Trade Review and Trading Tips for the British Pound

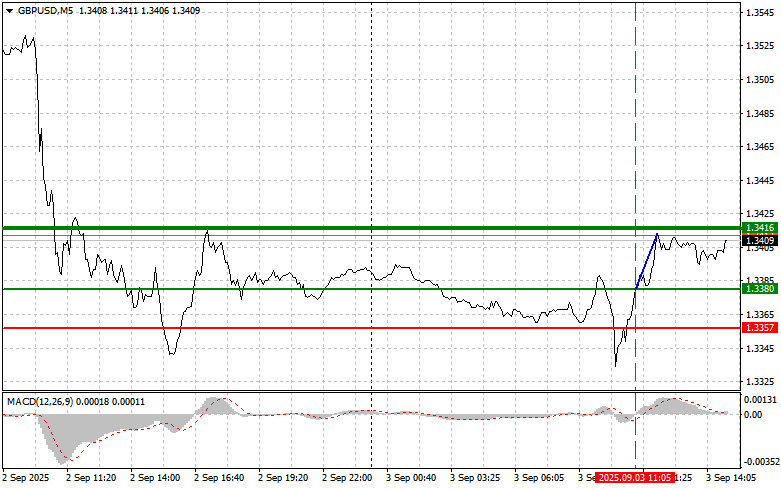

The test of the 1.3380 price level occurred when the MACD indicator had just started moving upward from the zero mark, confirming a proper entry point for buying the pound. As a result, the pair rose toward the target level of 1.3416.

Strong UK services sector data supported the pound, allowing it to recover quickly. The released business activity indices exceeded analysts' expectations, indicating the resilience of the British economy despite ongoing challenges such as inflation and trade tariffs. This positive momentum gives the Bank of England more room to maneuver in its monetary policy.

Today, the JOLTS report is expected, which is traditionally viewed as a leading indicator of labor market conditions. An increase in job openings will indicate strong demand for labor and may prompt the Fed to adopt a more cautious approach to rate policy. Conversely, a decline in this metric may be seen as a sign of slowing economic growth, potentially leading to monetary policy easing as early as September's meeting.

The second important factor will be the report on changes in factory orders. An increase in orders is usually interpreted as a positive signal for the economy, indicating growth in business activity and prospective industrial output. A decline in orders, on the other hand, may raise concerns about future economic growth.

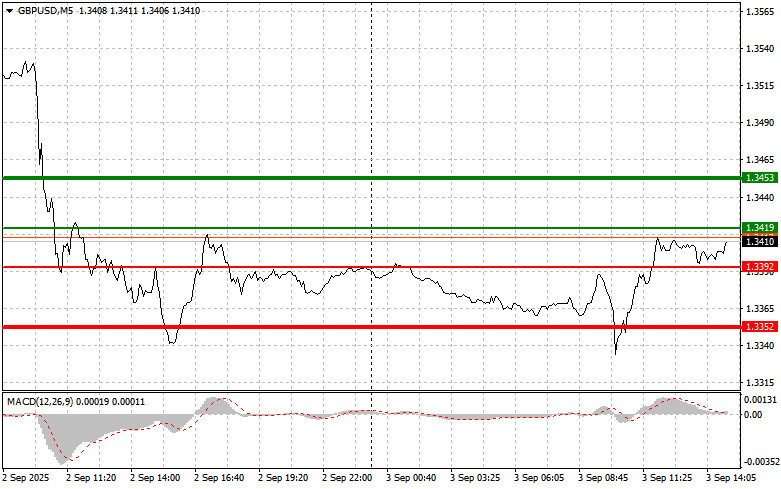

As for the intraday strategy, I will focus more on implementing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today I plan to buy the pound at the entry point around 1.3419 (green line on the chart) targeting growth to the 1.3453 level (thicker green line on the chart). Around 1.3453, I will exit long positions and open short trades in the opposite direction (targeting a 30–35 point move in the opposite direction from this level). Strong pound growth today may occur after weak US data. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3392 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and may trigger a reversal upward. Growth toward the opposite levels of 1.3419 and 1.3453 can be expected.

Sell Signal

Scenario #1: Today I plan to sell the pound after the price updates the 1.3392 level (red line on the chart), which should lead to a rapid decline in the pair. The main target for sellers will be the 1.3352 level, where I will exit short trades and immediately open long trades in the opposite direction (targeting a 20–25 point move in the opposite direction from this level). Strong data may lead to a new decline in the pair. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3419 level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 1.3392 and 1.3352 can be expected.

Chart Legend:

- Thin green line – entry price at which you can buy the trading instrument;

- Thick green line – estimated price for setting Take Profit or manually fixing profit, as further growth above this level is unlikely;

- Thin red line – entry price at which you can sell the trading instrument;

- Thick red line – estimated price for setting Take Profit or manually fixing profit, as further decline below this level is unlikely;

- MACD Indicator – when entering the market, it is important to follow overbought and oversold zones.

Important: Beginner Forex traders should make entry decisions with great caution. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember: for successful trading, you need a clear trading plan, like the one above. Spontaneous trading decisions based on the current market situation are, by definition, a losing strategy for intraday traders.