On Monday, the GBP/USD currency pair calmed down rather quickly, although we had expected more active intraday movement. It's important to understand that the dollar has been rising in recent weeks for several reasons.

First, there was a technical need for periodic corrections. On the daily timeframe, corrections are also necessary. If the pair moved upward by 1,600 points over six months with virtually no pullbacks, then what kind of correction should we expect? Indeed not just 200 points.

Second, there was news about the signing of trade agreements between the U.S. and some of its trade partners—particularly with the European Union, which is the U.S.'s largest trading partner by volume. Naturally, traders were most interested in that deal and the pending agreement with China. As for the EU deal itself, virtually all experts described it as "oppressive" for Europe and "extremely beneficial" for the U.S. So the dollar's growth made perfect sense.

Third, due to concerns about rising inflation amid the ongoing trade war, the market had little faith in a rapid and aggressive rate cut by the Federal Reserve. Yes, there were always expectations of one or two cuts "that the Fed would soon implement," but in reality, if Powell was stating weekly that such a move was off the table, how could easing be expected? The situation is now changing because a deteriorating labor market is a genuine concern.

Fourth, there was the positive GDP report and the first monthly U.S. budget surplus in eight years. This is easily explained, as import tariffs to the U.S. have begun to flow into the federal budget, which contributed to those improved figures.

Meanwhile, Donald Trump continues to pressure Fed Chair Jerome Powell, demanding rate cuts. In the president's view, U.S. inflation is low, and he doesn't understand why Powell is reluctant to lower the rate. For our part, we don't understand Trump's position either. It seems the U.S. president is so used to making decisions unilaterally that he's forgotten about the existence of the Federal Open Market Committee (FOMC). It is the committee that votes on interest rate decisions. There are 12 voting members on the FOMC. Only two of them—Michelle Bowman and Christopher Waller—voted for rate cuts at the last two meetings. Both believe that inflation has stabilized and that further delay by the Fed could severely hurt the labor market.

Yet Trump demands a rate cut specifically from Powell, likely assuming that Powell, like himself, can simply order everyone else to vote the way the president wants. However, the Fed remains an independent institution, and Powell's vote carries no more weight than that of any other FOMC member. Therefore, the issue isn't with Powell alone, but at the very least with the other 10 board members. This is something Trump seems unable to grasp. Still, the U.S. president always needs someone to blame in any undesirable situation. So in this case, the scapegoat is Powell.

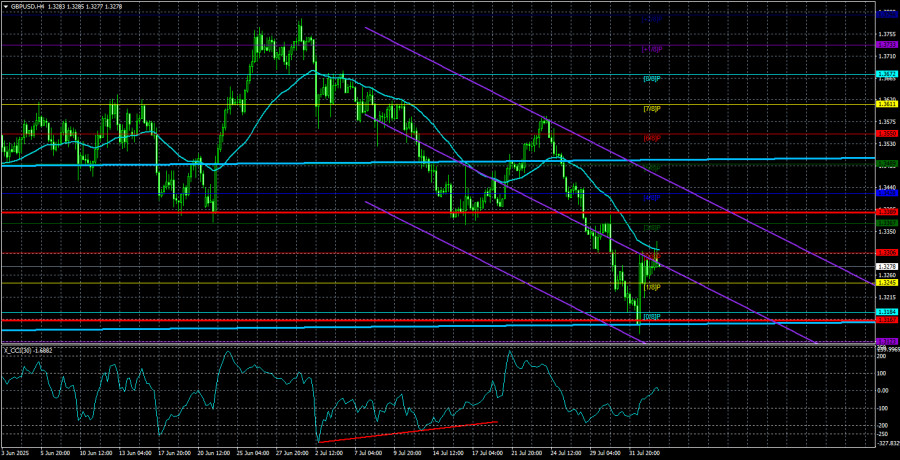

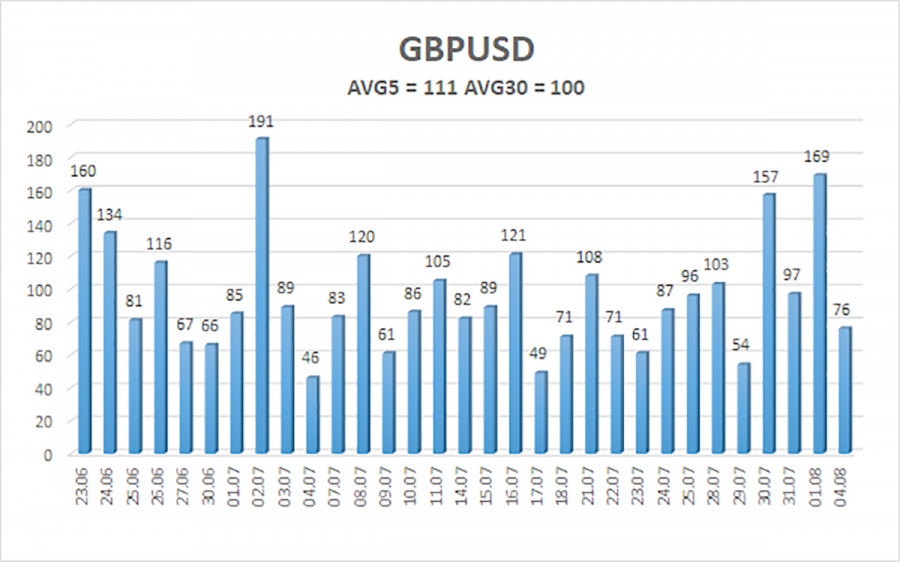

The average volatility of the GBP/USD pair over the past five trading days is 111 pips. For this currency pair, this is considered "high." On Tuesday, August 5, we expect movement within the range of 1.3167 to 1.3389. The long-term linear regression channel is pointing upward, indicating a clear uptrend. The CCI indicator has entered the oversold zone twice, signaling a potential resumption of the bullish trend. A new corrective phase is currently underway.

Nearest Support Levels:

S1 – 1.3245

S2 – 1.3184

S3 – 1.3123

Nearest Resistance Levels:

R1 – 1.3306

R2 – 1.3367

R3 – 1.3428

Trading Recommendations:

The GBP/USD pair is currently undergoing a downward correction. In the medium term, Trump's policies are likely to continue exerting pressure on the dollar. Therefore, long positions with targets at 1.3550 and 1.3611 remain much more relevant if the price is above the moving average. If the price is below the moving average, small short positions may be considered with targets at 1.3184 and 1.3167 based purely on technical grounds. From time to time, the U.S. currency shows corrective strength, but for a sustained uptrend, the market needs real signs that the global trade war is over—something that is likely no longer possible.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.