trump's broad trade tariffs.

Tariff Drama Takes Center Stage

A federal appeals court reversed a recent decision by the trade court, which had sought to block the tariffs immediately. The legal back-and-forth injected volatility into the trading session, leaving major indexes well below their intraday highs by the close.

Salesforce Slips Despite Strong Guidance

Shares of Salesforce declined 3.3%, even though the enterprise software provider upgraded its full-year revenue and earnings outlook. The sell-off suggests that the upbeat forecast may have already been priced in—or that investors were concerned about underlying metrics.

AI Demand Surges Ahead of China Restrictions

Nvidia stock gained 3.2% after the chipmaker reported robust sales fueled by customers stockpiling AI processors in anticipation of new U.S. export restrictions targeting China. Yet the company cautioned that these upcoming rules could slash its current-quarter revenue by as much as $8 billion.

"Magnificent Seven" Wraps Earnings Season

Nvidia's report marked the final earnings release among the so-called "Magnificent Seven" — a group of mega-cap tech and growth companies. Even with Thursday's gains, Nvidia's shares are up just 3.6% for the year, highlighting investor caution despite the AI boom.

Indexes Edge Higher: Wall Street Holds Steady Amid Mixed Signals

Major U.S. stock benchmarks closed in positive territory on Thursday, as investors balanced upbeat corporate developments with broader geopolitical and economic uncertainty.

Closing Figures:

- Dow Jones Industrial Average rose by 117.03 points (+0.28%) to 42,215.73;

- S&P 500 gained 23.62 points (+0.40%) to close at 5,912.17;

- Nasdaq Composite added 74.93 points (+0.39%) to settle at 19,175.87.

Tariff Tensions Linger

The markets remain sensitive to the fallout from former President Donald Trump's sweeping global tariff proposal, announced on April 2. While the news initially triggered a pullback, the S&P 500 has since rebounded as trade tensions eased and first-quarter earnings largely exceeded expectations.

The index is still trading below its all-time high from February, but it's now up 0.5% year-to-date — a modest sign of regained investor confidence.

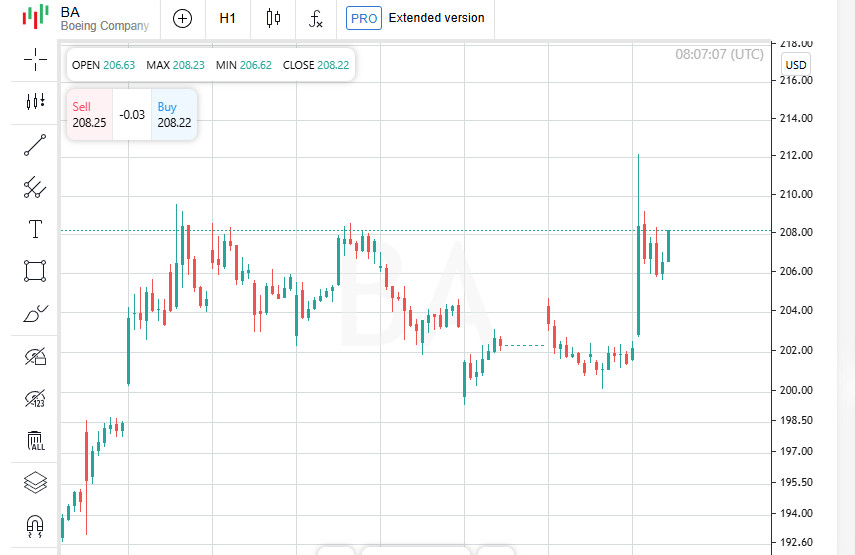

Boeing's Production Plans Fuel Optimism

Shares of Boeing climbed 3.3% after CEO Kelly Ortberg outlined the company's intention to ramp up output of its flagship 737 MAX jets. Production is set to hit 42 units per month in the coming months, with a target of 47 per month by early 2026. Markets responded positively to the growth trajectory for one of the aerospace giant's key products.

Best Buy Slumps: Tariffs Threaten Big-Ticket Spending

Shares of electronics retailer Best Buy tumbled 7.3% after the company downgraded its annual forecast for comparable sales and earnings. The revision came amid concerns that U.S. trade tariffs could curb consumer appetite for high-priced tech items — a potential headwind for the company's bottom line.

Asia Turns Red as Investors Seek Safety

Asian stock markets moved lower on Friday as traders responded to renewed uncertainty over U.S. tariff policy. The pullback came just a day after a brief rally, fueled by a court ruling to halt most of the Trump-era tariffs — a decision that was quickly overturned. Meanwhile, the Japanese yen gained strength as a safe-haven currency, applying extra pressure on Japan's Nikkei 225, which had climbed nearly 2% the previous day.

Yen Surges, Japan's Nikkei Stumbles

Japan's Nikkei index dropped 1.1% as the yen strengthened sharply by 2%, climbing to 143.45 per dollar. A stronger yen tends to hurt export-heavy Japanese companies by reducing the value of overseas earnings — a key factor behind the market's pullback.

Red Day for Asia-Pacific Markets

Friday brought losses across major Asian stock exchanges:

- Hong Kong's Hang Seng fell 1.6%, weighed down by Apple suppliers after the rollback of certain tariffs;

- Mainland China's CSI 300 dropped 0.3%, reflecting weakness in blue-chip stocks;

- South Korea's KOSPI slid 0.9%;

- The broader MSCI Asia-Pacific index (excluding Japan) lost 0.6%.

Wall Street Futures Retreat Slightly

U.S. S&P 500 futures ticked down 0.1%, giving back some of the prior session's gains, which were fueled by Nvidia's strong earnings. However, Asian markets had already priced in that optimism. Euro STOXX 50 futures also edged slightly lower, suggesting a cautious European open.

Bonds Hold Steady, Oil Dips

U.S. 10-year Treasury yields remained flat at 4.42% on Friday, holding ground after Thursday's 5.5-basis-point decline.

Oil prices softened modestly:

- Brent crude slipped 0.3% to $63.95 per barrel;

WTI (West Texas Intermediate) also dipped 0.3% to $60.75.