Trade Review and Strategy for the British Pound

A price test at 1.3431 occurred while the MACD indicator was beginning to move downward from the zero line, confirming the right entry point for selling the pound. As a result, the pair dropped by more than 30 pips. Buying on a bounce from 1.3400 also allowed for a profit of approximately 20 pips.

The pound fell and the dollar strengthened following comments by Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, who warned that an aggressive rate cut could lead to rising inflation. Coming amid increasingly hawkish rhetoric from the Fed, his statement had an immediate impact on currency markets, boosting the dollar against most major currencies. The decline in the British pound was particularly sharp, given the UK's ongoing economic challenges — headline inflation remains elevated, and the country's growth outlook remains uncertain.

Later today, the Bank of England's Monetary Policy Committee (MPC) will release the minutes from its most recent meeting. Additionally, MPC member Huw Pill is scheduled to speak. These events are of high importance for investors closely monitoring pound movements and the UK's broader economic health.

The MPC minutes will contain detailed insights into the committee's discussions regarding current economic conditions, development forecasts, and the rationale behind their latest interest rate decision. Pill's remarks will add context to these decisions by offering his individual assessment of the challenges facing the UK economy. His comments on inflation, employment, and consumer spending may influence the pound's exchange rate by applying additional pressure. Special attention will be paid to any signals suggesting a potential shift in the BoE's monetary policy stance.

For today's intraday strategy, I will primarily rely on executing Buy Scenario 1 and 2, and Sell Scenario 1 and 2.

Buy Scenarios

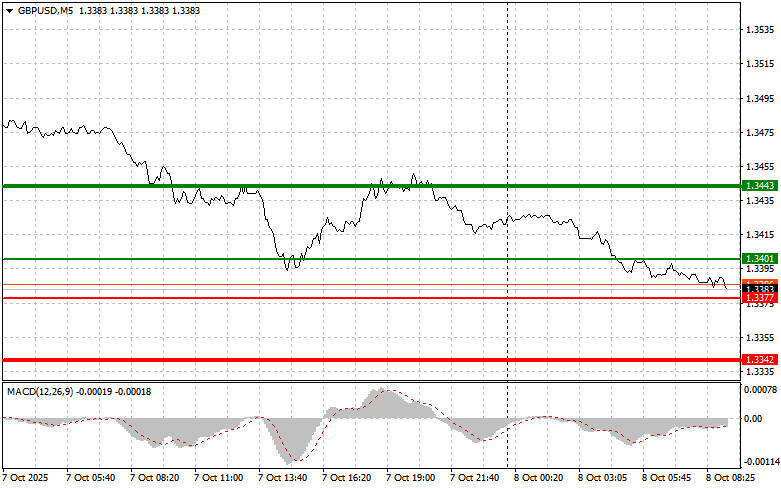

Scenario 1: I plan to buy the pound at the entry point around 1.3401, with an upside target at 1.3443. Once the price reaches 1.3443, I plan to exit the long position and open a short trade in the opposite direction, expecting a pullback of around 30–35 pips from that level. This strategy should only be used if strong economic data are released and the MACD is above the zero line and just beginning to rise.

Scenario 2: I also plan to buy the pound if there are two consecutive tests of the 1.3377 level while MACD is located in the oversold zone. This would restrain further downside and indicate a likely turnaround in the pair's direction. The expected upward move would target the levels of 1.3401 and 1.3443.

Sell Scenarios

Scenario 1: I plan to sell the pound after a break below the 1.3377 level. This should trigger a fast decline toward the key support area at 1.3342. I plan to exit the short position there and potentially switch to buying, looking for a 20–25 pip rebound. Pound sellers will attempt to take control at every opportunity. Before entering the trade, MACD should be below the zero line and just beginning to fall.

Scenario 2: I also plan to sell the pound if the price tests 1.3401 twice while MACD is in the overbought zone. This would signal limited upside potential and likely result in a bearish reversal, sending the pair down toward 1.3377 and 1.3342.

Chart Annotations:

A thin green line represents the suggested entry price for long trades.

A thick green line marks the target area for taking profit on long trades, as movement beyond this level is unlikely.

A thin red line shows the entry level for short positions.

A thick red line indicates the zone where profits may be taken on short trades because further decline is less likely.

The MACD indicator should guide your entry decision based on overbought or oversold conditions.

Important Notes for Beginner Forex Traders:

If you are starting out on the forex market, exercise extreme caution when entering trades — especially before major data releases. The best approach is often to stay out of the market during those times to avoid sudden price spikes.

If you choose to trade during news events, always use a Stop-Loss to minimize potential losses. Trading without it — especially in high volumes and without proper money management — can quickly lead to a complete loss of your capital.

Finally, remember that no strategy guarantees constant success. Developing and following a consistent trading plan, such as the one provided above, is crucial for achieving long-term results. Acting spontaneously based on short-term market noise is almost always a losing approach for intraday traders.