Friday Trade Review

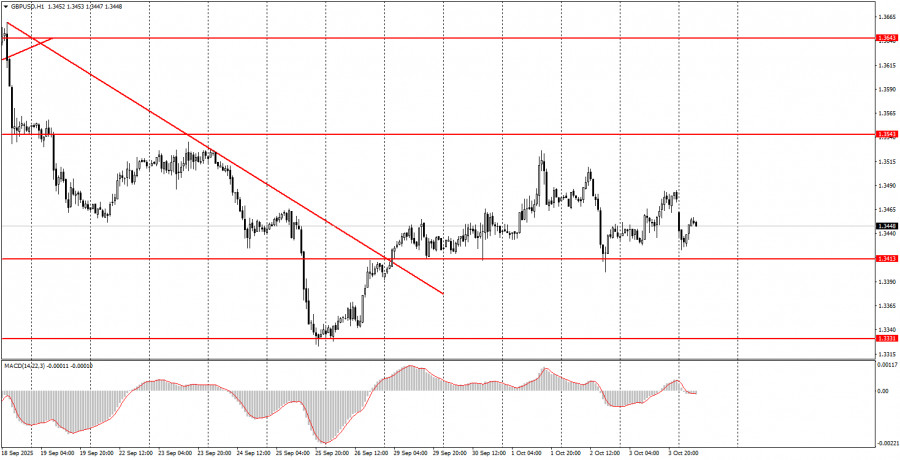

1H Chart – GBP/USD

On Friday, the GBP/USD pair exhibited a slight bullish movement that didn't affect the overall technical picture. Since breaking the downward trendline, the upward movement has yet to truly begin. As with the euro, this kind of behavior raises many questions. Just last week, the U.S. government experienced a shutdown (a major event clearly weighing on the economy), the only labor market report (ADP) came in extremely weak, and the ISM business activity indices signaled economic slowdown.

So, the market currently has plenty of reasons to sell the U.S. dollar—yet it's not happening. Mid-term, GBP still maintains a bullish bias, but upward movement has stalled in recent months. Although the pound isn't fully utilizing its available growth drivers, we still do not believe in the long-term strength of the dollar.

However, on the 5-minute chart, global trends are less important—especially under current conditions, where no strong persistent trend exists.

5M Chart – GBP/USD

On Friday's 5-minute chart, the price bounced from the 1.3466–1.3475 zone during the European session but managed only a 20-pip drop. That was enough to trigger a Stop Loss to breakeven, and the trade closed with zero loss. By evening, the price had returned to the same 1.3466–1.3475 area, but no new signal had formed. Due to low volatility, no major profit was feasible either way.

How to Trade on Monday

On the hourly timeframe, GBP/USD has completed the formation of a downtrend. As we mentioned earlier, there are no solid reasons for sustainable USD growth, so we expect the mid-term movement to remain bullish. Currently, however, the market appears to be in a state of stagnation or hibernation, resulting in minimal movement. Trading can still be based on technical signals from lower timeframes, even though overall volatility remains subdued.

On Monday, GBP/USD may continue to trade within the 1.3413–1.3421 and 1.3466–1.3475 zones. Bounces from either zone can act as trade entries with the opposing zone as a target. A confirmed breakout beyond either range opens the possibility of renewing the broader trend.

Key Levels to Trade (5M TF): 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466–1.3475, 1.3529–1.3543, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763. On Monday, Bank of England Governor Andrew Bailey is scheduled to speak, but the U.S. economic calendar is completely empty. Therefore, we expect a classic "slow Monday" in the market.

Core Rules of the Trading System:

- The strength of a signal is determined by how long it takes to form (a bounce or a breakout). The shorter the formation time, the stronger the signal.

- If two or more false signals are triggered near a certain level, it is recommended to ignore further signals from that level.

- In a flat market, any currency pair may produce multiple false signals, or none at all. It's best to quit trading at the first signs of flat movement.

- Trades should be opened between the start of the European session and the midpoint of the U.S. session. All trades should be manually closed afterward.

- On the hourly timeframe, MACD signals should only be used in conditions of strong volatility and when accompanied by a trend confirmed with a trendline or channel.

- If two levels are positioned too closely (5–20 pips apart), treat the entire area as a single support or resistance zone.

- Once a trade moves 20 pips in the correct direction, set the Stop Loss to breakeven to protect against reversals.

Chart Elements Explained:

- Support and resistance levels – Target zones for opening buy/sell positions. Take Profit levels can be set near these.

- Red lines – Trendlines or channels indicating the current market trend and preferred trading direction.

- MACD indicator (14,22,3) – Histogram and signal line used as an auxiliary signal source.

- Important speeches and reports (always listed in the news calendar) can strongly affect price movement. Caution is advised when trading during such events, or consider exiting the market altogether to avoid sharp reversals.

Note for Beginner Traders: Not every trade will be profitable. A clear strategy and proper money management are essential for long-term success in Forex trading.